Telstra’s Growth Conundrum

Today’s AFR reports on Telstra’s (TLS) capital investment plans, and states that the man in charge of those investment plans, Brendon Riley, believes that “the answer to the growth question is to keep investing.”

We don’t disagree with this in principal, but note that historically, TLS has not had much success in investing for growth.

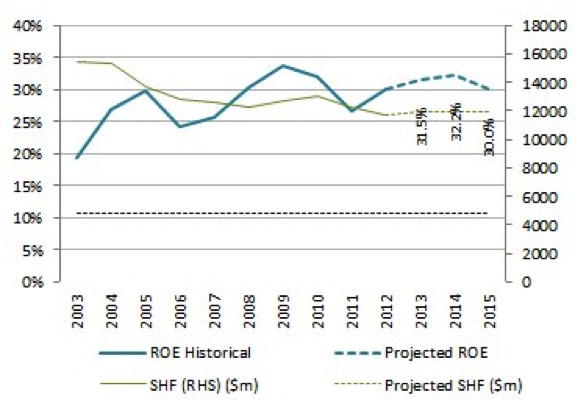

While it enjoys a high ROE, TLS has over the years been unable to increase shareholders’ equity. The chart below shows how both ROE and Shareholders Funds (SHF) have been more or less flat for many years (in fact gradually declining in the case of SHF). The chart also shows some internally generated projections for the next few years.

SHF has not grown because TLS pays out all of its profits as dividends. What this suggests to us is that TLS does not have a wealth of opportunities to deploy additional capital at attractive rates of return. In these circumstances, it is appropriate that TLS should pay out all its earnings as dividends, but it means that shareholders should not expect much by way of profit growth. Profit is ROE multiplied by SHF, and if both of these numbers stay the same, then profit also stays the same.

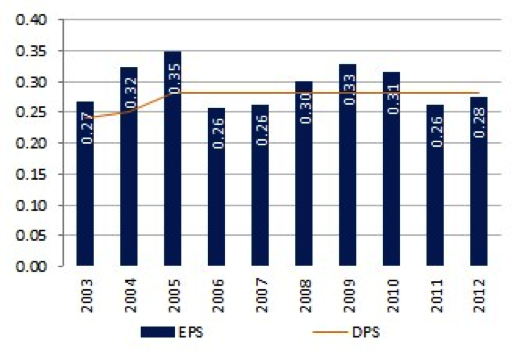

The chart below shows TLS’ Earnings Per Share (EPS) and Dividends Per Share (DPS). Note that the DPS is roughly the same as the EPS, and that the EPS has gone nowhere for the last 10 years.

This is not a criticism of TLS management. The scale of the business means that there is not a lot of room for it to grow in Australia, and distributing the cash to shareholders may well be the best course of action for shareholders. It does mean, however, that in valuing TLS investors should not assume that material growth is likely. Our sense is that the market may have lost sight of this in driving the TLS share price up over the last year or so.