Stick to the knitting

We have discussed previously the ingredients required to invest successfully over the very long run. And it is encouraging that the two essential ingredients, the ability to value a business and understanding how the market works -particularly its bipolar nature and tendency to treat temporary events as permanent – can be taught.

But there is one other ingredient that is talked about far less, perhaps because this element is accepted as not being learnable. The ingredient is, I believe, Buffett’s special gift. It is of course temperament.

Many years ago Buffett famously wrote:

“Success in investing doesn’t correlate with I.Q. once you’re above the level of 25. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing.”

When markets are volatile and most investors are losing their heads or when high and rising prices are drawing ever increasing numbers of former bears who are throwing in the towel, these are the periods when discipline and fortitude are essential to plant the seeds of the next fortune.

The benefits of the right temperament can be leveraged in any asset class.

Witness, by way of example, the current boom in commercial property on Military Road in the Sydney Suburb of Mosman. Vacancies on the exclusive strip are at their lowest in four years and rents are now reaching $2000 per square metre. According to the Australian Financial review, 40 national and state upmarket brands, including one of my old favourites, Henry Bucks, have set up shop.

In the two years to 2011 however rents had fallen 20 per cent and there were as many as 30 vacant stores. Laura Ashley, Portmans, Saba, Just Jeans and Ella Bache vacated the strip when their leases came up for renewal.

To take advantage of the recovery requires an ability to control emotional urges. One requires patience to take advantage only when commercial real estate is distressed and similarly the discipline to pull the trigger when everyone else is calling the end of the world.

“…to be fearful when others are greedy and to be greedy when others are fearful.”

Another example of the calibre of emotional intelligence required to succeed is Buffett’s own Berkshire Hathaway share price and his response to it.

Many investors look to the current Berkshire share price of $172,089 per share and compare it to the $11.5 Buffett was offered for his stock in 1964, wistfully imagining having purchased a portfolio made up only of stock in the world’s eight largest corporations back in the 1960s.

But very few investors who bought stock back in the 1960s would have had the temperament to hold it through thick and thin.

Berkshire Hathaway has been 58 per cent more volatile than the S&P500 index and only investors who remained disciplined and held their Berkshire shares would have enjoyed the long term performance.

By way of example, over the 20-month period to February 2000 – the peak of the internet bubble – Berkshire shares lost 44 per cent in market value terms, while the market gained 32 per cent.

Think about that for a moment…

Imagine you invested with a fund manager and while the market went up by 32 per cent, your units fell, in market value terms, by 44 per cent! Perhaps giving more life to the example, imagine you invested a million dollars with Montgomery and your $1 million turned into $560,000 while an index fund would have turned your million into $1.32 million. Would you have stuck around?

Not many rating houses in Australia would have continued to give Buffett a high rating after he underperformed by 76 per cent over two years. And very few Australian institutions would have maintained an allocation with Buffett either.

However Warren Buffett did stick with the methodology, preventing emotion from interfering with a disciplined strategy.

Warren Buffett isn’t worth US$53.5 billion because he sold at the first sign of dark clouds on the horizon, because he balked at short term underperformance or because he sold Berkshire shares when he thought they’d gone as high as they were going to for the foreseeable future. No. He has more than tripled the return of the S&P500 since 1976 by simply by being emotionally intelligent. The fact is you can do the same but it isn’t easy – and I’m speaking from experience.

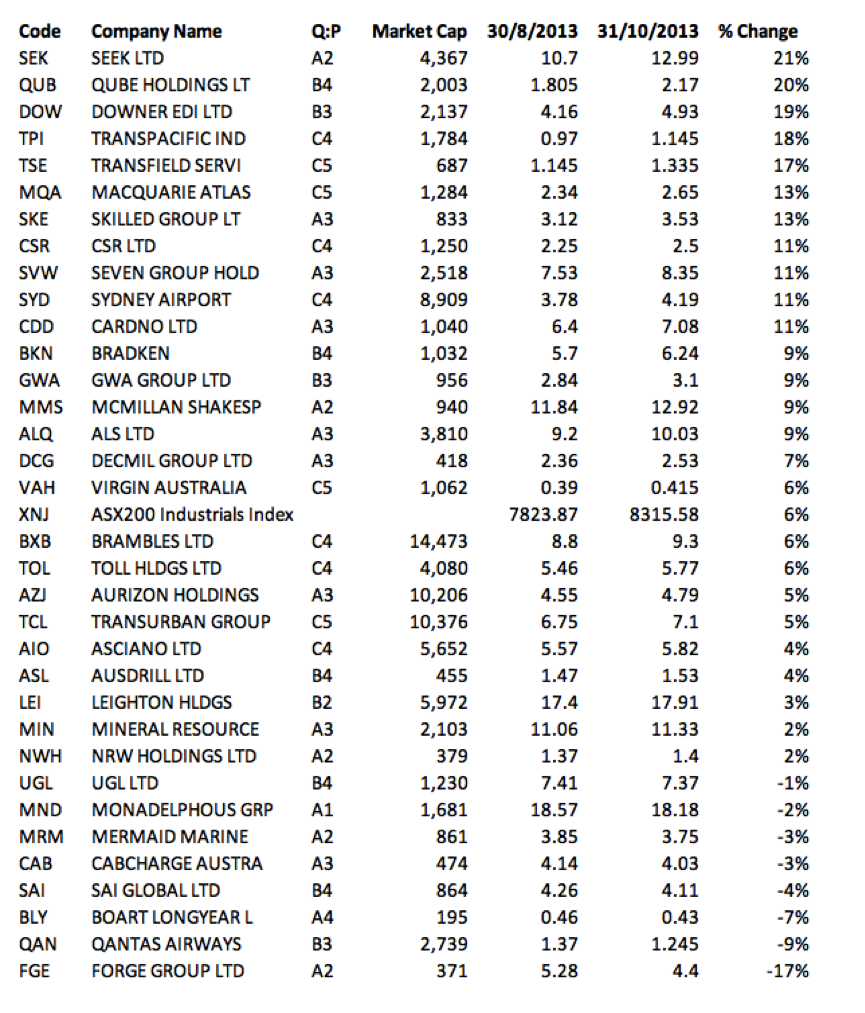

At Montgomery, the last two months have seen both of our funds underperform their respective indices. Should we do the submit and change strategies? Should we jump out of the high quality companies we own and buy the C3 and C4 quality companies that have been rallying the most in the ASX 200 Industrial Index (see Table.1)?

Table 1. Performance of XNJ Constituents

Clearly the answer is no.

What we know is that poor quality companies don’t add economic value over the long run and this is reflected in the less-than-satisfactory increases in intrinsic values over the same period. Most importantly, over the long run prices are determined by intrinsic values and as long as the intrinsic values are higher and rising, and the prospects for the business are bright, the prices should take care of themselves.

Warren Buffett said as recently as October 31 for Fortune Magazine, “Temperament is more important than IQ. You need reasonable intelligence, but you absolutely have to have the right temperament. Otherwise, something will snap you.”

In our view the market is once again in expensive territory with just a small number of large caps showing any margin of safety. Nevertheless, valuing a company is not the same as predicting its direction, and so while the market keeps rallying, we must follow our process and ignore the temptation to swing no matter how loud the calls to do so.

Having a plan and sticking to it, whether good times or bad, I believe is the key to success. I have a plan with specific parameters to buy when opportunities arise and plan that tells me when to sell. As, there is little of value to consider buying at the moment, I have been reviewing my holdings and selling those that my plans tells me to sell. While my plans keep me financially on track, I cannot deny that I am still an emotional human being. At the moment, I am “fearful” and waiting for the greedy days to come….

Thanks for sharing those tales from the trenches Warren.

Hi Roger big big fan never miss the bussiness always love it when your on and a religious reader of your work looking forward to getting your book for a read. My question is I would love to invest in your fund but the minimum in is $250000 and being 30 and paying off a house to raise that kind of money is hard. I was just wondering if in future u would consider lowering the amount cause I would love to get my foot in the door and get in and then continue to invest more overtime. Thanks again until then I will continue to save for it I’m glad your young I might get there someday.

G’day Stephen. The minimum is $25,000 not $250,000. Look forward to working for you if your financial adviser deems it appropriate and you change your mind.

I wouldn’t change a proven strategy that has stood then test of time for anything. Even though the last two months the funds may have lagged the index, surely it is still in front since inception.

Hi Roger,

I am new to this website, can you explain the categorization of A2, B3, C4, C5, etc in term of company quality? thanks.

Hi James,

You will see a search box on the home page. If you type in A2 or A1 for example, you will be able to find all the stories where we have mentioned and explained the ratings.

Temperment as i said in one of your previous posts is probably the most important aspect as far as i am concerned. If you can teach yourself to see busts as great buying periods and booms as great selling periods i think you would do rather well and it would naturally result in your portfolio being ready to take advantage of situations as the higher the boom gets the more cash you will have sitting around due to lack of purchasing opportunities and when the market corrects or crashes then you can use this excess cash to invest at the lower prices that show more value and higher dividend yields.

if you are not in a hurry then events like the GFC was probably one of the biggest wealth creating opportunities to have happened for a while.

“If you can keep your head about you…..” Thanks for the reminder roger.

How to reconcile these two Roger

“while the market keeps rallying, we must follow our process and ignore the temptation to swing.”

“if company earnings are growing at a slower rate than this, the logical response for long-term investors may be to gently start taking a little cash off the table. (From Tim Kellys ” Is that the time?”)

Temptation to swing refers to buying. Taking cash off the table refers to selling. They are perfectly in sync. Spend some time doing something more constructive Michael.

Montgomery Funds/Index

We did not complain when funds were beating the index by a long mile and we shall not complain about them now too.

Sitting on some cash(that earns very little)and doing nothing with it is not easy

but when the time comes to pull the trigger again we will laugh all the way to the bank, pun intended.

Cheers

Thanks for the encouraging words Zoran.

Does this mean that in bubbles the Montgomery fund should underperform the index and in a bust should out perform the index?

Only time will tell. Part of me certainly hopes so. Its during the busts that we get pretty excited. We love a sale.

That’s why we invested in TMF.

Very good, carry on.

Thanks Greg.