The dangers of missing numbers when trading at elevated multiples

A brief note today just to compare the share price reactions of two different companies both trading at what we consider expensive valuations. Now, trading at an expensive valuation does not mean that it is necessarily not a good idea to own the stock, what it does though is increase the risk if things do not go to plan.

The results published yesterday provide some good examples of this.

The first is Cochlear:

- Cochlear is as most readers probably know one of the great global success stories of Australian technology having pioneered and developed the implanted hearing aid that is now even generically called a “cochlear implant”.

- Cochlear has always been a very expensive company due to its strong growth profile in a market that has all the right demographic drivers (aging population, increasing social security systems in more and more countries etc.)

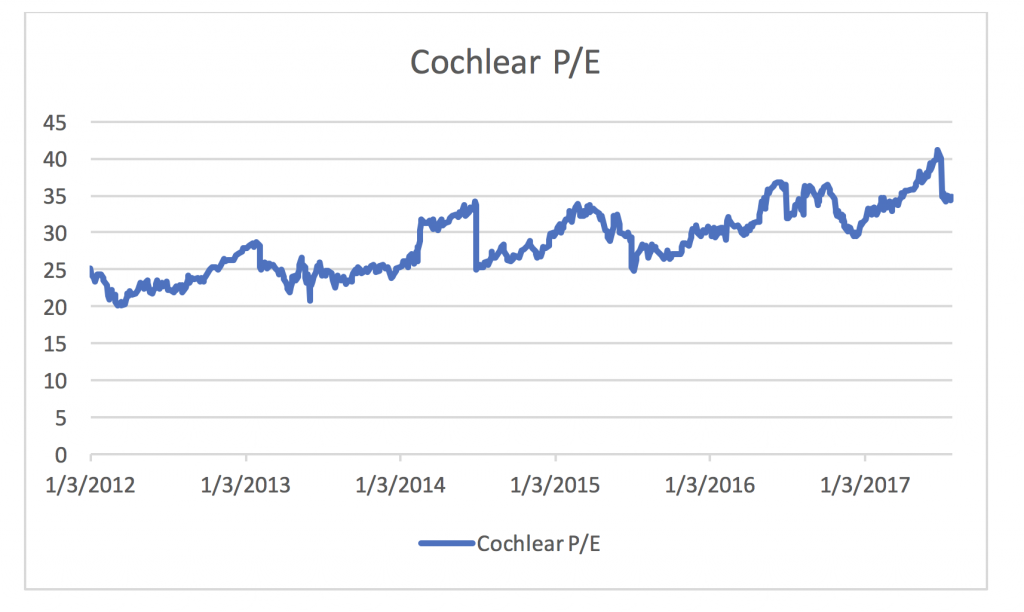

- The company is currently trading at a P/E of well above 30x as can be seen from the chart below.

- Cochlear announced results that were exactly in line with what the market was forecasting (Net profit of AUD223 million vs. consensus forecast of AUD222 million).

- The share price as a result is as of the time of writing UP 7 percent.

Let’s now compare this with IRESS:

- IRESS is another Australian success story even though it is not as well-known as Cochlear.

- IRESS develops financial IT systems used by banks and investors to analyse and trade shares and also systems used by Financial Planners to help give advice to their customers. The company has a very strong position in Australia but also has significant operation in UK, South Africa and Canada.

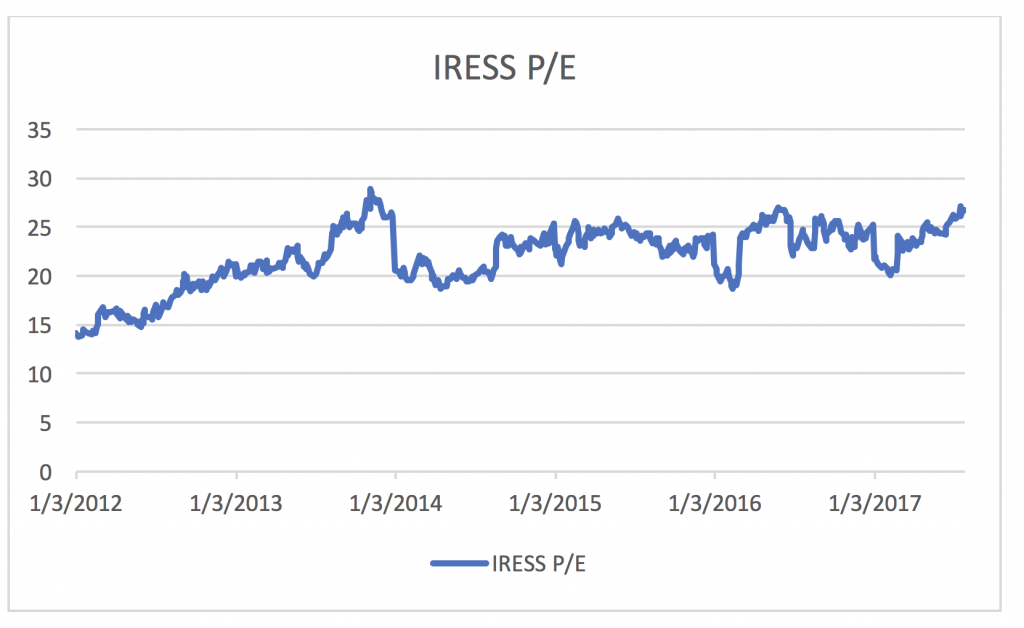

- Due to its growth profile, it has also historically been an expensive company and is currently trading at a bit over 25x P/E.

- IRESS announced its first half 2017 results yesterday which were about 15 percent below what the market was looking for (Net Profit of AUD29.5 million vs. market expectations of ~AUD34 million) and which was actually 10 percent below the level that they produced in the first half 2016. The consensus forecast for the full year is for about 10 percent profit growth over the previous year and that looks very hard to achieve when the first six months are going backwards.

- As a result, the stock is at the time of writing DOWN by 6 percent.

Now, initial price reactions to results are often exaggerated but these two results highlight an important fact:

- If there are very high expectations built into the current market price, the consequences of not fulfilling those expectations are large.

Now, at Montgomery, we do not own either of Cochlear and IRESS even though they both fulfil our definition of quality businesses and the reason is that we think they are both priced for perfection which does not give much room for error. Cochlear has clearly passed the expectations test while IRESS has failed.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY