The shifting focus from inflation to jobs

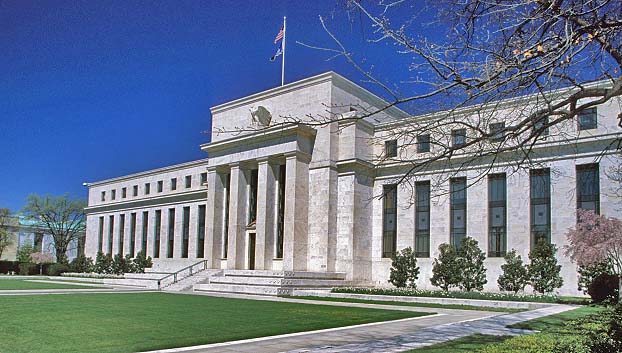

The Federal Open Market Committee stated in its latest release that it is willing to continue with its easing measures until the unemployment rate is below 6 ½ per cent. This is remarkable, as is it officially states that the Federal Reserve is using its monetary policy tools to bring down the unemployment rate to below a certain level, when historically its focus has been on maintaining stable inflation – effectively, if inflation is maintained at a certain rate, unemployment should take care of itself.

An economy benefits when the policies of the government and the central bank are aligned (these are referred to as fiscal and monetary policy respectively). Unfortunately, this hasn’t been the case in the USA for some time, with Ben Bernanke commenting in the past that the Federal Reserve were “looking for policymakers in other areas to do their part”. The Federal Reserve doesn’t have the tools to solve unemployment by themselves, and while logjams continue in Congress, you should expect to see the Fed doing a lot more of the heavy lifting.

Parallels can be drawn with the Australian market. The Reserve Bank of Australia has gradually been lowering the cash rate to record levels – just consider that the cash rate is now at the same level that was reached at the height of the GFC. Meanwhile, the government’s sole focus has been to bring the budget back to surplus, which means they are unlikely to embark on any major stimulus measures anytime soon.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY