The key investment trends in FY16

The 2016 financial year saw some significant changes in investment in Australia. There were major movements in relation to global shares, fixed interest, global property and infrastructure, and alternatives. We can learn a lot by looking at where the money flowed.

I recently attended a briefing from one of the major banks which discussed this topic. The bank’s investment platform is used by many financial planners to allocate their clients’ investments across a wide variety of strategies. It has more than $8 billion of client assets administered, making it a pretty good proxy for adviser market-wide investment trends.

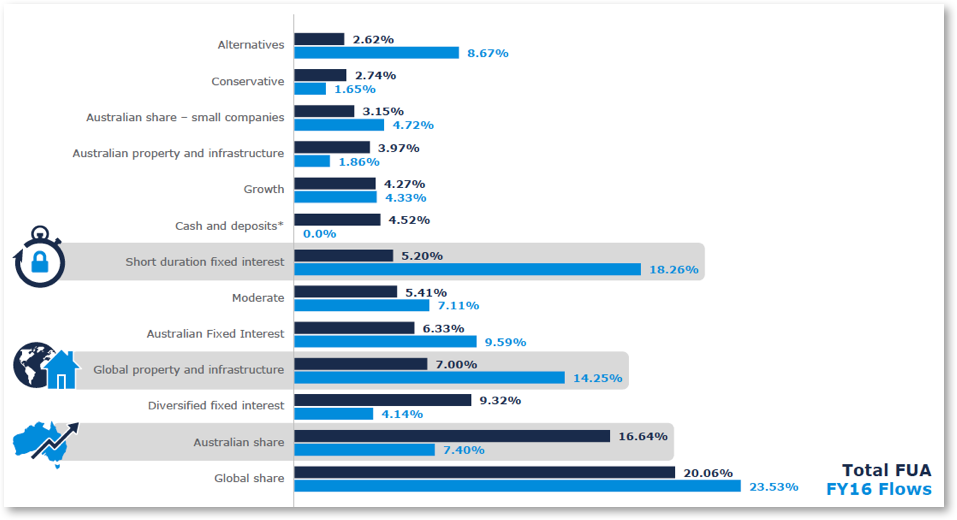

The results are illustrated in the bar chart below. The light blue bars represent the proportion of net inflows into that asset category, and the dark blue bars represent the proportion of total Funds Under Advice (FUA) in that category.

So, what can we read into these results?

Global shares – this asset class received the highest proportion of new client investments, taking almost a quarter of all money allocated. This is in line with what we have seen in the institutional market and consistent with findings in a past blog. There would seem to be a clear trend to reweight portfolios from a heavy Australian equity bias to a more even split with global equities and hence why we are seeing only 7.4% of flows go to Australian equities. (Remember, Australia only makes up around 2% of the world’s stock market opportunities.)

Short duration fixed interest – there was a 98% increase in total FUA into this asset category from the previous year, mostly funded from existing cash investments and a reduction in advisers using diversified fixed interest funds. With cash rates so low, advisers have been allocating to higher yielding strategies without taking on long duration risk.

Global property and infrastructure – this asset class was the market darling for investors looking for extra yield and benefiting from the offshore currency exposure. FUA increased by 57% from the previous year because of receiving 14.25% of inflows.

Alternatives – this asset class picked up 8% of the inflows, probably driven by advisers seeking an uncorrelated asset return for client portfolios in what many believe could be a low or negative returning environment for growth asset classes (equities and property). Previously, Alternatives only made up around 2% of client portfolios but this has increased significantly. The newly launched Montgomery Alpha Plus Fund would typically fit into this category as well.

The other point worth taking away from this data is that no one adviser/ investor/ fund manager has a clear crystal ball that can consistently predict the future. Hence why diversification within and across asset classes is a sensible approach which can reduce risk and deliver a more consistent return. It is also an act of humility given few could have predicted the events such as Brexit and Trump!