The Aura difference

Given the considerable volatility of markets this year it is no surprise investors are seeking to derive income from areas not correlated to traditional asset classes, namely equities and bonds.

A means to do so is via the emerging asset class of private debt which we have explored in great detail with our readership in recent months through our introduction to Brett Craig and Aura Private Credit. However, are all private debt strategies the same? I seek to explore some of the key differences investors should be mindful of when considering private debt as an investment option for their portfolios.

Liquidity and duration

For any investors that had mortgage-backed investments during the GFC they would be aware a key learning for unlisted managed investments, regardless of the asset class, was that daily unit pricing does not equal daily liquidity. Moreover, rule number one and two in investing in unlisted managed funds is that you are only as liquid as the assets the fund invests in. In the case of private debt, investors should be mindful of any lock-up periods in the strategies they are considering, particularly for those that specialise in funding for property development purposes, a sector Aura Private Credit do not currently lend to.

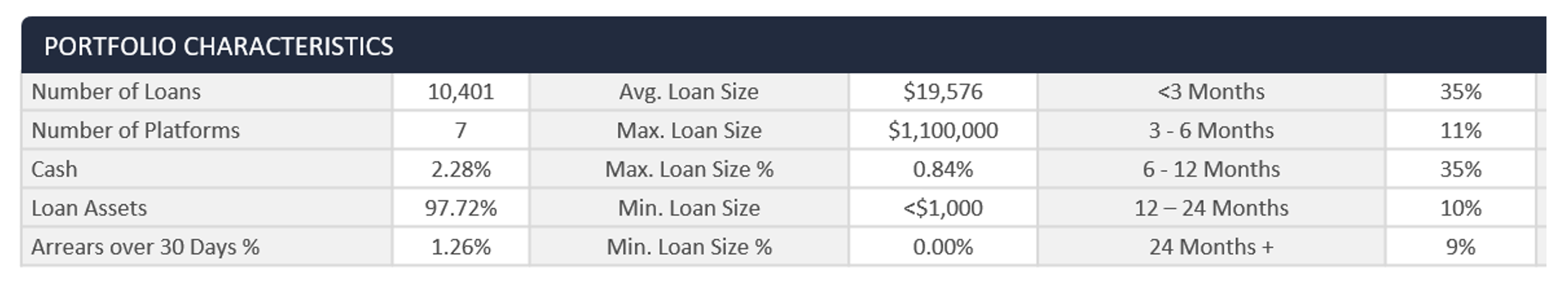

The Aura High Yield SME Fund accepts redemptions on a monthly basis, provided there is sufficient liquidity. To date, the Fund has been able to meet all its monthly redemption payments. Similarly, the Aura Core Income Fund intends to make limited withdrawal offers monthly subject to available liquidity and the Fund expects to hold 10 per cent cash to aid this. Importantly, both these strategies focus on shorter duration lending, with an average duration across the Aura High Yield SME Fund of just four months, as captured in the table below. Given this, the duration roughly matches the liquidity of the Fund, which should be something investors are mindful of when exploring investments in private markets.

Source: Aura Private Credit for the Aura High Yield SME Fund, as at 30 September 2022

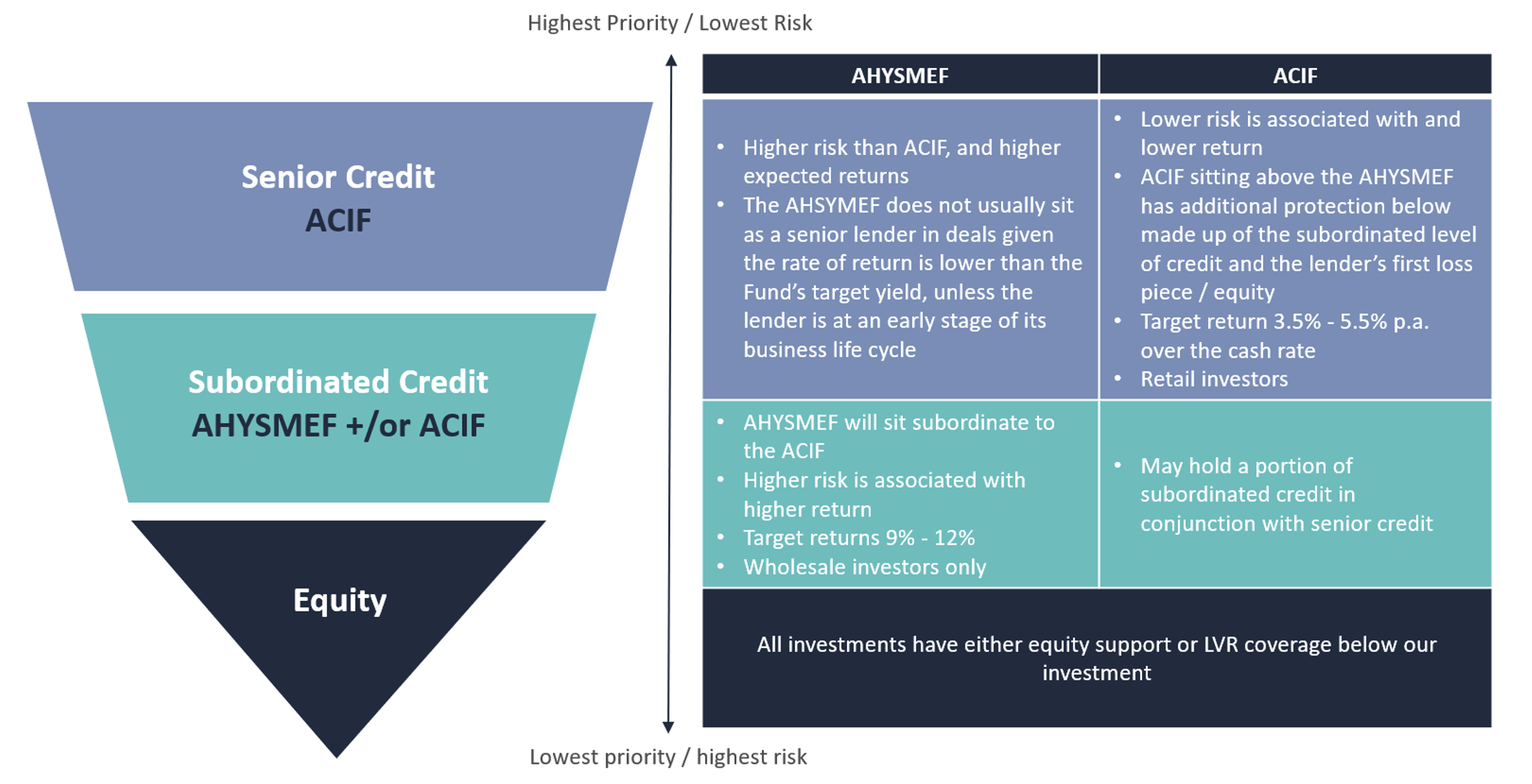

Bi-lateral lending versus warehouse financing

There are a number of loan types that can be encompassed in a private debt solution in the SME space, with bi-lateral loans and warehouse financing the most common. Bi-lateral loans are the easiest to understand, as they are simply a loan written directly with a single lending party usually for a specific purpose such as M&A, product development or even distressed lending. As an aside, Aura Private Credit do not provide any funding for distressed lending. Warehouse financing has grown in prominence since the GFC and describes a facility where the loans are written within a bankruptcy remote trust or special purpose vehicle. These loans involve one or more lenders which sit in different tranches relating to their priority and terms under the agreement. This is a common vehicle used for entities that are not lending directly themselves but rather funding the lenders, which is exactly what Aura Private Credit do, as illustrated below. The benefit of this warehouse structure is the lenders the team are funding sit as subordinate in the capital stack, and therefore wear the first loss as negotiated under the priority and terms of the agreement itself. This protection sits in addition to the underlying collateral the lenders require for the (asset-backed) loans themselves, meaning investors have two forms of protection in the event of a borrower default.

Source: Aura Private Credit. ACIF is the Aura Core Income Fund.

AHYSMEF is the Aura High Yield SME Fund available for Wholesale Clients only

Return premia from SME lending

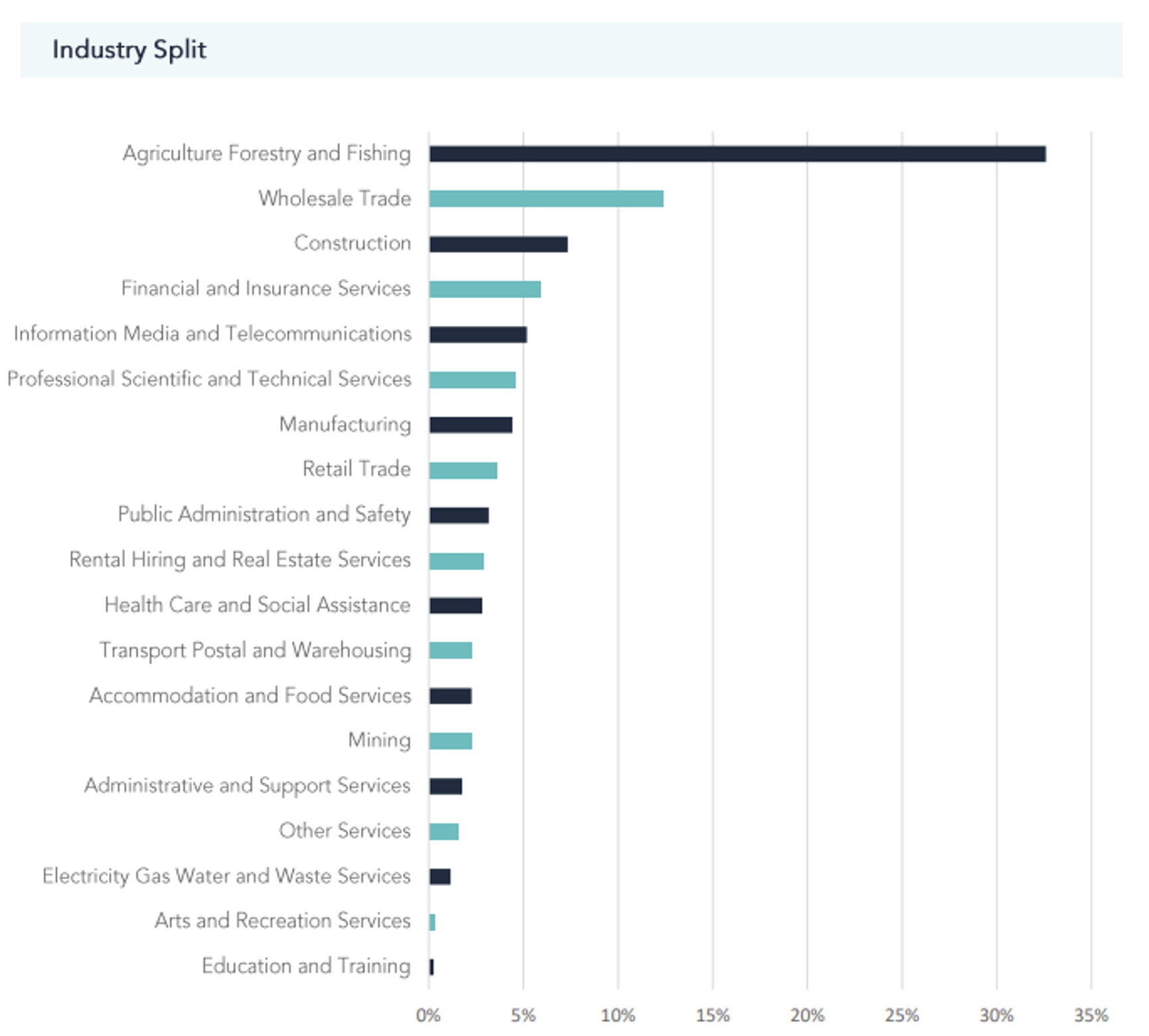

Part of the attraction of investing in private markets is the return premia investors can access by their illiquid nature. However, there is also a return premia from focussing on SME lending specifically. According to Judo Bank, a pioneer in the non-bank lending space, there is approximately a $119 billion gap in funding for SMEs in Australia.[1] This shortfall has significantly increased since the GFC as the big four banks have migrated away from financing SMEs, particularly short duration loans less than $2 million. The end result, lots of fast growing, highly innovative SMEs that are starving for capital and very few lenders out there who are able to provide this to them. This is exactly the space Aura Private Credit looks to focus its attention on almost exclusively as they seek out specialist non-bank lenders with strong business fundamentals and robust lending practices. The Aura High Yield SME Fund are currently funding seven non-bank lenders across over 10,000 underlying loans, where the average loan size is only $19,576. These underlying loans are very well diversified across industries as per the bar graph below. The Aura High Yield SME Fund offers a blend of senior and subordinated lending exposures, which is the source of return premia it has been able harness over its five-plus year history. The Aura Core Income Fund, will look to benefit from the same process that has driven the success of the Aura High Yield SME Fund.

Source: Aura Private Credit for the Aura High Yield SME Fund, as at 30 September 2022

[1] Source: Judo SME Banking Insights Report for 2021

If you would like to learn more about the Aura Core Income Fund, please visit the fund’s web page to learn more: Aura Core Income Fund

If you would like to learn more about the Aura High Yield SME Fund (wholesale clients only), please visit the fund’s web page to learn more: Aura High Yield SME Fund

You should read the relevant Product Disclosure Statement (PDS) or Information Memorandum (IM) before deciding to acquire any investment products.

Past performance is not an indicator of future performance. Returns are not guaranteed and so the value of an investment may rise or fall.

This information is provided by Montgomery Investment Management Pty Ltd (ACN 139 161 701 | AFSL 354564) (Montgomery) as authorised distributor of the Aura Core Income Fund (ARSN 658 462 652) (Fund). As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230).

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Aura Core Income Fund before making any decision about whether to acquire or continue to hold an interest in the Fund. Applications for units in the Fund can only be made through a valid paper or online application form accompanying the PDS. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from www.oneinvestment.com.au/auracoreincomefund or from Montgomery.

The Aura High Yield SME Fund is an unregistered managed investment scheme for wholesale clients only and is issued under an Information Memorandum by Aura Funds Management Pty Ltd (ABN 96 607 158 814, Authorised Representative No. 1233893 of Aura Capital Pty Ltd AFSL No. 366 230, ABN 48 143 700 887).

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

Montgomery, ACH and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.