The colour of money?

It’s been a lackluster start to this year’s company confession session. Only a few companies have so far bucked the stable / downward trend in revenues and profits.

It’s been a lackluster start to this year’s company confession session. Only a few companies have so far bucked the stable / downward trend in revenues and profits.

At the top of this list, reporting what I would consider to be quality results are CCP (SQR A2) – so far the clear standout and a business we own in the Montgomery Private Fund. This is followed by WEB (SQR A2) a business whose Total Transaction Value (TTV) is growing at rates 4x the industry average but is a little expensive in terms of its future prospects for now.

And that’s about it at the quality end of the investment spectrum (with the exception of Breville, Forge and Decmil’s updates). Remember that we rate every single listed company from A1 (the best) to C5 (the worst) so we follow them all. If you want to find opportunities such as CCP before everyone else, take a look at Skaffold.com

There have been a number of other businesses which have reported so far and on face value, while LGD (SQR B2) experienced strong revenue and profit growth; a large proportion of its growth was driven by several recent acquisitions. Organic growth is less than 50% of that being reported currently; something to watch in future reporting seasons.

Now to our friends long Telstra:

(SQR B3) the half year was a little sobering for those who have bought the stock for its dividend yield. Whilst reported Free Cash Flow was $1,795b and dividends paid amounted to $1,738b, one would assume the yield was fully covered. Not so. The free Cash number reported did not include $559m in interest repayments on almost $15b debt. $500m additional debt was borrowed to fund dividends and CAPEX – debt to equity thus increased and is currently 104%. While dividends are being paid, and will probably continue being paid, its just worth noting how they are being funded…

Over at the Big Australian – BHP:

Staying at the big end of town and global diversified mineral and petroleum producer BHP (SQR B1) reported a HY NPAT $9.9b NPAT down on last year’s. The lower results was despite very attractive Iron Ore, Bulks and Petroleum margins – prices which declined in the latter part of 2012 and which may impact profits further in the 2nd half. The acquisition of Petrohawk for $13b (which pushed gearing to 34%) contributed to earnings but couldnt arrest the decline. Industry-wide cost pressures with consumable, labour and contractor costs added $400m to cost inflation! On a more positive note, the project pipeline of $27b and $5b in actual committed projects. In the half total CAPEX (investment) projects + exploration spend was $9b – this continues to support EPC / EPCM engineers, drillers, mud suppliers (Decmil, Forge, Maca, Fleetwood et. al.) which are all operating at full capacity and expanding like there is no tomorrow. However for BHP investors, because the company continuously has to invest in greenfield projects to offset natural production decline, this results in a capital intensive investment program – something investors in BHP 20 years ago might be acutely aware of. Although they have long-life, world class assets and significant cash flows that are able to meet the demands currently, over the past three months profits have been downgraded from circa $25b to circa $19b. Indicative of an economic slowdown and slowing demand for resources. So something to be watchful of is the fact that declining profits = declining cashflows = declining future investment. Albeit the investment future and plans looks like its all boom time right now.

Posted by Russell Muldoon per Montgomery Investment Management, Value.able and Skaffoldauthor and Fund Manager, 9 February 2012.

Does anyone else see more value in TGA than CCP atm?

Why does MACA have leverage to the Capex cycle, apart from more mine equating to potentially more future contract wins?

Hey Dan,

Just my take but TGA abd CCP are very different businesses and should not be compared.

MLD have some very long term contracts so maybe they are deleveraged to a capex fall…………..But I doubt that.

Cheers

Thanks for the example on Telstra. I have been looking for some interesting free cash flow stories to back up that i am looking at this metric correctly.

I remember the Telstra example in value.able where Roger mentions that Telstra put interest paid in the financing cash flows other than operating cashflows but this post reminded me to have a look at it and being able to spot what you mention has been encouraging.

I can’t for the life of me see Telstra ever cutting dividends unless they really really had to which means they will probably continue to borrow money to fill the gap between free cash and div’s. Apparently 40% of Telstra’s register is made up of mums and dads which i think is pretty high. The yield would probably be the most important thing to most of these investors.

Another very interesting post.

then you need to look at whether a company has a commodity pre-pay or something like it. The key is whether the type of business it is in should logically have an unearned revenue line.

Hey Roger,

I can’t stop laughing,

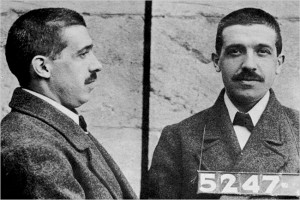

The Telstra logo next door to a photo of Charlie Ponzi.

It’s a classic……………….Too funny

Cheers