Still Going Strong

For the month of July, a substantial proportion of The Montgomery [Private] Fund’s portfolio was parked in the safety of cash because few new opportunities to invest in quality at cheap prices became available. Despite a lack of value available in the market, the market rose and this resulted in what is conventionally known as ‘cash drag’. Over the very long term however we believe a sensible approach – only employing capital when extraordinary businesses are available at bargain prices – should produce returns in excess of an index whose constituents are frequently businesses that have failed to add economic value over a decade.

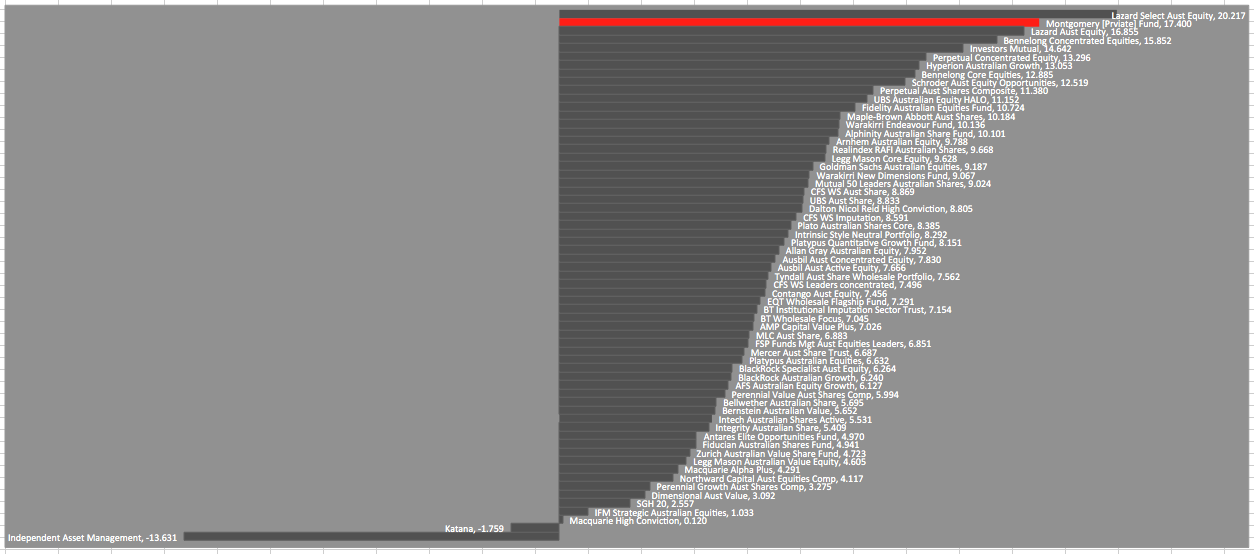

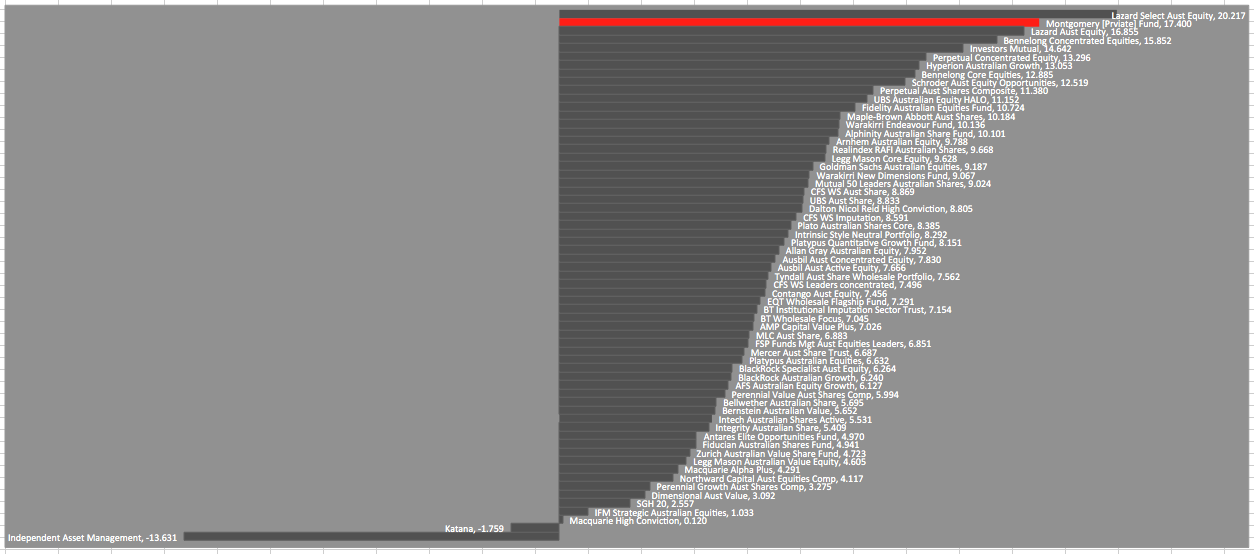

Figure 1. illustrates the hypothetical relative position of The Montgomery [Private] Fund against a field of manager returns, using the approach we advocate and apply.

The graphic illustrates the returns averaged over two years for Montgomery [Private] Fund, hypothetically positioned against some of the funds officially in the Mercer survey to June 30, 2013. Please note we aren’t officially in the survey, but we thought you might like to know, by way of background, where The Montgomery [Private] Fund would have ranked over two years. It provides some perspective. You may also be interested to know that The Montgomery [Private] Fund’s 1-year return to June 30, 2013 ‘hypothetically’ ranked Montgomery in the top ten against a field of over 90 funds. And for the 12 months to 30 June 2012 (the year before), The Montgomery [Private] Fund was one of only a handful of funds that produced a positive return.

To find out more about investing with Montgomery, visit www.montinvest.com or speak with your financial adviser.

FIGURE 1. Average annual returns – 2 Years to June 30, 2013

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Hi Roger,

When you say “cash” what exactly do you mean? Is this in some sort of online saving account or stock broker account? Is it short term deposits expiring within 6 months or some other sort of short term investment? I find when people say “cash” it is a very loose meaning and can be a variety of things.

If you could provide a rough breakdown in percentages what type of holdings your “cash” is in that would be great.

Thanks,

Elliot.

Thanks for the idea Elliot. The result won’t change the message though