The King

“Revenue is vanity, profits are sanity and cash flow is reality”. That was a quote I heard from a very successful business man and a company I was fortunate enough to be researching in my formative years as an analyst. Thankfully, it stuck.

Poor cash management practices are the number one reason why businesses go bankrupt. Without the proper amount of cash on hand, reckless spending on unprofitable ventures or worse a business that doesn’t produce any, entities can run into trouble quicker than you think wreaking havoc on your portfolio.

This is why when researching potential companies in which to invest, one attribute we often place a lot on is the ability of the business to generate significant-levels of recurring revenues on a scaled (profitable) base.

We will show you why it is so important but for us to do so you need to put the stock market and all those charts to one side. Turn off all the noise and instead, think like a business owner.

Now consider the benefits of running a business that begins each year, month, week, day with a material amount of revenues (vanity), profits (sanity) and cash flows (reality) already locked in and flowing through the door. The impact should be obvious and the confidence you gain from being in such a position is invaluable.

For having certainty that 70, 80, 90 or even 100 per cent of your revenues are secure for any future period is an enormous “leg up”. Knowing that cash will continue to flow through your door each and every day, regardless of what events transpire enables business goals, forecasts and budgets to be accurately prepared and for management to attack their plans relentlessly.

This may sound logical and simplistic, but keep in mind that stockmarket investors regularly lose sight of their core goal of long-term stable returns when they are being bamboozled by a constant stream of IPO’s, research, short-term negative global economic news and the latest hot-tip.

Unless you can reliably predict the movements of share prices in the short term or are incredibly lucky with your taxi drivers stocks ideas, you must give your portfolio the very best opportunity to weather the market fluctuations. Whether you are building a portfolio from the ground up or adjusting your current holdings, we believe that you must ensure your portfolio is always pointed in the right direction. One way to do this (we believe) is to focus on stability and predictability as being key ingredients to use in your investment process.

Now, while there are many definitions of what constitutes “stable” and “predictable”, in my mind “recurring revenue” certainly fits the bill on many levels. For flowing out of the recurring revenue concept is generally (but not always) an efficient, well-run entity with a well-funded balance sheet and a business producing predictable sources of future financing to fund growth or dividends.

As an example, this is what sets companies in the telecommunications sector apart – a fertile ground of investment for our funds here at Montgomery.

Whilst the industry has undergone material consolidation of late, the performances of Vocus (VOC), M2 Telecommunications (MTU), TPG Telecom (TPM), Big Air Group (BGL), My Net Phone (MNF) and Telstra (TLS) can perhaps be traced back to them all having a stable and recurring core business which have been leveraged to produce exciting growth.

For telcos, the obvious core of their business are the long-term contracts for phone plans, internet subscriptions, fibre optic rental, data-centre use, wireless and unified communications they have with their clients. All of which are typically 12 to 24 months in length and generally each telco will have hundreds of thousands of customers making payments each month like clockwork.

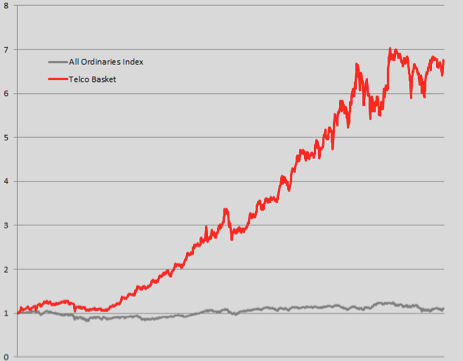

With this in mind, let’s turn the stock market back on and question whether or not you, as an investor, should build a portfolio of such businesses? To answer this, the chart below compares the performance of an equally weighted portfolio of all businesses in the telecommunications sector (as they exist currently) over the past 5 years compared to the All Ordinaries Index over the same period.

Our conclusion? The out-performance of businesses with large recurring revenue streams with attractive growth prospects can be simply stunning.

Some will argue that such conclusions are inappropriate given the short sample period and survivorship bias inherent in the analysis. While this may be the case, the reality is that these stocks and their underlying businesses have performed wonderfully over a period that saw budgetary turmoil in America, wars and terrorist attacks in foreign countries, nuclear and natural disasters in Asia and a debt crisis in Europe. And if we add back-in Amcom and iiNet for example who have been taken over more recently (removing survivorship bias), the results are just as impressive.

My own direct investing experience over the past 15 years supports the notion that businesses with earnings stability have a greater chance of providing outperformance over the long run. Why? Simply because investors gravitate to them given their stability and predictability which has the added benefit of seeing such businesses valued by the market on much higher forward multiples (P/E expansion) when compared to businesses that do not have the same recurring characteristics.

This is why we own a number of such businesses in our portfolios, and not just in the telco space. If you can think of any we should take a look at, we’d be delighted to hear from you.  Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery domestically and globally, find out more.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Graeme

:

Getting somewhat off track, but when graphing something that has changed by a factor of seven you should be using a logarithmic scaled chart. Arithmetic charts can be misleading in a couple of ways. Firstly ‘straight line’ increases on the chart actually represent continually deteriorating performance eg. from 1 to 2 is +100%, whereas 6 to 7 is +16%. Secondly, they magnify price swings at the top end of the chart that percentage wise may not be that significant.

Not disagreeing with what you say, just suggesting a fairer way of representing it.

Roger Montgomery

:

We agree with you Graeme but our clients who are very wealthy business owners might not. They care more about the dollars than percentages.

CHARLES MCDONALD

:

Hi Russell, perhaps it’s time to start having a closer look at Xero (XRO)?

Regatds,

Russell Muldoon

:

Hi Charles, what an amazing achievement by the XRO team. Im sure there will be a time that XRO may look interesting to us, and we are always watching, just not time yet.