The fortunes of IRESS

IRESS is a company that we love at Montgomery Investment Management and it’s been frustrating to watch the company’s share price trade at a material premium to our estimate of its intrinsic value. But has its latest acquisition presented an entry opportunity?

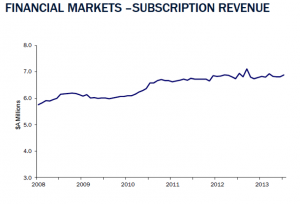

IRESS is a supplier of share market and wealth management systems in Australia. The subscription base of its domestic equity platform provides a high level of recurring revenue but growth has matured, and so the company has been seeking to increase earnings by expanding into new markets and developing new products.

The most promising development has been its wealth management platform, XPLAN. The service comprises a range of software tools for financial planners, such as data migration, documentation and client management. Conversely, the company’s foray overseas has been rather challenging. The United Kingdom is one market in particular that the company has been trying to tap into, but the strategy has proven unprofitable thus far.

Management determined that IRESS could only make an impact in the UK market via acquisition, and it has just announced the purchase of a major competitor, Avelo. The competitor is in a strong position within the wealth management and mortgage origination markets. Avelo’s wealth management business mirrors IRESS’s existing XPLAN technology by providing software solutions to a long-standing client base of financial advisers and brokers. The Enterprise Solutions business provides software solutions to banks and building societies for mortgage sourcing origination.

The acquisition is significant in terms of revenue, and considerably diversifies IRESS’s earnings stream by region and segment. The acquisition was designed to penetrate the UK market, and so was not made with the intention of generating synergies. In saying that, there are a number of opportunities that could provide upside risk to earnings:

• Avelo was in the process of developing a wealth management platform to compete with XPLAN. The acquisition means that future expenditure can now be reallocated

• IRESS believes that Avelo’s existing assets are underleveraged and can provide immediate scale with new products

• Cost savings may be achieved through reductions in headcount

IRESS expects that the acquisition will improve the company’s earnings per share by 10 per cent in 2014. While Avelo is a natural fit for IRESS, the company is also a major player in a mature industry, which makes it difficult to imagine that it will be able to drive materially higher growth than the parent entity. Unfortunately, incorporating this 10 per cent accretion into our estimate of intrinsic value does not justify the company’s premium share price.

IRESS is a high quality company that we would love to buy at the right price and hold for a very long time. The acquisition of Avelo solidifies IRESS’s earnings profile and certainly makes the company more attractive. But at its current share price we will prefer to wait on the sidelines until we have a better sense of whether the upside delivered by the acquisition can materially bridge the valuation gap.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi, just bought this stock only $1000. But want to hold for the long time. As a new investor, doing it very slowly. Like your posts Roger. Thank you Susie

Roger, great stuff. This makes me interested to know where you sit in the spectrum of value investing. Graham bought good companies at great prices, Buffett moved on to great companies at fair prices. Would you buy a great company (perhaps IRESS) at a fair price or are you more conservative again, buying great companies only at great prices? And does that require larger investments in those more rare events?

Hi Dave,

Not sure Graham bought good companies. Thought a bit of the cigarbutt style crept in?

I haven’t done any research on this company so will be guided by your suggestion of waiting on the sidelines

Hi Allan,

You cannot make a decision to do anything or to do nothing without further research of your own and never without seeking personal professional advice.