The Evolving ASX

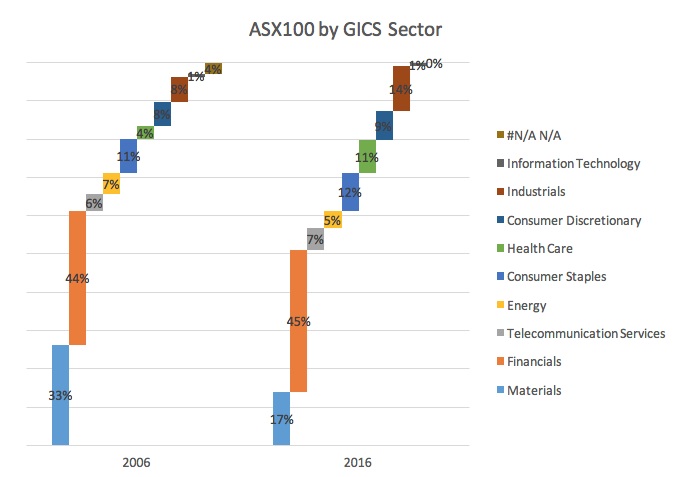

The chart below splits the market capitalisation of the ASX100 Index into GICS sectors, and shows the index as it was ten years ago (on the left) and the index as it is today (on the right).

A couple of things stand out in this chart. The main one is the declining significance of materials, which made up 33 per cent of the Index by capitalisation in 2006, compared with just 17 per cent today. This perhaps doesn’t come as a big surprise; we all know that the resources boom has ended and resource company share prices have fallen sharply.

A couple of things stand out in this chart. The main one is the declining significance of materials, which made up 33 per cent of the Index by capitalisation in 2006, compared with just 17 per cent today. This perhaps doesn’t come as a big surprise; we all know that the resources boom has ended and resource company share prices have fallen sharply.

What is a little more interesting is which sectors have been the largest beneficiaries of the declining share of materials. All else being equal, we might expect financials – by far the largest component of the index – might stand to pick up the most percentage points. In fact, financials have barely moved.

A large part of this is probably due to some recent bank share price weakness. The big four banks have been suffering under the weight of: increased capital requirements, slowing credit growth, global liquidity concerns and rising impairments. As a result, the Index has become significantly more diversified over the past decade, with some of the smaller sectors increasing in size.

The biggest winner here has been healthcare, which has picked up 7 percentage points, almost tripling in relative terms, followed by industrials which has picked up 6. The others sectors have been fairly static.

All else being equal, these developments are probably good. A more diverse market should hold greater appeal for investors of all stripes, and a declining materials sector in our view should improve overall market quality. Indeed, anything that encourages people to think more broadly than the traditional Australian portfolio of the big four banks, BHP and Rio is probably a good thing.

We might lament that information technology – one of the more interesting sectors in a world beset by technological disruption – is still only a rounding error in the Australian market. However, progress is progress!

Tim Kelley is Montgomery’s Head of Research and the Portfolio Manager of The Montgomery Fund. To invest with Montgomery domestically and globally, find out more.