The road ahead looks good for outdoor advertisers

These days, it’s hard to go far without being distracted by outdoor advertising. Displays are everywhere: from roadsides to shopping malls to bus stops. We believe the industry is poised to enjoy continued revenue growth. And this should benefit businesses like oOh!media and APN Outdoor – which have tabled a $1.6 billion merger – and QMS Media.

Historically, outdoor advertising has captured a relatively small share of the overall advertising market. It has also tended to be even more cyclical than the broader advertising market given its impact and return on investment has been less measurable than other forms of media.

But this is changing due to the following four drivers of growth:

- Improved audience measurement – While far from perfect, the development of the MOVE audience measurement system has greatly improved the data available to the industry in selling the product to advertisers and agencies.

- Declining audiences in traditional media – The fragmentation and decline of audience and readership for traditional print and television media has seen the value of these channels to advertisers decline over time. While most of the lost advertising revenue share has gone into the online advertising market, outdoor has also been able to demonstrate consistently growing audiences.

- Digitalisation of signage – The conversion of signs to digital screens generates two main benefits for the industry. The first is that it increases the available inventory due to the ability to run multiple advertisements at the same time. The second is the increased speed to market and content opportunities on digital signs relative to traditional static signs. Given the lead times involved in printing and installing traditional signs, advertising tended to be limited to longer dated brand building campaigns. Advertisements can be applied to digital screens almost instantaneously. This opens the door to outdoor advertisers to tap into tactical advertising budgets. This can include short term price promotions for consumer goods and more event based and reactionary advertising. For example, an ice cream brand owner could contract a digital roadside billboard to display its product if the temperature increased above 30 degrees.

This opportunity will take a number of years to exploit given the need to develop appropriate content for digital screens, gather enough data to demonstrate the effectiveness of such campaigns, and change entrenched behaviour of advertising gatekeepers.

- Effectiveness – More recently, there has been some discussion about the true audience and effectiveness of some of the online advertising offers. This could see some advertising share flow back to traditional media, reversing some of the rapid growth in online advertising revenue in recent years.

These factors present a longer term structural revenue growth thesis for the outdoor advertising industry. However, the path of growth is rarely a straight line, and there are some short to medium term risks that need to be considered.

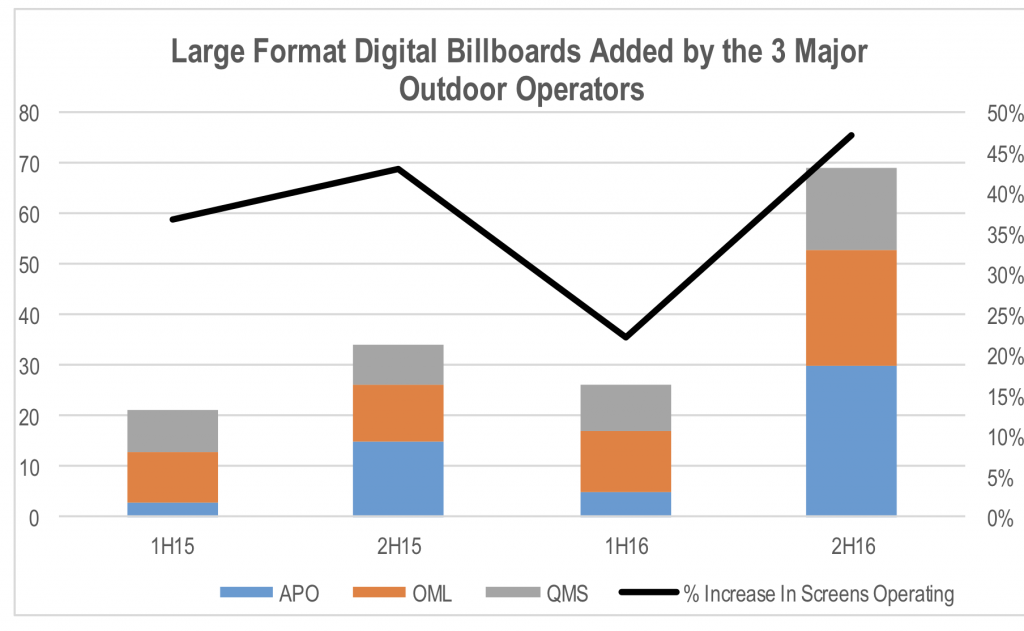

The opportunity presented by digital signs and the return generated on an incremental basis has seen an aggressive step up in the rate of rollout by the major outdoor advertising companies. In the six months to December 2016, the 3 largest billboard operators installed and converted 69 new large format digital signs across Australia and New Zealand. This presents an increase of 47% relative to the number operated by these companies as at 30 June 106.

Comments from each of the companies suggest that they’re not pulling the foot off the accelerator yet either.

Comments from each of the companies suggest that they’re not pulling the foot off the accelerator yet either.

Adding to this, APN’s Adshel street furniture business has been rapidly rolling out digital signage at its sites through the year, adding 113 new screens in Australia in the December quarter, representing an inventory increase of 45% in that quarter alone. Now that it owns 100% of the business, it has greater control over the capex pipeline and is likely to continue to aggressively rollout capacity in CY17.

What we are seeing is a land grab by the outdoor media operators. To date, the growth in digital revenues has cannibalised the traditional static sign revenue base to some extent, but has also taken share from other forms of media. While the digital rollout is likely to see outdoor increase its share of the overall advertising pie, the rapid acceleration in growth of digital inventory is likely to outstrip the rate at which advertising spend can rotate from other forms. As such, the degree of cannibalisation of existing outdoor advertising revenue, both static and digital, by the new digital capacity is also likely to increase in the near term.

This is essentially an issue of supply growth indigestion. When we look at the 4 drivers of structural growth in outdoor advertising revenue listed above, the benefits are likely to flow through over a longer period of time. The land grab going on at present is likely to see capacity expansion and investment exceed the growth rate of demand in the near term, leading to some near term pressure on returns and a weakening of margin performance relative to recent history.

The other issue confronting the listed outdoor media operators is the pending merger of Ooh Media and APN Outdoor. It is natural for large scale mergers of this sort to create distraction for staff given concerns around job security and the structure of the business going forward. This is likely to manifest itself as a reduced level of focus from the companies until the current situation is resolved. Reduced sales intensity could lead to slippage in revenue growth, exacerbating the current issues created by aggressive digital inventory expansion.

The ACCC’s 6 week extension of the release date for its initial findings regarding the proposed merger elongates this period of uncertainty for the employees of Ooh and APN Outdoor. This increases the risk of a slip in their relative performance in the near term.

Of course any slippage due to a reduced level of focus by Ooh Media and APN Outdoor could present an opportunity for other outdoor operators like QMS and APN.

So while we believe the long term future of the industry is positive, there are some reasons to be a bit cautious in the near term.

Montgomery funds own shares in APN Outdoor.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

A major blight on our visual environment if you ask me

Agree Carlos. While it doesn’t necessarily negate an investment case, it seems a bit of a reflection of a society where the merit of anything seems to be based more on the contribution made to economic activity ahead of any quality of life considerations.

No to mention the safety issues such as distracted drivers and unexpected flashes of light at intersections in particular – think bright red green and white flashes versus traffic lights and red light cameras. Idiotic stuff and completely unecessary.