The argument of CEO salaries

Perhaps I’m dropping the cat amongst the pigeons, poking a hornet’s nest or even releasing the hounds by talking about executive compensation, but a study conducted by recruitment firm Equilar, and reported in Bloomberg Businessweek by Eric Chemi and Ariana Giorgi, convincingly demonstrates there is little relationship between executive salaries and stock holder returns.

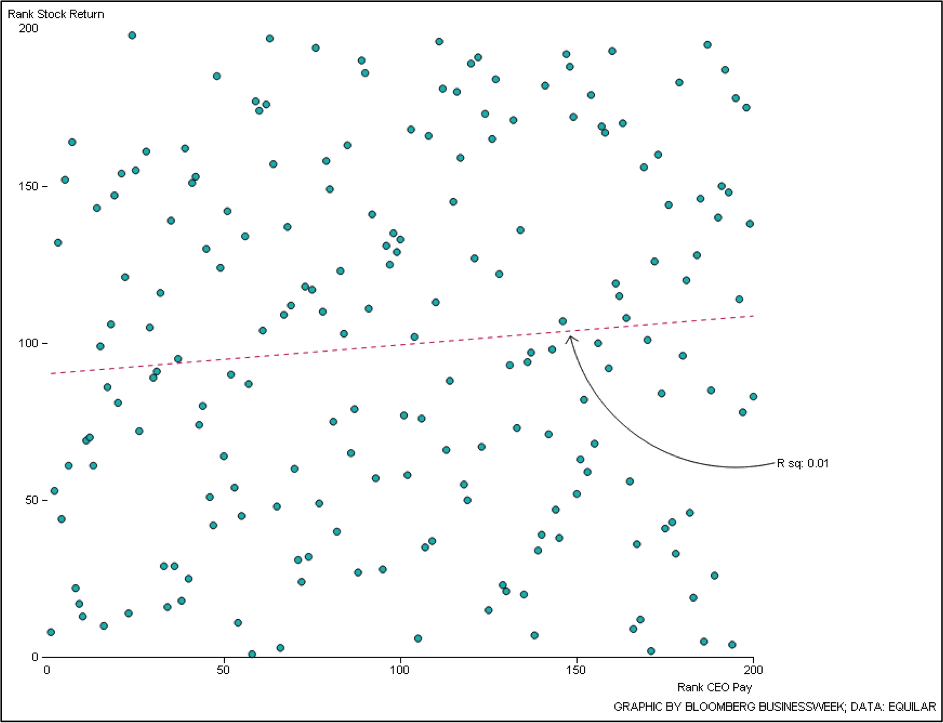

California-based Equilar sampled 200 US companies, comparing CEO pay against the company’s financial performance as measured by stock returns.

A simple scatter plot was used to display the relationship between CEO pay and stock returns.

One expects CEO salary to ultimately align with stockholder returns. By paying more for the most ‘talented’ CEOs, shareholders should see these individuals extract better returns from the businesses they steward. If a CEO is paid a hefty salary, strong financial performance should result (and this would translate into strong stock price performance).

If these rational shareholder expectations were reflected by reality, there would be a strong correlation evident between CEO pay and stockholder returns. Stock returns would rise with salaries and a tight cluster of observations around the line of best fit would be observed.

Notwithstanding the fact that the results would change depending on, for example, the period over which stockholder returns were measured, Equilar’s scatter plot reveals that the higher up the rankings a CEO’s salary is (moving from right to left on the X axis) no observable aggregate increase in stock returns results. One would expect to see a negatively sloped line of best fit with a high R-squared number reflecting a low level of errors around that line.

Upon analysing the results however, Chemi and Giorgi write that Equilar were not able to observe a correlation between CEO pay and stock price performance. This leads to some more interesting conclusions about whether extraordinary salaries and compensation packages are justified. If you click here, you will be taken to an interactive matrix allowing you to hover over each data point and examine the company and CEO’s name along with their salaries and stock return rankings

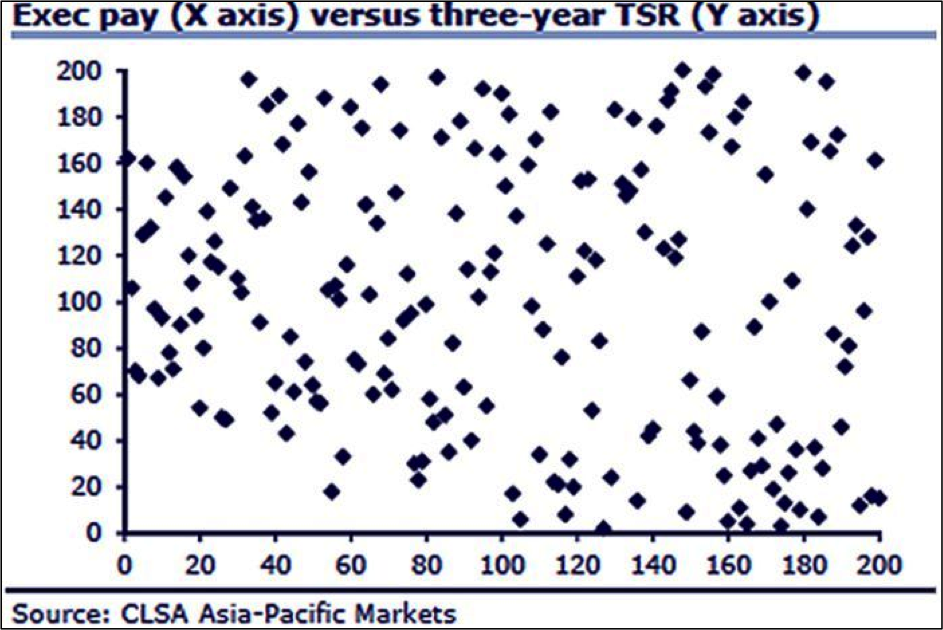

This blog wouldn’t be complete without an Australian example. The below graph was compiled by investment bank CLSA last year. We see similar results.

Note that TSR stands for total shareholder return and that the graph looks similar if we replace TSR with return on equity.

High pay for performance sounds and is very justifiable. I wouldn’t mind paying a CEO a billion dollars if he/she themselves added 10 billion dollars to the bottom line. But if there is no performance then I must ask, why should they get paid so much?

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

The problem with this data is that it needs controlling for company size as stock return is a % measure but pay is a gross figure:

Manager A who adds only 1% of value to a $100B multi-national has produced $1B in value while superstar Manager B who increases value 100% at a $10m micro-stock has only created $10m. Manager A fails to earn a performance bonus and just receives a base compensation of 1% of generated value, meaning pay of $10m; Manager B gets a sizable performance-related bonus and takes home 50% of created value, earning $5m.

These 2 salaries are performance based but will show negative correlation between performance & pay if the data is not controlled for company market cap.

I don’t doubt that there is an unfortunate lack of correlation between performance & renumeration, but this data cannot be considered to soundly support that assertion.

Indeed. Good point. There are always limitations.

well nothing new under the sun.

question is why companies that belong to us ( shareholders ) exist in the first place — ( to fill pockets of senior managers and directors ).

If company is privately owned that it is none of my/our business how much CEO get paid.

thanks Ned.

Just reinforces the fact that what you make isn’t really an indication of your ability. I read in the FIN today some guy saying how he worked for RBS and then got taken over by Computershare when RBS bought his unit. Hasn’t got a Uni degree and says that it would be a waste of time. Etc. That’s fine that it worked for him but I can tell you now that if you haven’t got at least a Bachelors degree you don’t even get to the top of the resume pile. And it’s this kind of crappy heuristic that “it worked for me so it will work for you” is the logical fallacy.

Basically the dude won the corporate lottery, just right place right time. That’s what a lot of this life is like.

The real challenge is making something that the market wants and needs and growing it.

The converse of this is a business like CPU which has a mature registry business that really has no where else to grow, they have to keep growing because that’s what the CEO has to do, so they just buy what they want to buy, bolt on stuff to the engine. if it sticks it sticks, if it doesnt, they write it off, reduces the tax component and drives their EPS growth.

Many Entrepreneurs who successfully build a business and, for example, sell it for hundreds of millions, fail to recognise how much happenstance was involved in their success. Bumping into so-and-so on the street who mentioned “you should get in touch with so and so because he’s looking for a whatsit” is so easily forgotten on the long journey to building a successful business. And when forgotten its easy for hubris to replace the void that is left. That happenstance was some part of the success, is evident in the many, often very public, failed subsequent attempts to replicate the original success.

as someone who spent 6 years at University and another 5 years of postgraduate studies to get where I am, working hard and earning a good income for it, I am totally appalled that these CEO’s think they deserve to

earn many millions per annum more than me. Who the hell do they think they are ???

The analysis is obviously a simple one and probably used to get publicity more so then explain anything in particular. But taking it at face value, I am personally not surprised, i think between management and industry fundamentals, the industry fundamentals provide the biggest effect. The best a manager can do is just try to make sure the boat is rowing the right way and whether a storm is coming or not. As is often noted, you could take the greatest management team in the world and put them in charge of some companies and the company will still perform poorly. Conversley, some really bad management could probably look really good if in charge of great companies.

Definitely incomplete research and limited scope…but the point made by them is well made.

Thanks Roger, for raising this subject.

I have never understood how anyone can justify turning an (often) average manager into a lotto winner every year is good for the company or the community.

It needs to be turned around.