The Impact of quantitative easing on equity prices

Over the weekend I read a great article written by James Olsen of First Niagura Private Client Services. For those of you with access to ProQuest I would highly recommend that you read the full article there but for those of you without I have summarized the key points below.

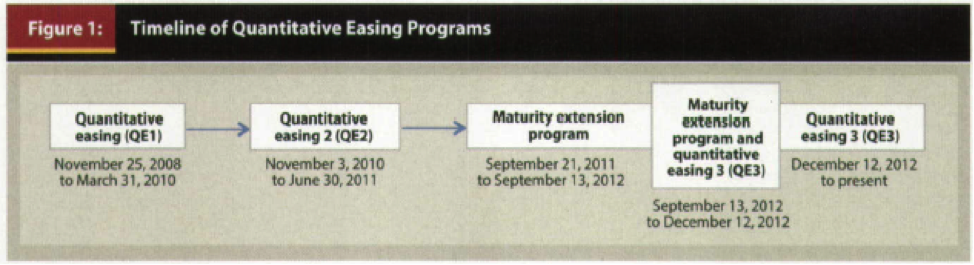

For your reference, a timeline of the various programs is as follows:

So a common question that follows the topic of quantitative easing (QE) is “will it lead to inflated equity prices?” It’s quite surprising but if you have been invested for several years invested then this study would suggest that your portfolio has both gained and lost its “QE premium”, even before tapering had largely begun. Olsen conducted a study where he compared the value of the S&P500 Index on an actual basis to an estimated index with the effects of QE taken out.

The impact of QE depended on its stage. For example, QE1 and QE2 had little to no effect on the index as opposed to Q3 which had a large positive effect of 22 per cent. This is not surprising as QE1 & QE2 primarily targeted the mortgage securities market whereas QE3 sold short term bonds and bought long term bonds in an effort to stimulate economic growth in the United States via interest rates. Indexes such as the S&P500 typically rise as the economy is stimulated and this is exactly what transpired.

Following falls in the market which occurred subsequently after the May and June 2013 FOMC meetings as talks of tapering begun, the “QE premium” largely vanished with differentials between actual interest rate and estimated interest rates (without QE effects) beginning to converge.

It should be noted that the study acknowledges, but quantitatively doesn’t take into account the positive effect of QE on corporate earnings.

Citation: Olsen, James L. 2014. “The Impact of Quantitative Easing on Equity Prices.” Journal of Financial Planning 27 (5): 52 – 60

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

QE is just a fancy name for good ol’ Money Printing. Is it too early to know the long term effects of the trillions of dollars that Central Banks (CB) have added to the global financial system?

Would equity prices be much lower without QE?

The benign effects of QE has certainly made nearly everyone comfortable with it. Will this lead to CBs being more reckless in the future as people will now want QE in future major downturns?

It certainly is an interesting topic.