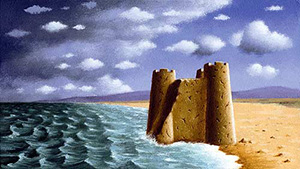

The tides, they are a-changin?

Charlie Munger was once asked what made him such a great investor. His reply was: “my guesses are better than yours”.

At Montgomery, we obviously don’t invest in guesses, but we do spend a lot of our time thinking about markets and the broader implications of statements made by sector leaders, those at the forefront of change, and those who have a bird’s eye view of changing industry dynamics. Our lively internal discussions about the possible outcomes CEOs are alluding to in their pronouncements lead us to varied conclusions, but when we all agree something is obvious and self evident, we know it’s time to emerge from our slumber and do something.

This has enabled us, over the years, to make some excellent calls on businesses – and indeed entire markets. In doing so, we have also experienced the tremendous, albeit brief, pain of being early when our views swim against mainstream thinking.

As an example, since April last year, we have been warning about the emerging signs of impending declines in base metal prices, the international demand and local supply influences that might exacerbate those declines and the impact that would have on other sectors, including the contracting space.

More recently, we sold a meaningful part of our exposure to Australian retail business amid the seemingly obvious signs that conservatism would reemerge as an influence amongst consumers. I would like to briefly explain this.

While we have earned some financial benefits on behalf of investors, we earn no points for stating the retail sector has had a good run of late. The heavy discounting that dominated many businesses and the resultant squeeze on their margins and profitability began abating, we estimate, in October last year and retail businesses have subsequently been enjoying some sunlight on their faces and wind at their backs.

Recently however, we have grown concerned. We have been bombarded by a raft of anecdotal evidence that suggests despite more rate cuts, consumer confidence is continuing to deteriorate. We all know that when a consumer has zipped up their wallet, it is bad news for highly cyclical businesses.

Recent announcements of poor turnover – due to warm weather – for David Jones, and sluggish sales results for Myer have added fuel to the fire.

We are aware that Myer and DJ’s results are partly due to structural issues, however, the new talk of discounting to clear stock, our fear of another round of margin compression, and Asiano (Australia’s largest port operator) signaling at a recent briefing that container volumes were unusually low given the alleged strength in retail sales (a possible sign retailers are de-stocking), brought us back to Mark Twain’s core investing principle with a thud:

“The return of my money is much more important than the return on my money”.

One of the distinct features of Montgomery is that unlike our much larger peers, we have the ability to park a large portion of fund assets in the safety of cash when a dearth of quality and value is available. Right now, we sit on very comfortable cash positions in both The Montgomery [Private] Fund and The Montgomery Fund, following the lowering of our exposure to certain businesses and sectors, including retail. While we may not get every “guess” right, and we may be wrong this time, we can always rejoin the party later – when our data and sources suggest that the tide, which currently appears to be rolling out, washes back in again.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

xiao fang xu

:

well i put my supper in cash option in 2006 and invested my savings only 50% in late 2008.

i did miss on some nice gains but well at least i know what i am doing now.

it is not painfully as watching when ALL go from $ 0,79 to $18 ( i bought on feeling and sold for $ 0,94 )

or WOR bought on IPO and sold few months later for $1,85 and watch it going to $40.

well, there is price to pay for everything and learning is one.

Mike Williams

:

Apologies…..Russell.

Mike Williams

:

Roger,

Given your pessimistic outlook for retail, what is your view on The Reject Shop? I think you recently stated this was Montgomrry Fund’s second largest holding.

Roger Montgomery

:

It certainly was. We have reduced our weighting a couple of weeks ago by about half.

Mark Kruger

:

Thanks for the article, Roger.

Could you please explain the first sentence of your last paragraph? Why can’t your ‘larger peers’ have larger cash holdings if they deem it appropriate?

Many thanks,

Mark

Roger Montgomery

:

mandates prevent.

Asher Jebbink

:

Is it a good guess that the retail fund has more than the 30% ‘upper limit’ in cash at the moment? Or maybe a week ago it was?

Roger Montgomery

:

a reasonable guess but not 100%