The Global Private Equity Rage

On 10 October, Navitas (ASX: NVT) announced it had received an unsolicited, preliminary, conditional and non-binding proposal from BGH Capital, Australian Super and Mr Rodney Jones to acquire 100 per cent of the shares in Navitas at $5.50 per share.

On 21 November, Trade Me (ASX: TME) announced it had received a preliminary, non-binding, indicative proposal from Apax Partners to acquire 100 per cent of the shares in Trade Me at NZ$6.40 per share.

One thing is clear. As interest rates hit historic lows, and quantitative easing has pushed asset values to elevated levels, the global build-up of cash reserves held by “private equity” has meant the sector is paying up to consummate deals.

Cynics argue that the typical Private Equity business model is to substitute debt for equity on a company’s balance sheet, aggressively cut staff numbers, rein in Research and Development and Capital expenditure, and then about three to five years later “feed the stock market dog when it is barking”. (Admittedly, many sales are made to industry players trying to grow their market share). Unsurprisingly, secondary market buyers are becoming increasingly cautious when Private Equity is the vendor, as in Australia we have witnessed several post IPO shocks.

In the Spring 2018 edition of the American Affairs Journal, Daniel Rasmussen wrote an article entitled “Private Equity: Overvalued and Overrated?” His firm, Verdad, compiled a comprehensive data base of 390 private equity deals, and the results were sobering. Of the transactions examined, 54 per cent saw revenue growth slow, in 45 per cent of cases profit margins contracted and in 55 per cent of cases capital expenditure as a percentage of revenue declined.

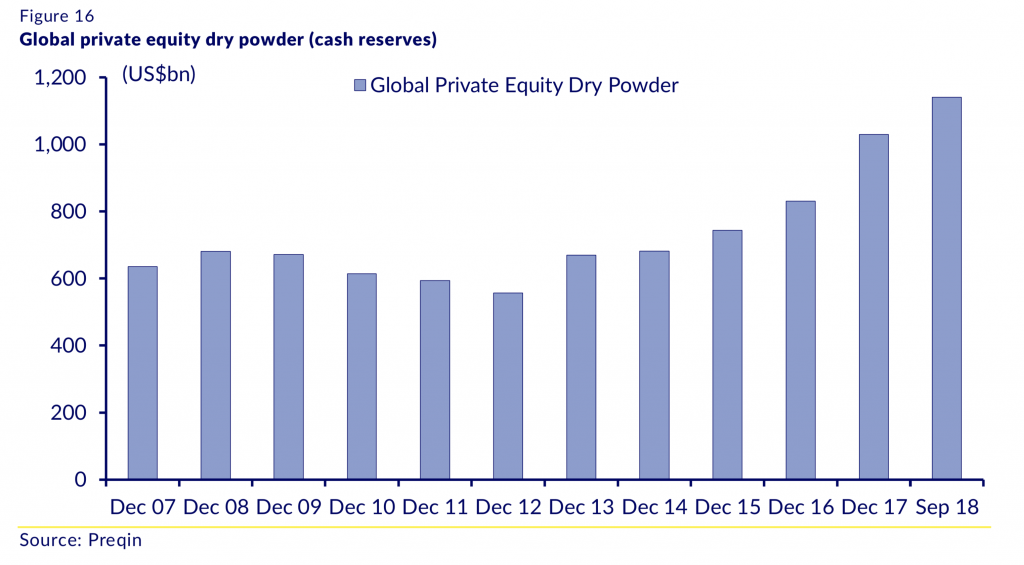

Rasmussen noted the Private Equity sector was chasing rising valuations and paying solid double-digit EBITDA multiples for acquisitions. According to private equity data provider Preqin, Private Equity currently has US$1.1 trillion of cash to invest, which can be seen in the graph below.

Like all investments, the degree of financing taken on should be closely scrutinised, as total leveraged loans have grown at an annual rate which is approximately triple the global GDP growth since the GFC, and there has been an increasing willingness amongst lenders to accept “covenant-light” protection. And this scrutiny should be bolstered with the normalisation of US monetary policy and quantitative tightening.

The Montgomery Funds own shares in Navitas and Trade Me. This article was prepared 23 November with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade either of these you should seek financial advice.