The Reserve Bank of New Zealand wrong foots economists…again

One way to reduce inflationary expectations is for the Central Bank to aggressively lift their official cash rate to a level whereby the countries’ consumers are in enormous pain, thereby crunching the economy. And with today’s 0.5 per cent tightening to 5.25 per cent, the 11th since 6 October 2021, that is exactly what the Reserve Bank of New Zealand (RBNZ) had in mind.

With inflation for the year to December 2022 running at 7.2 per cent, the highest level in 35 years, it seems likely that figure will fall substantially as 2023 progresses. Gross Domestic Product declined by 0.6 per cent in the December 2022 quarter (for an annual rate of 2.4 per cent) and an upcoming recession in New Zealand now seems probable.

According to the Real Estate Institute of New Zealand (REINZ), for example, the median New Zealand house price has declined by approximately 24 per cent from a very elevated $1.0 million in November 2021 to $762,000 in February 2023. This $240,000 decline for the average household, together with the strongly rising variable mortgage rate, places incredible financial stress on many property owners who acquired their residence more recently.

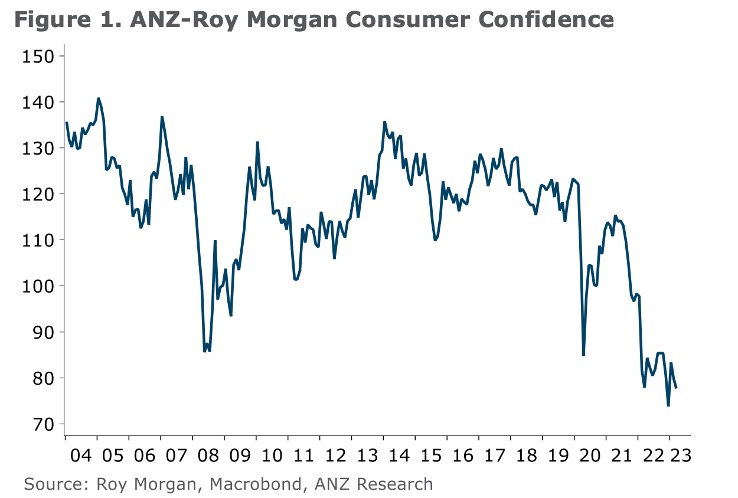

The recent ANZ-Roy Morgan Consumer Confidence Index hit 77.7 in March, close to a 20 year low, with around one-third of respondents thinking it is a bad time to buy a major household item. And that was before the 0.5 per cent tightening.

Domestic consumption, which was growing at 1.7 per cent in the December 2022 quarter and by an annual rate of 5.4 per cent, will be hit.

Unemployment – which troughed at 3.2 per cent in the March 2022 quarter, and gently rising to 3.4 per cent by the December 2022 quarter, could jump to 5 per cent over the medium-term.

The national savings rate, which declined from 8.9 per cent in 2021 to 3.3 per cent in 2022, will likely enter negative territory in 2023 and beyond. (Note, this ratio was negative in each of 2016, 2017 and 2018).

Overall, the average New Zealander is feeling the effects of a substantial increase in the cost of living reducing their purchasing power and given this is accompanied by a sharp increase in the variable mortgage rate as well as a severe decline in house prices, it seems most likely consumers will hibernate over the medium-term.