The headwinds hitting free-to-air TV keep blowing stronger

Ten Network Holdings Limited (TEN:ASX) held its 2016 annual general meeting last week. The news was not great for shareholders, who are witnessing the decline of a once-robust media company. And there seems to be no light at the end of the tunnel.

Despite losing seven board members during the fiscal 2016 year, the good news is the company picked up some market share and recorded a 7.5 per cent jump in television revenue to $676.4m.

The problem, however, is that while television costs approximate television revenue, they appear to be on a faster growth path. For example, management indicated that for the November 2016 quarter (TEN’s balance date is 31 August), television revenue grew by 1.9 per cent (an annualised $13m) while television costs grew by around 5 per cent (an annualised $33m).

Even if we exclude the significant items – an aggregate of $640m have been written off over the five years to 31 August 2016 – it seems TEN just can’t make a profit.

And as Australia’s total advertising expenditure is further directed to on-line content providers, the suffering of free-to-air television networks like TEN is expected to continue.

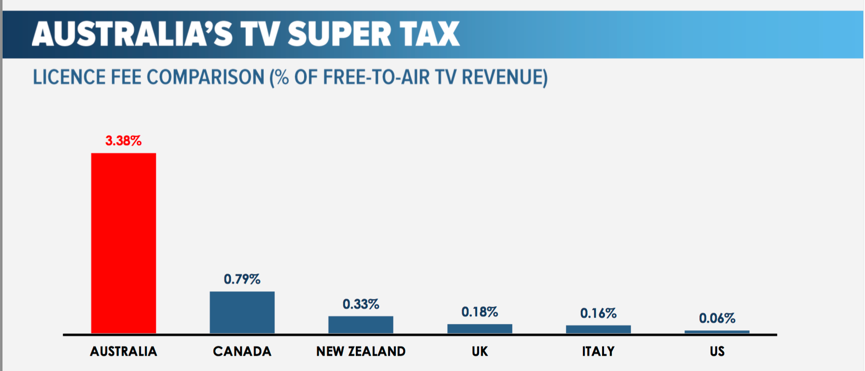

Adding to the pain are the licence fees paid to the Federal Government as a percentage of gross revenue, which have sparked a volume of protest from the networks. The slide below is taken from Chairman David Gordon’s AGM presentation. It shows that licence fees in Australia are, in percentage terms, far greater than those in comparable countries.

Little wonder that TEN is actively calling on the Senate committee hearing on media ownership legislation to “remove pre-internet era rules that are making Australian media companies less competitive”