The impact of ongoing inflationary pressure

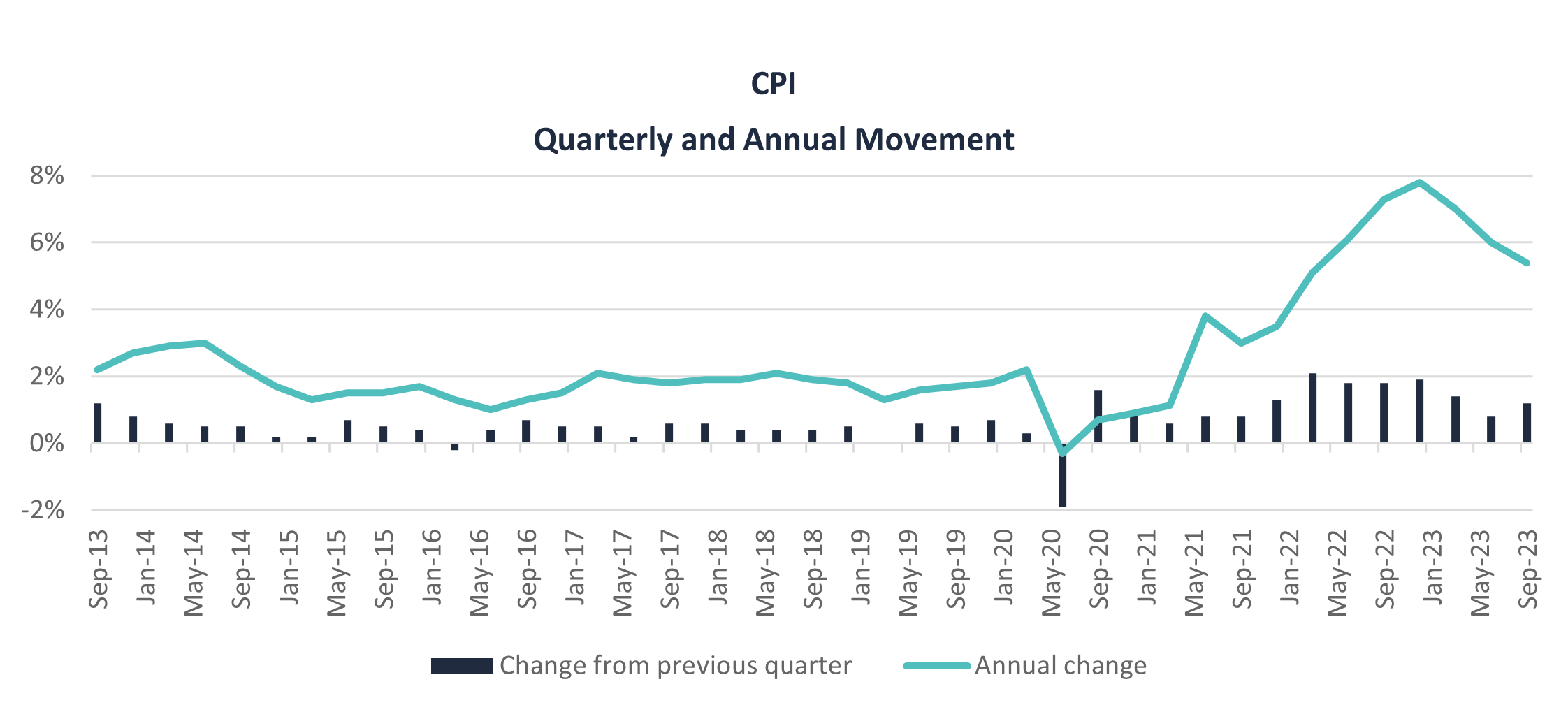

The quarterly consumer price index rose 1.2 per cent over the September quarter and 5.4 per cent over the last 12 months. The quarterly result is higher than the 0.8 per cent rise reported in June, however the annual consumer price index (CPI) headline figure has dropped from 6.0 per cent. The September results are still well above the 2 – 3 per cent target range. The Reserve Bank of Australia (RBA) has flagged that the return to target could be slower than their current forecasts. Additionally, they have clearly articulated that they will not hesitate to increase the interest rate further, should there be a material upwards revision to the outlook for inflation.

The most significant contributors to this quarter’s increase in CPI were fuel (+7.2 per cent), rent (+2.2 per cent), new housing purchases (+1.3 per cent) and electricity (+4.2 per cent). The rising cost of fuel is expected to be a cause for concern for some time to come with global conflicts causing a mismatch between supply and demand and as such, driving global oil prices higher. The RBA Governor introduced this concept of “shock inflation,” as a result of the current geopolitical issues. This could heighten the risk that inflation and interest rates could stay higher for longer. The rising housing prices are a result of new subdued demand and easing material costs.

Inflation is still on a downward trend having passed the 7.8 per cent peak in December. Whilst this is positive, the rate at which inflation is declining is cause for concern. The RBA’s central forecast is for CPI inflation to continue to decline until reaching the target range by late 2025. Recent figures are presenting the RBA with additional challenges, as they grapple with the idea that their central forecast may not be achievable in line with their expectations. As such, the RBA would likely be considering a further rate rise next month.

The latest CPI data has stirred general market speculation for a rate rise next month. ANZ and CBA, had initially priced in no additional rate rises, however, both banks have now changed their tune after the latest CPI read and are now forecasting a 25 basis point rise to come at the November board meeting. NAB had already priced in a November rate rise irrespective of the latest CPI figures.

Whilst inflation is slowly moderating, it is proving to be persistent and more prevalent both at home and internationally. The RBA is likely putting serious thought into a rate rise for Melbourne Cup Day.