The three-bucket strategy for building a retirement portfolio

What’s the best way to build a robust retirement portfolio that can ride out market fluctuations and provide steady and dependable income? Back in the 1980s, renowned U.S. financial strategist, Harold Evensky, devised what we believe is a smart approach. He called it the ‘Bucket strategy’.

I grew up in the 1970s and 80s and the one thing I remember – apart from the flared brown corduroy jeans – was the measurably higher interest rates available to those living on their retirement savings. In 1981, for example, while inflation was admittedly rampant, the average interest rate for six-month term deposits was 11.6 per cent per annum. The rate was high enough (and prices for everything significantly cheaper than today) for many retirees to experience a reasonable, if not enjoyable, lifestyle without needing to “risk” their capital or dip into their retirement savings.

Sadly, those rates (and the sartorial elegance of the era) are a fond but now distant memory. Today, investors approaching retirement must be understandably nervous about how much they need to have accumulated to meet their lifestyle objectives, acknowledging that some of the saved capital may need to be drawn down in addition to the income earned.

The simple fact is that since those days of heady yields on cash, interest rates have plummeted, and the process has amassed what appear to be insurmountable hurdles for retirees.

For those without millions in super, and even for those with, this blog will provide an insight into a framework for building a retirement portfolio, while featuring a product that has the potential to, at least partially, alleviate the investment and income concerns for some retirees.

Enter the “Bucket Methodology” in retirement asset management, a brainchild of the renowned U.S. financial strategist Harold Evensky. This strategy offers a blueprint for retirees to maximise their financial assets and the chances for a stable retirement income long after retirement.

Some retirees are fixated on income-centric models. This may, however, inadvertently push them towards riskier securities. The Bucket Methodology represents an alternative to this, and is grounded in a simple, yet potent, principle: Funds allocated for imminent expenses should remain in cash, irrespective of the yields – diminutive or otherwise.

Conversely, assets which are set aside for the more distant future can be diversified across a broad spectrum of longer-term investments. The immediate cash reservoir in Bucket One ensures retirees have a sufficient financial cushion to withstand and ride out the inevitable volatility in their long-term portfolio.

|

Time period |

Investment type |

|

1. Short |

Bucket One: A cash bucket. This bucket is designed to meet immediate income needs for two years to five years. The capital in this bucket is for spending on those needs. |

|

2. Medium |

Bucket Two: Less conservative than Bucket One but more conservative than Bucket three and offering medium term stability to fund Bucket one’s future years. |

|

3. Long |

Bucket Three: The growth bucket invested more aggressively to provide the opportunity to grow savings and ensure longevity. Returns in this bucket will vary more than the other two buckets. |

The Bucket strategy helps to endure, survive, and thrive amid a risk referred to as sequencing risk, which is the risk of a big fall in asset values early in the investment journey.

Understandably, and without gainful employment, many retirees are required to take fixed dollar withdrawals (pension drawdowns) regularly from their retirement portfolio. If the retirement portfolio is entirely invested in volatile securities, retirees could experience the opposite of the ‘dollar-cost averager’ when prices fall.

At lower prices, a retiree would be forced to sell more units simply because more units are required to meet their minimum pension payment obligation. And then after those units are sold, the remaining portfolio is smaller. With fewer units, a greater burden is now placed on the remainder of the portfolio to recover the losses.

It is, therefore, essential that large losses early in the investment journey are avoided or the risk at least mitigated.

And that’s where Evenksy’s three bucket strategy works so well. Welcome to the retirement bucket list!

Bucket One: The immediate financial buffer

Central to the Bucket strategy is the need to quarantine from volatile assets the cash needed to cover short-term living expenses for a period of two to five years – the estimated time required for markets to recover. In a climate of diminished cash yields, this may appear foolish. Still, its primary purpose is to offer a solid foundation for covering immediate expenses not met by other income channels.

To ascertain the requisite amount for Bucket One, begin by outlining projected annual expenditures and deduct any assured, non-portfolio income such as pensions. The residual figure provides a clear indication of the funds required to be sourced from Bucket One. A prudent investor might decide to double this number to gauge their cash reserve requirement more conservatively for Bucket One.

Those wary of locking in substantial cash at punitively low yields, might contemplate dividing Bucket One into two portions: real cash covering a year’s expenses and additional funds in slightly more lucrative alternatives, such as term deposits. It would be judicious for retirees to also incorporate a contingency fund within Bucket One to cater to unforeseen costs.

Subsequent buckets: expanding the strategy

While retirees have flexibility in designing their unique bucket arrangements and asset distributions, one suggested model comprises of two supplementary buckets:

Bucket Two:

In this paradigm, this Bucket embodies five or more years of anticipated expenses, emphasising income generation and stability. It is predominantly made up of robust income-producing assets, including a selection of high-yielding investments such as infrastructure funds or equities, Real Estate Investment Trusts (REITS), hybrid securities, fixed interest investments or a private credit fund (see Box 1, for wholesale investors). The returns from this segment can be utilised to replenish Bucket One when necessary (and sometimes Bucket Three if the opportunity presents itself).

Box 1. The Aura High Yield SME Fund

The Aura High Yield SME Fund, for wholesale investors only, is a private credit fund. Investors buy units in a fund, and the manager selects loan originators through whom the funds are loaned to Australian corporates. There are more than 10,000 small, secured loans, across many different industries with an average duration of just four months.

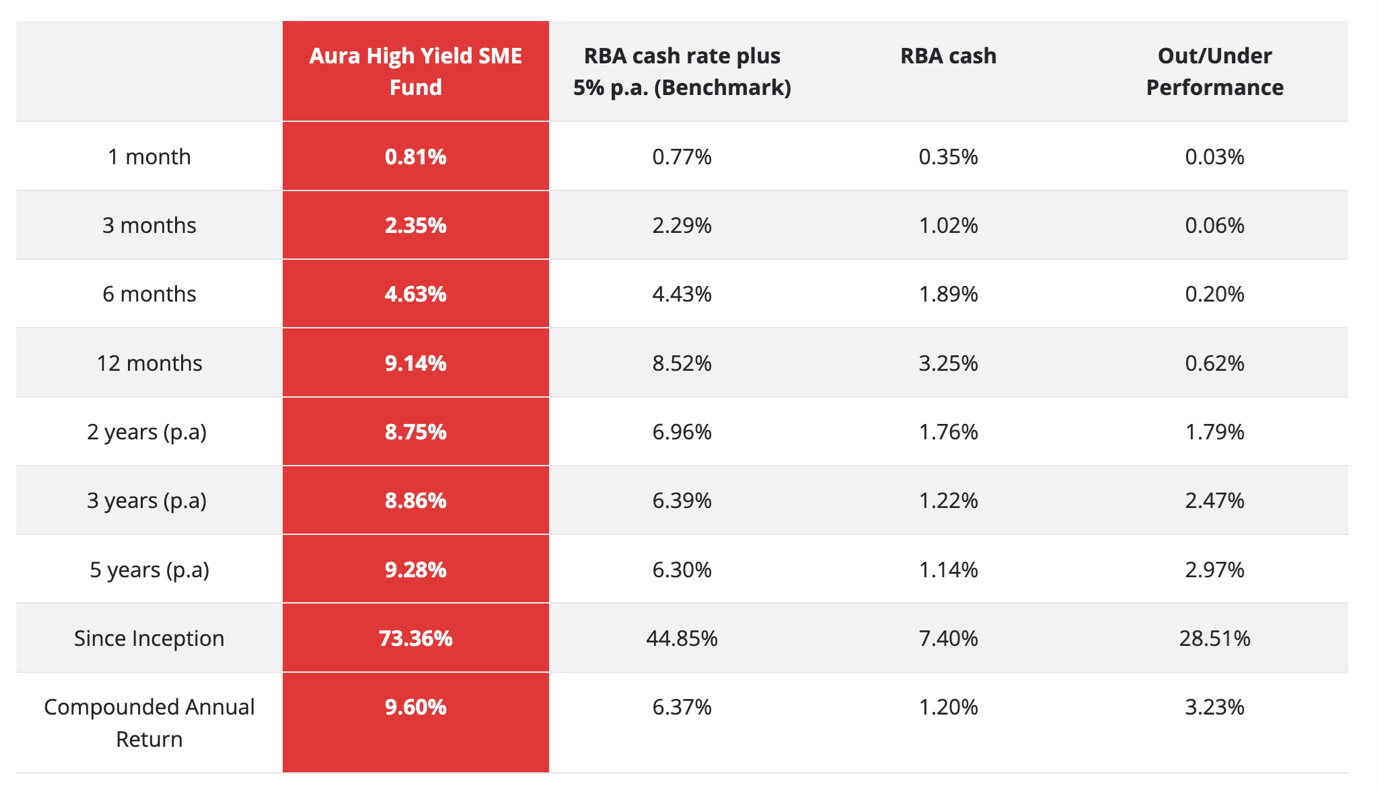

The Fund has been running for over six years, and during that period, the Fund has returned investors an average of 9.60 per cent per annum to 31 July 2023, paid monthly, with zero loss of investor capital.

Since 2017, that’s been a better return than the stock market without any of the volatility. For some investors, this could be an appropriate vehicle into which some funds for bucket 2 could be allocated.

Aura High Yield SME Fund returns to 31 July 2023

Aura High Yield SME Fund comparison

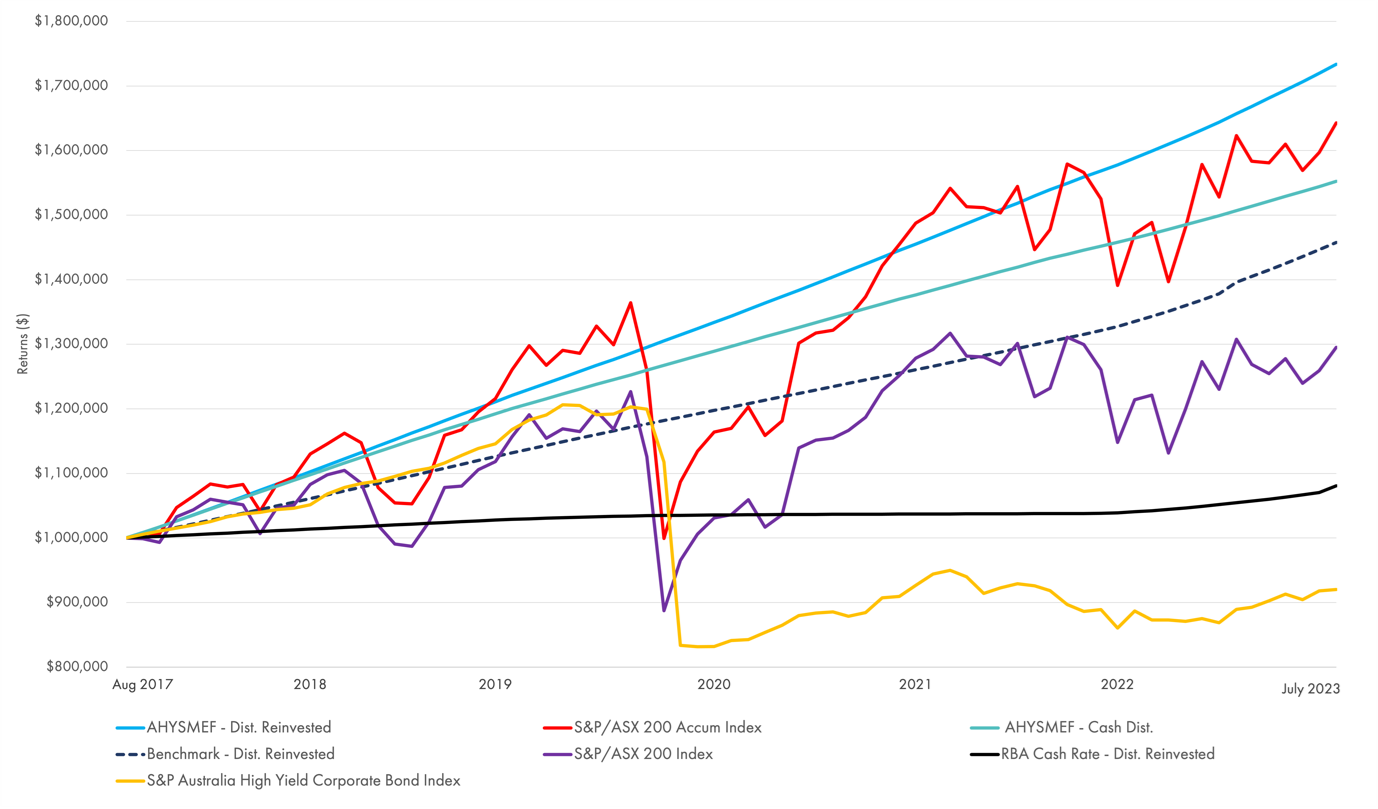

As you can see from the below graph, the blue line represents the Aura High Yield SME Fund with distributions reinvested, in comparison to the S&P/ASX 200 Accumulation Index as seen by the red line.

Alternatively, you can compare the green line, which is the Aura High Yield SME fund with distributions paid as income, against the S&P/ASX 200 Index (which excludes dividends) in the purple line.

Source: S&P/ASX 200 (^AXJO) Adjusted Close Historical Data and S&P Global – S&P Australia High Yield Corporate Bond Index Historical Data.

Performance net of fees and expenses (1) Inception date 1-Aug-17, (2) Benchmark is RBA cash rate plus 5% p.a.

Returns assume reinvestment of all distributions. Past performance is not a reliable indication of future performance.

Bucket Three:

Representing the most extended horizon, this bucket is primarily composed of large and small capitalisation equity funds – both domestic and global – and alternative investments such as long/short funds and private equity funds. While promising the most substantial long-term gains, this bucket also bears the potential for considerable losses due to its higher volatility. The presence of Buckets One and Two is crucial to deter premature withdrawal from Bucket Three during market downturns.

During downturns, if returns from Bucket Two allow it, and if spending from Bucket One permits it, Bucket Three investments might be subsidised from Bucket Two.

Re-balancing the buckets

At some point each year, the buckets are rebalanced with the objective of starting a new year with two to five years’ lifestyle income needs in Bucket One.

In this instance, the first step is to examine the investment returns in Buckets Two and Three. Depending on performance, there are three possible results. The first scenario is that both buckets produced a positive result. The second is that both produced a negative result, and the third is that one bucket produced a positive return and the other a negative one.

The second step is to withdraw from the Bucket(s) which have generated a positive return, sufficient funds to meet the objective set for Bucket One – that is, two to five years income needs at the start of each year.

The Bucket with a negative year remains untouched. If both buckets are negative, they both remain untouched. This is the reason Bucket One has two to five years’ income needs at the commencement of the strategy so that the retiree can ride out the dips.

The importance of Buckets One and Two to the strategy, and the possibility of a negative scenario in both buckets, make a high-quality private credit fund (the investment described in Box 1), for example, an attractive option for Bucket Two.

If the cash balance in Bucket One at the end of any year is less than two years’ worth of income requirements, equal amounts are drawn from Buckets Two and Three, irrespective of their earning to replenish the Cash Bucket so that it begins the following year with the two years’ income requirement.

Of course, as with anything related to investment that is regulated, there are drawbacks and risks. Consequently, the bucket strategy may not suit everyone.

Setting up and maintaining the strategy demands attention and discipline. Deciding on how much to invest in each bucket and the asset mix in each demands careful thought. An adviser could help here. One must also determine the rules for rebalancing the buckets, and discipline must be applied to following those rules.

Further, if the retiree holds too much in Buckets One and Two, relative to Bucket Three, the long-term growth bucket won’t out-earn the withdrawals in Bucket One due to inflation. This would result in declining income as the retiree ages.

Moreover, for the strategy to have any chance of working, Buckets Two and Three require some exposure to growth assets. A conservative investor may find such investment entirely uncomfortable, which would render following the strategy problematic, if not impossible, even remembering Bucket One’s purpose is to provide a buffer against negative returns.

Finally, the bucket strategy, as we have presented here, has ignored asset allocation. While we have suggested there might be merit in an allocation to the Aura High Yield SME Fund for wholesale investors, we haven’t defined how to rebalance each bucket’s individual investments during good or bad years.

Education and advice, or the ongoing guidance of a qualified adviser, might be appropriate, if not necessary.

The retirement bucket strategy has been around for a long time and is one of many approaches to help retirees meet their income and lifestyle needs. As the presence of private credit funds is increasingly felt across the investment landscape, and their performance track record more established, their suitability and role in strategies such as the bucket strategy becomes more relevant and arguably vital.

Disclaimer

Find out more about the Aura Private Credit Funds

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through the online application form. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.

Roger,

The problem is this – nowhere have I managed to find anyone (case study) or any numbers that show how this works in practice. Even hypothetically, e.g. “on a $1m portfolio consisting of X, Y, Z, the buckets would look like this: “.

Obviously, everyone’s expenses are different and depending on the stage of their life, but some numbers to indicate so would be great please.

Hi Chris, I’d be delighted to hear from individual retired investors who have been applying this approach. It’s not a “problem” with the approach that you haven’t met anyone who has adopted it. It could be a “problem” with/for the retiree!

With retirement looming at the end of the year, I was thinking of rearranging my SMSF assets earlier today and bingo, you write this very helpful, educational piece. Thank you very much Roger, I will begin creating and arranging my buckets!

P.S. I think there is a double up paragraph in your article Roger.

All the best

Gary Briton

Thanks for the encouraging words Gary. Be sure to seek and take personal professional advice too.