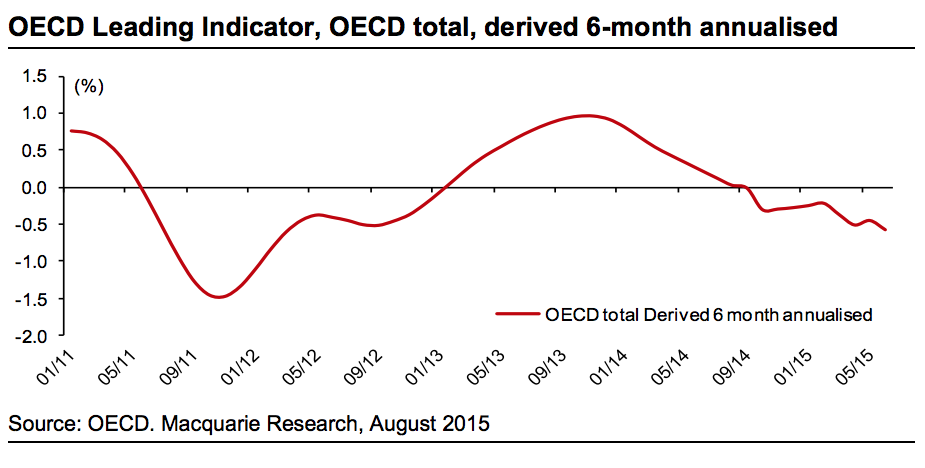

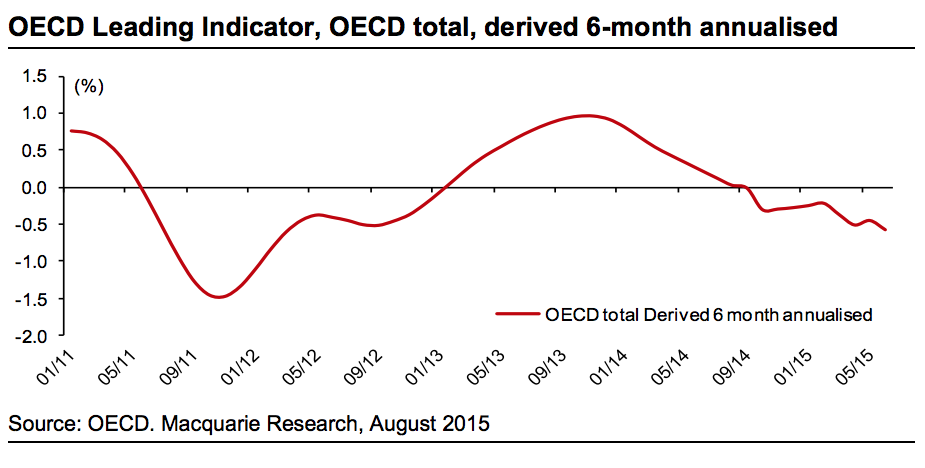

The long grinding economic cycle continues

The pace of the current global expansion is expected to be structurally lower than in previous cycles and this is attributable to high leverage, challenging western world demographic trends and low productivity growth.

And this has certainly been reflected through the commodity complex. We have noted on numerous occasions the very weak price of coal, iron-ore, steel, oil and the value of most commodity countries’ currencies.

Today’s announcement saw Japanese Industrial Production contract by 0.6 per cent month on month in July 2015 with China bound shipments declining by 1.3 per cent from twelve months earlier.

This data provides more evidence of China’s slowdown, which is being exacerbated by their high debt levels, housing bubble and industrial over-capacity – particularly in steel. We know China’s manufacturing wages have risen three fold in the past eight years, or close to 15 per cent per annum, and significant job losses as a result of factory closures could usher in deflationary risks.

To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 30 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.