The Reserve Bank of New Zealand leads the way….again

The Reserve Bank of New Zealand (RBNZ) is determined to crush inflationary expectations, with their 12th increase in official cash rates in the 19 months since 6 October 2021 from 0.25 per cent to 5.50 per cent.

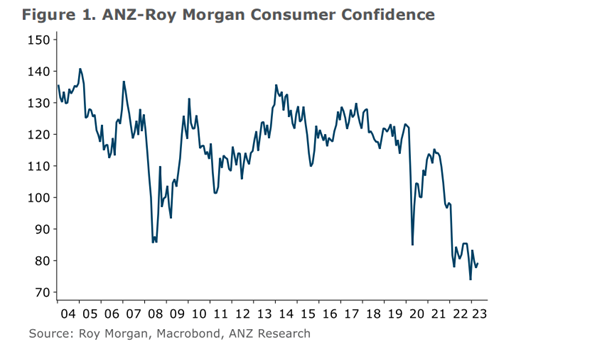

Inflationary expectations have been bouncing around in a narrow range over the recent several months and currently sit at 5.2 per cent. This is despite consumer confidence near a 20-year low, with around one third of the ANZ-Roy Morgan survey respondents believing it is a bad time to buy a major household item, and 50 per cent of the respondents believing financial conditions will be worse in 12 months’ time.

And from the peak in late-2021, the Real Estate Institute of New Zealand (REINZ) indicates the average New Zealand residence has declined in value by 18 per cent (with Wellington and Auckland leading the way, down 25 per cent and 23 per cent, respectively). And with the adjusted variable mortgage rate now exceeding 8.25 per cent per annum it seems likely the consumer and housing pain will continue for some time.

Analysis from the five countries below – New Zealand, the USA, the UK, Canada and Australia – reveals an average of 11 interest rate increases taking place over an average of 16 months, mostly to the highest level in 15 years.

|

Country |

Date of first tightening |

Number of interest rate increases |

Months since tightening |

Current official cash rate (%) |

Highest level since (year) |

|

New Zealand |

6 October 2021 |

12 |

19 |

5.50 |

2008 |

|

USA |

17 March 2022 |

11 |

14 |

5.25 |

2007 |

|

UK |

16 December 2021 |

12 |

17 |

4.50 |

2008 |

|

Canada |

26 January 2022 |

9 |

16 |

4.50 |

2008 |

|

Australia |

6 April 2022 |

11 |

13 |

3.85 |

2012 |

We note Australia is the outlier, being the last country to tighten (six months after New Zealand) whilst maintaining the lowest official cash rate amongst its peer group. This is likely due to the fact 61 per cent of Australian mortgages are variable, and the vast bulk of the fixed mortgages convert to the variable rate of interest over the next two years. This “Mortgage Cliff” is front-end loaded for those borrowers that locked in an approximate 2.0 per cent per annum fixed rate via the COVID-related term funding facility.

The RBNZ has certainly led the way amongst its peers in fighting inflationary expectations, and I continue to recommend keeping an eye on the pain experienced by the New Zealand consumer as a potential guide to other English-speaking economies.