The MG EV that blew up downstream

While investors in electric vehicle (EV) themed companies debate long-term forecasts for the price of lithium and the pace of EV adoption, the downstream impacts of that adoption may produce more interesting investment conclusions. It’s a side to the EV story that remains largely ignored by the mainstream investment narrative.

In the UK, under current government plans, an electric car will be the only car residents will be allowed to buy after 2035. And even before that in 2030, hybrids will be the only fuel-driven option available. The big ‘Mo’ (Momentum) is already behind the EV revolution and will be impossible to oppose. As more jurisdictions jump on the EV bandwagon, manufacturers will be forced to ramp up EV production, ensuring other jurisdictions will have no choice but to conform. By way of example, the ACT is investigating a ban on new fossil-fuel-powered cars by 2035.

The motivation is well understood. Current levels of Co2 emissions need to be halved by 2030 to stop further global warming.

A Polestar 2 electric car produces 24 tonnes of CO2 in its manufacturing process. The Volvo XC40 internal combustion engine (ICE) produces 14 tonnes. Production emissions for battery EVs are approximately 40 per cent higher on average than hybrid and combustion engine vehicles. The difference requires an EV to travel 80,000 km, or twice around the equator, to match the carbon footprint of an ICE vehicle over its life. Many studies indicate that EVs, especially those charged on grids reliant on fossil fuels, might take years to offset their carbon footprint compared to traditional vehicles.

While contradictory studies confirm EVs produce significantly less carbon over their lives than ICE-powered vehicles, they tend not to disclose the definition of a vehicle’s “life”, nor the assumptions made about kilometers travelled, or years operated. Given the materially higher CO2 produced in the production phase of an EV, if a buyer only uses that EV to drive to church on Sundays, the production of that vehicle is a net detriment to the environment.

A complete life cycle analysis of a complex value chain like that of a car is a notoriously difficult proposition, and many popular comparisons are unrealistic.

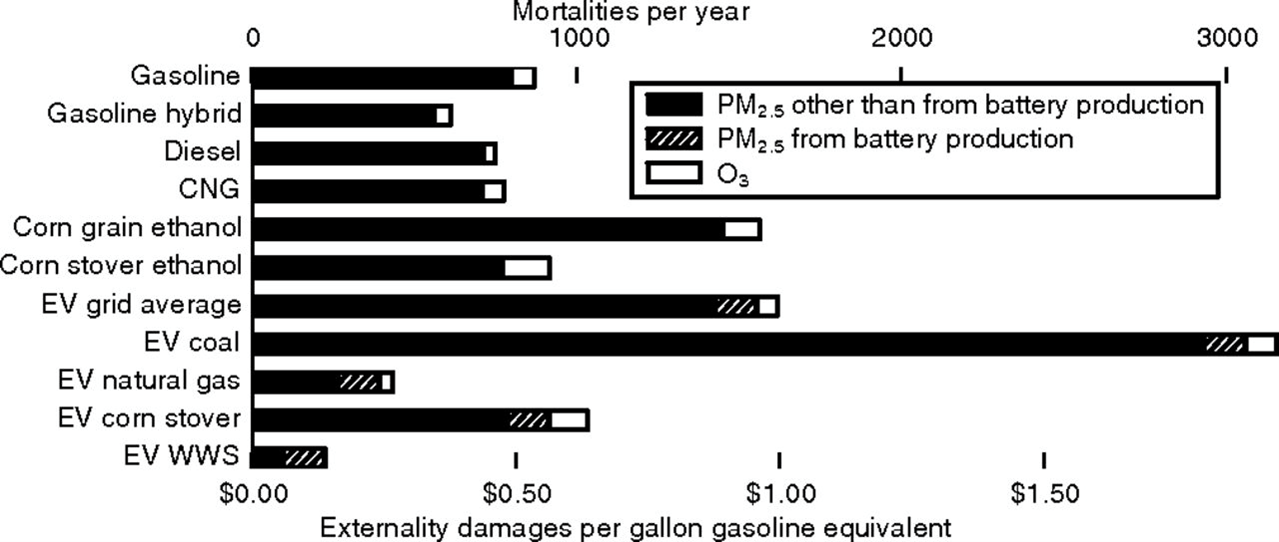

In a 2014 study[1] (Figure 1.) that looked at the health impact of 10 fuel sources and modelled the impact out to 2020 (assuming 10 per cent of ICE cars would be replaced), EVs fueled by coal and ethanol-based vehicles were, unsurprisingly, much worse than conventional vehicles. EVs powered by natural gas, wind or solar were some of the best performers.

Figure 1. Air quality health impacts in the United States for each scenario: attributable increases in annual mortality (upper scale) and the resulting monetized health impacts (lower scale).

Source: PNAS.org

I note that, in the UK in 2022, more than 40 per cent of electricity is still produced with fossil fuels and in the U.S. that number is 60 per cent.

But it’s not only the environmental debate that investors in EV-related companies should be mindful of. Notwithstanding the ridiculously high lithium prices that would result from the entire world’s passenger vehicle fleet switching to electric, that debate currently favours the continued manufacture and adoption of EVs.

Investors may be more interested in the downstream impacts of EV adoption.

The impact on insurance, for example, of the high cost of EV batteries is raising important questions about the true value of EVs themselves, the economic and financial implications of rapid adoption, and the long-term returns from the inevitably socialised but required infrastructure investment.

In a recent incident, an electric scooter burst into flames at a Sydney hostel, drawing attention again to the potential hazards of lithium-ion batteries, which are now ubiquitous homes across the country. In a separate NSW incident, a home was burned down by a lithium battery that had been completely discharged and unused for more than a year. As the environmental protection agency (EPA) notes, “There’s enough chemical energy when the batteries are flat, to generate enough heat to cause a fire explosion.”

Indeed, a detached battery from an EV caused a fire that destroyed five cars at Sydney’s Mascot Airport last month. Curiously, news reports were only willing to say a “luxury EV” had caught fire. Their failure to mention it was a Chinese-built MG-branded EV is but a testament to the fact car manufacturers are major advertisers, and media outlets don’t want to upset their major benefactors.

Figure 2. The burnt-out EV at Mascot Airport alongside a promo shot for an MG EV SUV

In the ACT’s Fishwick, a Beam E-scooter caught fire at a recharging station. The fire was extinguished, but emergency services stayed on site for another two days in case the fire reignited. One battery did, on 1 June, and then again six weeks later on 14 July.

According to EVFireSafe.com, six lithium battery fires have occurred amongst the 120,000 battery electric (BEV) and plug-in electric vehicles (PEV) registered in Australia. Globally, since 2010, there have been 393 verified EV traction battery fires and another 95 waiting to be verified.

While EV fires are statistically rare, their unique challenges, such as the immense amount of water required to douse them, are noteworthy. A firetruck typically doesn’t carry the 60,000 litres of water required to extinguish an EV battery fire, so you’d want to live near a fire hydrant if your EV catches alight in the garage. In comparison, the average conventional car fire uses less than 1400 litres to be extinguished. This happens to be about the amount of water a Fire & Rescue ‘pumper’ truck carries.

Despite the arrival of Lithium iron phosphate batteries, which are less prone to combustion and thermal runaway, thus making them safer for home use, their fragility is already impacting insurance markets. In the UK, reports suggest EV insurance premiums could jump by up to 1000 per cent because batteries, which constitute nearly half the cost of a new EV, are susceptible to damage even in minor accidents. The high cost and complexity of battery repairs often lead insurers to deem slightly damaged vehicles as total losses.

According to Reuters, some car-makers, including Ford, are manufacturing battery packs that are easier to repair, while others, such as Tesla, “have opted to use structural battery packs, which have ‘zero repairability’.”

Insurers and industry experts quoted by Reuters said that unless original equipment manufacturers (OEM), including Tesla, produce more easily repairable battery packs and provide third-party access to battery cell data “already-high insurance premiums will keep rising as EV sales grow and more low-mileage cars are scrapped after minor collisions.”

Meanwhile, in the U.S., consumer sentiment might be shifting, with battery ‘handle with care’ message possibly explaining a decline in EV sales and an increase in unsold inventory.

Finally, the environmental implications of discarded batteries are concerning. Countries without battery recycling facilities will witness an accumulation of discarded but ‘live’ batteries in scrap yards. The cost and challenges associated with battery repairs and disposal are also expected to influence insurance premiums globally.

The high price of lithium required to balance out demand for EVs is a well known brake on estimates for the pace of EV adoption. When demand rises, lithium miners can’t keep up, the price of lithium batteries rises rendering EVs too expensive and consumer adoption wanes. But less well understood is the impact on EV adoption from rising insurance premiums. Investors may have just found another reason to be circumspect about the lithium EV investment thematic.

[1] Lifecycle air quality impacts of conventional and alternative light-duty transportation in the United States