Spotlight on: ARB

ARB Corporation is a well-known small cap company, often quoted as “the stock Warren Buffet would buy”. Today we were lucky enough to hear from the company’s managing director, Roger Brown, whom shared his insights on the company’s current standing and future. A summary of my notes follows:

Results:

- Australian Aftermarket up 1%, OEM down 36%, exports (non-USA) up 19%, exports (via USA subsidiary) up 16% and Thailand Offroad Accessories up 45% (note: mostly intercompany). Overall, sales were stagnant but are expected to approach $300m. Roger believes that the bottom has been reached in OEM sales, but they are not going to compete further on price given the already low margins in this segment.

- YTD March revenues comprised of 70% (March ’13: 69%) from the Australian Aftermarket, 6% original equipment (March ’13: 10%), 13% non-USA exports (March ’13: 11%) and 11% USA exports (March ’13: 10%).

Supply side:

- ARB noted that they are looking to expand their marketing efforts. More specifically, this means putting more salespeople on the ground in the right locations. Presently, several markets are different to service (for example, South America is serviced from Seattle). More local sources of distribution and promotion will naturally increase penetration into these markets.

- There are currently 48 ARB-branded stores in Australia. 20 of these are owned by the company with the remaining 28 being independently licensed. This is up from 46 stores at the end of FY13 (new stores are in Broken Hill, NSW and Welshpool, WA). 2 new licensed stores will open prior to the end of FY15, bringing the total to 50.

- ARB Darwin will move from an independent store to a company-owned store, and the firm is looking to add additional warehousing capacity in Adelaide in the near future.

- ARB established a distribution centre in Jacksonville, Florida, this February. Along with their other distribution centres, this now gives ARB the capacity to distribute products across the US in a timely manner (prior, deliveries took 6 days which was did not suit retailer demands).

Demand side:

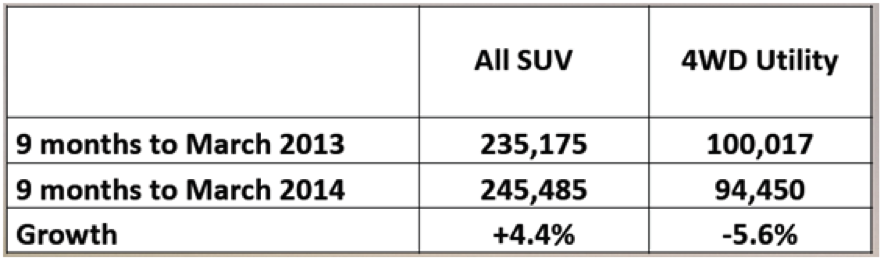

- Sport Utility 4WDs and 4WD Utilities are a significant part of ARB’s demand curve. As shown above, sales of 4WD Utilities are down.

- Whilst issues such as the events in the Ukraine do create instability, reducing demand from some consumers, it creates opportunities from others, such as UNHCF and other aid organisations.

Product development:

- Expenditure on R&D has increased over the period. R&D team has expanded to 35 people, all located in Kilsyth.

- Firm has launched their new ARB Ascent Canopy for the Ford Ranger. This product will require several new versions for other vehicle makes (total of 9) and will be released over the next 18 months. More details can be found here.

- ARB continues to look to develop bull bars for the US market. US consumers are reported to prefer bull bars for large 4WDs and SUVs, whilst ARB’s inventory is comprised of bars that fit smaller 4WDs and SUVs.

- ARB is developing bull bars and suspension for the Ford F series, Chevy and Dodge brands to be released over the next 6-8 months. Another unnamed product is due for release in Thailand from July.

- Roger notes that historically ARB bull bars have been copied by competitors and sold for lower prices. This had little effect on ARB sales overall, as the copies were recognised for their inferior quality (mostly defeating the purpose of having an ARB bull bar). New bull bar designs are noted to be more complicated and will be difficult for competitors to replicate.

In summary, given the circumstances in the OEM & Mining sector, the result is not without merit. Naturally, the opportunity for this stock is via exports, however much more work is required to enhance the firm’s distributional capacities and development of new products in a timely manner to market. This is a stock we will continue to monitor closely.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY