The screen – part II

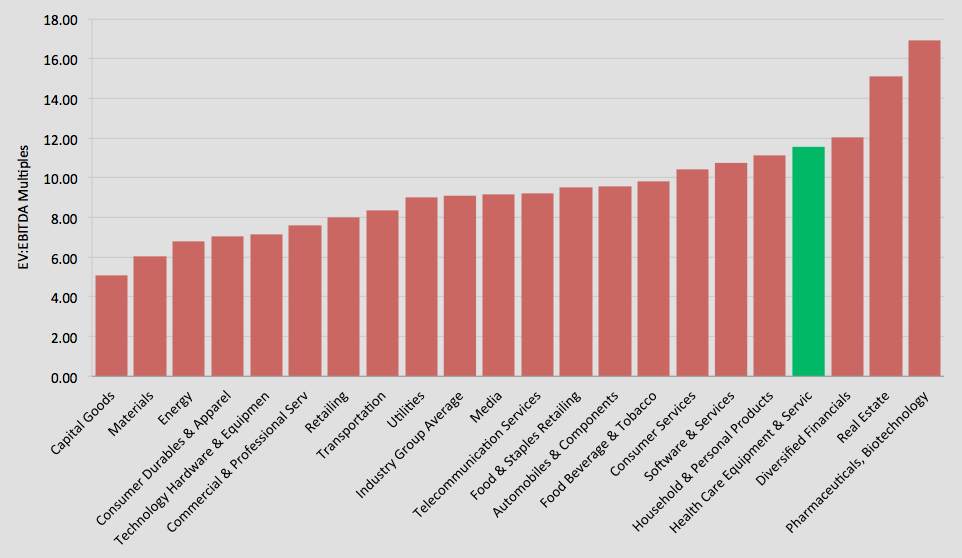

The other day, we ran ‘the screen’: a quantitative tool we use from time to time (and we employ a number of them at Montgomery) in an attempt to rank the market based on the relative valuations of industry groups.

The goal with such a tool is to highlight areas of the market which are cheaper than the average. In doing so, we hope to identify potential opportunities that the research team can dig deeper to determine if the business is unduly cheap based on its prospects, and thus consider possible inclusion in our funds. One such candidate was found the other day using this approach and remains under investigation.

Another way a screen like this can be useful, is to make sure we take a good look at those groups and businesses that appear to be relatively expensive, particularly if we are holding any of them in our portfolios.

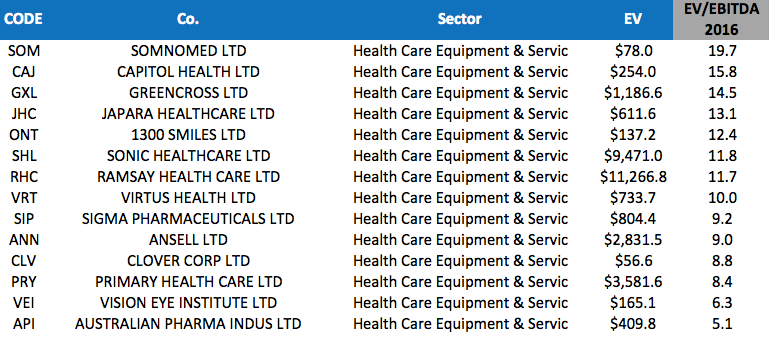

Take healthcare equipment and services, an industry group we have a particular interest in. Some of the constituents in the industry group are listed below.

Having ranked this list from relatively most to the least expensive, two names stick out in terms of potential exuberance/ excessive pricing, and they are Somnomed Ltd (ASX: SOM) and Capitol Health Ltd (ASX: CAJ).

Both businesses are clearly favoured by investors, given they are growing strongly. Somnomed recently announced that revenues for 2014 will grow by 40 per cent and have also forecast that sales will grow again by at least 25 per cent in 2015. Capitol Health on the other hand have reported a 44 per cent growth in revenue following their 2013 acquisition of MDI Group and again are expecting strong growth to continue in the coming year.

Based on this momentum, SOM and CAJ have attracted keen investor interest and their pricing reflects the expectation of strong growth to continue for some time yet. This has not been lost on management.

If we look through their recent announcements, it comes as little surprise that both have taken advantage of their strong share prices by raising capital. We take this as a potential sign that they tend to agree with our simple relative screener, that their shares are expensive.

The risk in owning such business – despite their quality and impressive historical and future growth profiles – is that share prices can and often do get too far ahead of their fundamentals when the market gets excited.

In our experience a few scenarios can thus occur. Either the growth comes through as expected, the pricing is justified and the shares continue to march upwards; the growth takes longer than expected to come through and the shares mark-time, delivering poor returns for a few years while waiting for the fundamentals to catch-up, or; the growth fails to materialise and the share price falls to reflect that reality.

Faced with share prices that therefore have a lot baked into them, unless we believe we can easily justify business growth, the risk-to-reward scenarios are clearly skewed to the downside.

This, to us, is another advantage in using a relative valuation tool such as ‘the screen’.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Roger,

I have ” loaned ” out my valuable copy of ValueAble.

So, as I do not now have a copy, the question is; when are going to write the third edition? (:-)

Cheers,

Peter Bryan

I have something in mind. Expect something before 2017…

Thank you Russell for the interesting analysis; can you comment on 1300 smiles, an small A1 company? Also where do Sirtex and CSL sit in this scheme?

based on metrics, isn’t Seek also very expensive looking ?

Great Article Russ,

Interesting to note that the 2 “cheapest” on your screen are a C4 and a C3.

Clearly they are cheap for a reason and not investment grade.

All the best

Scott T