The great China slowdown – Part 4

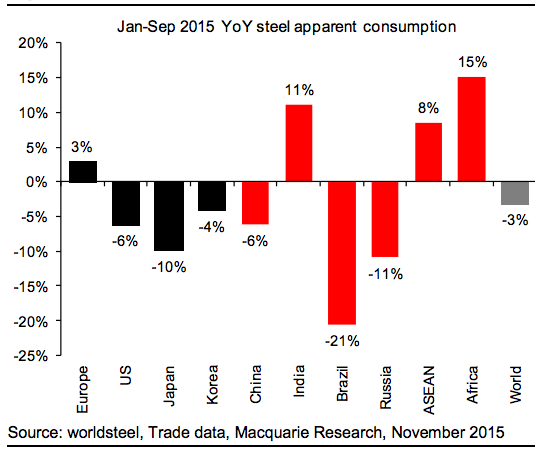

As we have noted previously, global steel consumption is expected to decline 3 per cent in 2015 to around 1.6 billion tonnes. According to Macquarie Research, apparent steel consumption from China is down 6 per cent over the nine months to September 2015 and this is largely related to the Chinese construction market, with residential construction demand expected to be down 10 per cent in 2015. According to Macquarie, “the only people who still seem to think there is significant upside in global steel consumption akin to the past decade (when it grew by an average annual 50 million tonnes) are the major iron ore producers – for example BHP’s belief global steel consumption will hit 2.5 billion tonnes by 2030 – just a further 50% upside required there!”

According to Macquarie, “the only people who still seem to think there is significant upside in global steel consumption akin to the past decade (when it grew by an average annual 50 million tonnes) are the major iron ore producers – for example BHP’s belief global steel consumption will hit 2.5 billion tonnes by 2030 – just a further 50% upside required there!”

The global steel industry has been operating at a 75 per cent to 80 per cent capacity utilization rate since 2009. The price of Hot Rolled Coil (HRC) and Rebar (Reinforcing Bar) is now running at 15 year lows in China (at RMB2,000/ tonne).

Our conclusion: until we see the permanent closure of at least 10 per cent of global steel capacity (and that is twice the current US annual production of around 80 million tonnes), we expect steel prices, iron-ore prices and metallurgical coal prices to remain depressed.

To learn more about our domestic and global funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.