Speculation miscalculation

Following yesterday’s article on Yo (found here) I was reminded of an article I read whilst studying investment analysis under Professor Robert Durand of the University of Western Australia (now at Curtin University). The article (which can be found here) titled “Contagious Speculation and a Cure for Cancer: A Nonevent that Made Stock Prices Soar” by Huberman and Regev, described the series of events surrounding the stock price of EntreMed (ENMD) and other biotech stocks listed in the United States.

Let’s elaborate, on Sunday the 3rd of May 1998 the New York Times reported that ENMD possessed licensing rights to a new breakthrough in the treatment of cancer. Whilst the report was published in 1998, news of the breakthrough had already been published in 1997 both in the Times and in the academic journal; Nature with little if any response in the stock price.

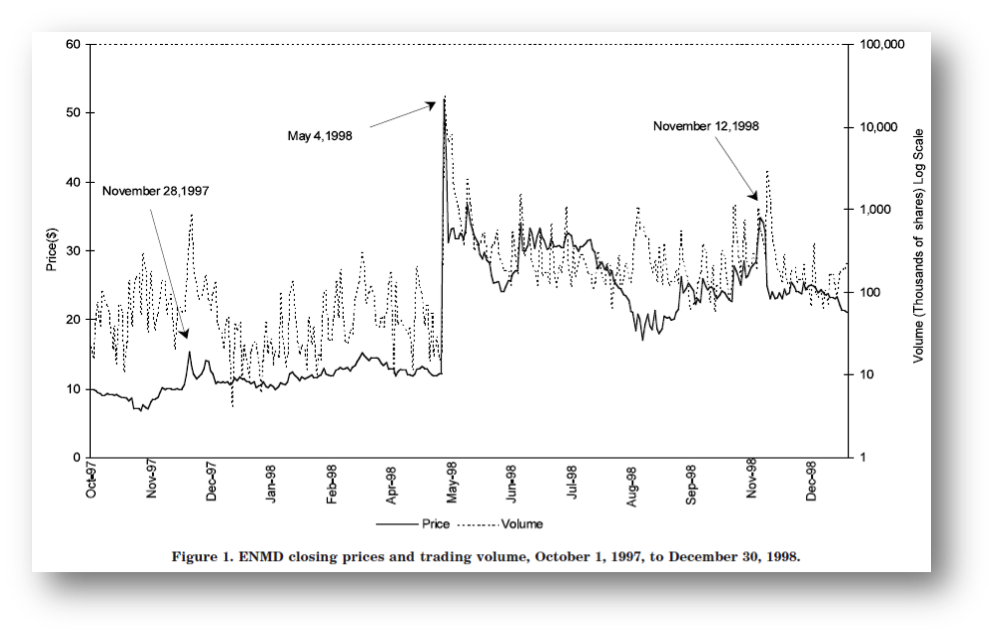

On the 4th of May 1998, the day following publication of the news (is it news if it’s not new? I wonder…), the stock price opened at $85 and closed at $52. Would you be surprised if I told you that the stock price had closed at $12.063 on the previous Friday? By early November 1998, the stock was trading in an upper 20’s to lower 30’s range and on the 12th of November the Times reported that further trials had failed to replicate earlier results. In response the stock price fell to close at $24.875. Note that this is still more than double the price it was trading at prior to the 3rd of May. Curious, no?

The article provides the following chart of ENMD’s stock price:

To add to this, the article reports:

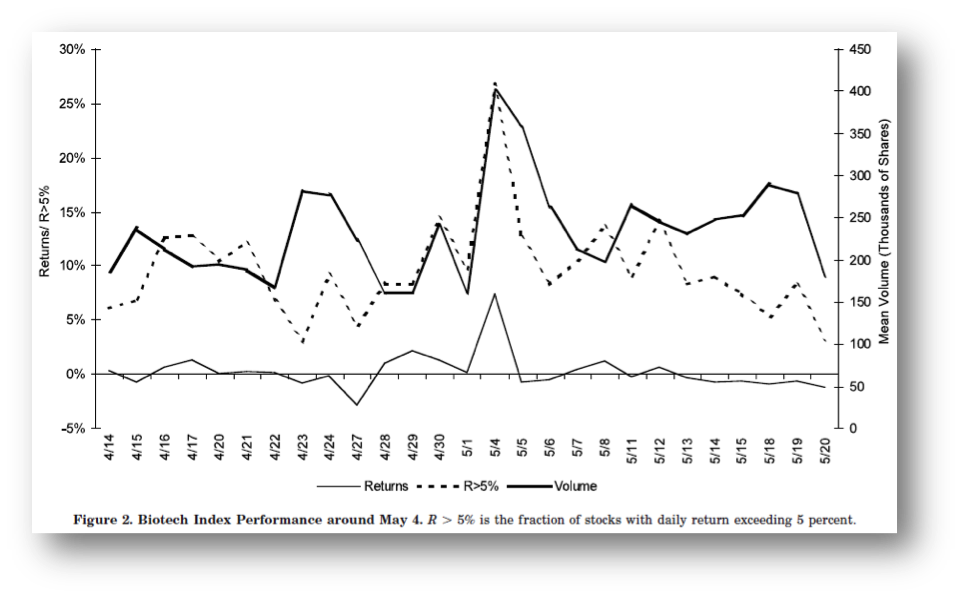

“The puzzle is magnified when we consider what happened to other bio-technology stocks on Monday, May 4, 1998. On average, members of the Nasdaq Biotechnology Combined Index, excluding ENMD, went up by an unusual 7.5 percent on that Monday. The returns of 7 of the stocks in the index exceeded 25 percent on a trading volume that was 50 times the aver-age daily volume the 7 stocks do not include ENMD! On November 28, 1997, when the breakthrough news actually broke, the average return of the 7 stocks was 4.89 percent on a trading volume comparable to the average daily trading volume at the time.”

A chart showing the returns of the Biotech Index can be found below:

If the information released in 1997 had somehow been missed then you could, to a degree, understand the optimism of the stock share price on May 4th 1998. A cure for cancer after all is a valuable asset. This however does not explain the $24 stock price which persisted after the 12th of November 1997 in ENMD. Moreover, the case of contagious optimism which spilled into the Biotech Index is mind boggling at best. Somehow the stocks that comprise the index were worth more for doing nothing at all?

Would love to hear your comments below.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Andrew Santharasegaran

:

I have had the pleasure last semester of being in the same investment class being taught by the very same Prof. Durand, and being given the very same article (Huberman and Regev) to read. A great example against the efficient market hypotheses, in regards to the exact same news about a probable cancer cure, reported by different sources at different points in time, having their own different effects on the share price of Entremed.