The rise of uranium and the opportunity for small cap investors

Australian small companies can provide investors with opportunities to tap into global themes that we believe will drive investment returns in the future. One of these is what is the most effective solution for achieving decarbonisation in electricity production.

Currently, there’s a debate raging in Australian politics about which energy sources, alongside solar energy, will enable Australia to achieve net-zero carbon emissions by 2050, whilst also supplying a baseload of energy. Chris Bowen, the Minister for Climate Change, is currently not considering nuclear energy as a viable option, a position which is in contrast to other parts of the world.

The global aspiration for decarbonisation, coupled with a significant shift in the world’s perspective on energy security, have highlighted Australia’s natural resources, especially uranium.

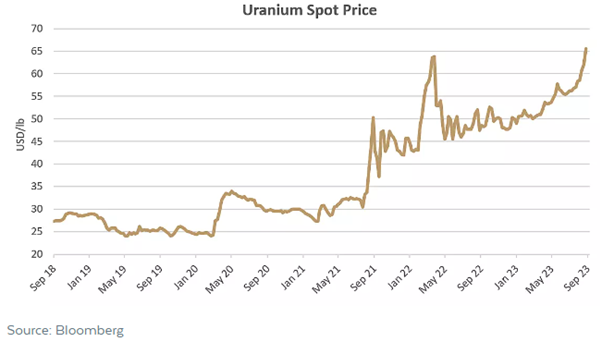

As outlined in the chart below, uranium prices, after being stuck in a tight trading range for an extended period, have recently surged. And, at the time of writing, the uranium spot price has surpassed U.S.$70/pound, marking a 12-year high.

In the short term, the price gain is partially attributed to the market recognising an imbalance between the supply and demand for uranium. For instance, in 2022, the primary production of uranium totalled 129 million pounds, contrasted against a demand of approximately 178 million pounds. The shortfall was counterbalanced using existing inventories.

Furthermore, many governments now categorise nuclear energy as a ‘green’ energy alternative. The construction of nuclear reactors is underway in many countries around the world, with approximately 40 new nuclear reactors set to be built by China and India alone between 2024 and 2027, where nuclear energy forms a core part of their plans to reduce emissions in the coming decades. Looking further out in time, there are an additional 19 reactors currently under construction, with many more being planned for construction worldwide.

Although the construction of a nuclear plant comes at a high initial capital cost, nuclear energy stands out as one of the few green energy sources capable of supplying essential baseload power to any grid, unlike other renewable energy forms that are susceptible to changes in weather and need certain conditions to generate power.

This growth in nuclear reactor construction is set to materially increase the demand for uranium consumption for energy production in the upcoming decades. When combined with the current demand, this positions uranium as a commodity poised to benefit from significant global macroeconomic tailwinds.

As I mentioned in my blog on 24 October, 2022, Australian small cap investors have multiple ways to access global thematic investment opportunities like these. We offer two positions for investors to leverage this opportunity is Boss Energy (ASX: BOE), and Paladin Energy (ASX: PDN), both companies are involved in the production of uranium.

Boss is placed to be Australia’s next leading uranium producer. Based on the announcement of their latest financial results, they are on track to restart production at the Honeymoon project in the December quarter of this year.

Given the price of Uranium is at 12-year highs and the ongoing shortfall in uranium supply, the outlook for Boss Energy remains favourable. We continue to hold our position in Boss Energy in our portfolio as a part of our broader exposure to the energy sector.

In conclusion, the growing global demand for clean energy has made uranium more valuable, and small Australian companies like Boss Energy and Paladin Energy are in prime positions to benefit. This presents a promising opportunity for savvy investors, with nuclear energy gaining traction as a dependable source of green power.

The Montgomery Small Companies Fund owns shares in Boss Energy and Paladin Energy. This article was prepared 27 September 2023 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade in shares in Boss Energy and Paladin Energy, you should seek financial advice.