Spotlight on: TPG Telecom

Given July has been long- slated as the month that the Government is due to release its much anticipated Vertigan (NBN) review, we think the next few weeks are going to be a nervous and potentially volatile period for TPG Telecom (ASX: TPM) shareholders.

For those who are not aware, the Government is currently conducting an independent cost-benefit analysis and review of regulation for the NBN. For a deep dive, they have set up the following website to provide information on the panel conducting the review and the objectives of that analysis here.

Whilst the final outcomes of the review are completely unknowable at this point, there is a clear risk that the existing regulatory framework in place will be altered which may impact existing fibre optic cable operators.

Under its term of reference, the panel among other things is specifically undertaking a statutory review of the telecommunications industry access arrangements under section 152EOA of the Competition and Consumer Act 2010.

Included within the Act is the following under section 6, 152AGA;

(6) If:

(a) a telecommunication network was in existence immediately before 1 January 2011; and

(b) the network is extended on or after 1 January 2011; and

(c) no point on the infrastructure of the extension is located more than:

(i) 1 kilometer; or

(ii) if a longer distance is specified in the regulations–that longer distance;

from a point on the infrastructure of the network as the network stood immediately before 1 January 2011;

subsection (4) does not apply to the extension.

It’s here we think that TPM may run into some future headwinds in terms of its Fibre to the Business (FTTB) plan. Any change to the current legislation – which clearly allows them to extend their networks by 1 kilometer (if it was in existence immediately 1 January 2011 which captures both AAPT and Pipe Networks acquisitions) – is vital in enabling their networks to be extended into buildings for businesses to access. This change would ultimately result in our current projections becoming harder to meet.

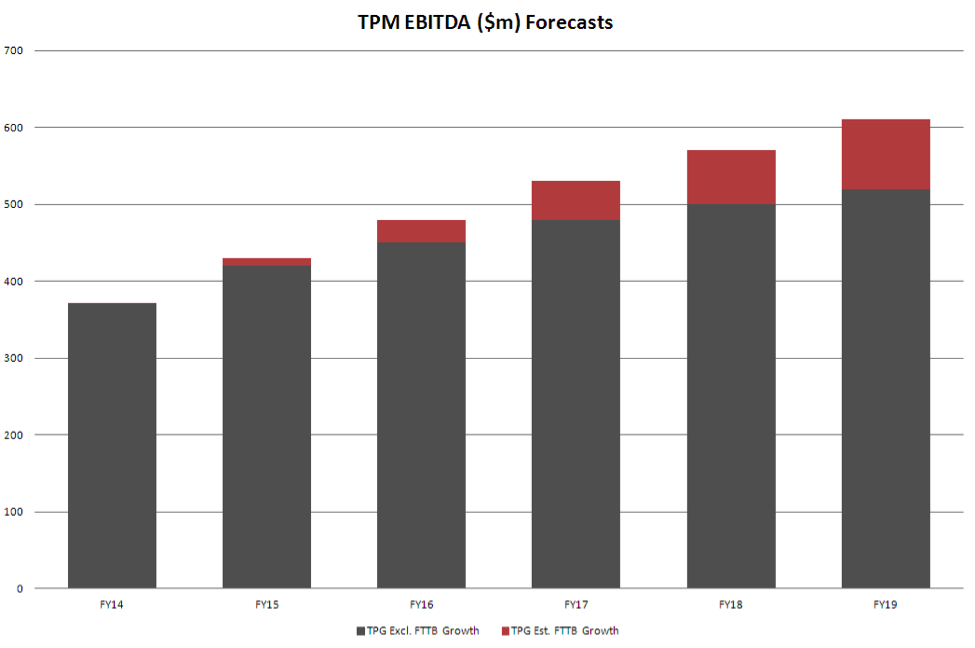

Given that we expect the business to grow EBITDA by $240m between FY14 and FY19 and $90m (38 per cent) of this growth coming from FTTB, a potentially lower growth outlook results.

Whilst TPM does not currently generate any meaningful revenue or earnings from its FTTB strategy, it does trade on high forward multiples in expectation of its FTTB potential, impressive historical growth profile and its potential to leverage and integrate their recent AAPT acquisition.

Any adverse outcomes stemming from the Vertigan review (if any) therefore need to be considered carefully in the context of how quickly a business such as TPM can grow if their environment is changed and how this may impact growth and hence its valuation.

This is of course a very large unknown. Whilst we have previously held shares in TPM, we sold our large portfolio weightings in The Montgomery Private Fund and The Montgomery Fund several months ago to reduce our exposure to regulatory risk. We will watch from the sidelines and review when the outlook is a clearer.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Bruce, we presently don’t believe there will be any material impact on Vocus’ business model. Caveat of course being of course that the Govt has shown in the past a willingness to change regulation in favour of national interests over private business operations. Worth keeping that in mind when such an important review is pending.

Is Vocus likely to suffer if the broom sweeps too deep?