Something to crow about

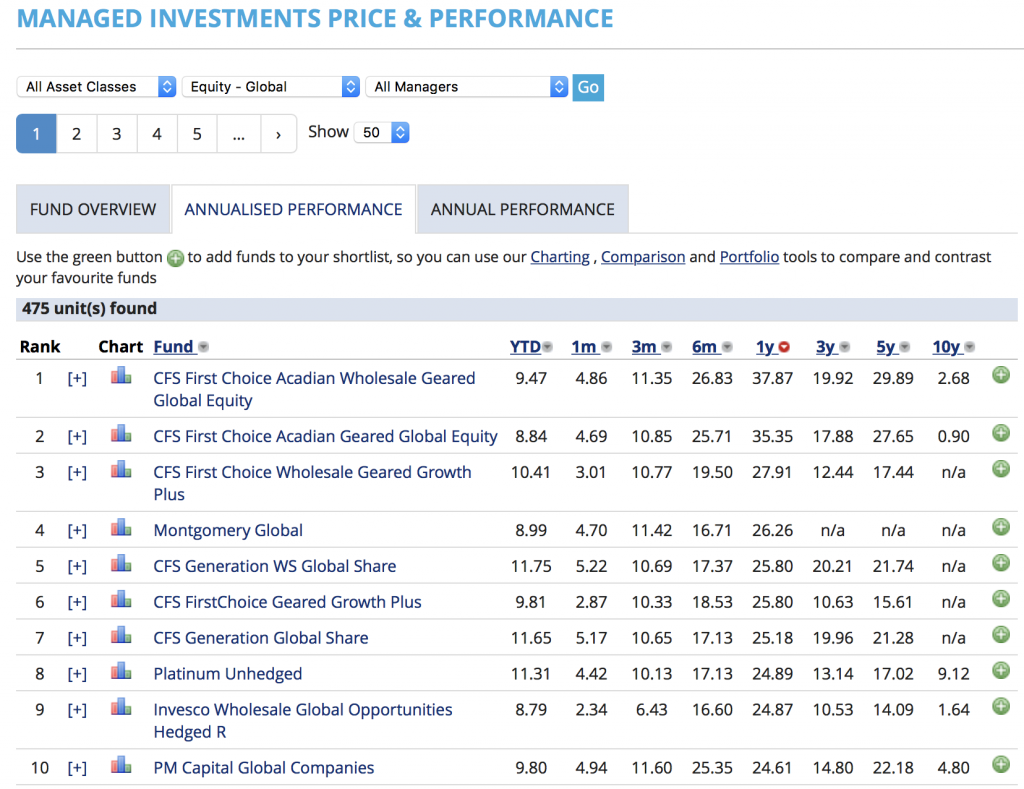

Topping a list of 475 fund managers has got to be worth mentioning, so forgive us for the plug. Out of the 475 global funds offered in Australia and classified by data and analytics provider Financial Express as global equity funds, The Montgomery Global Fund was placed 4th in performance terms over the last year (ending 30/4/17).

What is even more remarkable is that it was only pipped by three geared funds that employ debt or leverage to magnify returns. Excluding geared funds, The Montgomery Global Fund is the top performing global equity strategy in the market over 1 Year, beating 471 other funds.

Screenshot of the ranking as at 25 May 2017, ranked by 1year returns

Furthermore, and as is becoming increasing familiar to followers of, and investors with, Montgomery, The Montgomery Global Fund has achieved this result with an average of 18% of the portfolio in the safety of cash over this period.

With a team of four investment professionals led by Portfolio Manager and Montaka CIO Andy Macken, The Montgomery Global Fund has beaten much larger highly respected global firms such as Fidelity, Schroders, BlackRock, Capital Group and Platinum.

Of course within the portfolio there are always hits and misses but the winners over the last twelve months include:

- Take-Two Interactive (NASDAQ: TTWO) >+100%

- Tencent (HKEx: 700) +70%

- Alibaba (NYSE: BABA) +65%

- Apple (NASDAQ: AAPL) +60%

My personal congratulations to Andrew Macken, Chris Demasi, George Hadjia and Dan Wu for their hard work on behalf of investors and outstanding results.

If you believe Australia’s high debt levels, slow wages growth, elevated property prices and rising energy costs puts the currency at risk of declines and gaining exposure to some of the world’s highest quality companies trading at attractive valuations makes investing overseas look attractive, then have a look at The Montgomery Global Fund and speak to your financial adviser.

Very impressive Roger, I now wish I had been in that fund but I guess the alpha plus fund will have its day in the sun also, the private fund has been very good experience over the last 6 years as well it seems to chug on regardless, and I’m glad to have been in that one too. A credit to your self and the team.

Thank you for the encouraging words Andrew.

Good work guys..wish I could of got 20 plus returns….and wish I parked some money with you guys. a year ago. So might give you a call. How do you respond to those who think we might be investing at the top of the market.? It is a most difficult time to decide where to invest. Are we at the top of the cycle? I honestly sometimes think of parking in a fixed term deposit and not having the worries. While the outlook for the Australian market maybe dismal, how confident are you globally?

Hi Roger,

Great news and achievement so soon on the Montgomery Global Fund.

Is this fund available to investors who have income stream pension accounts

via the BT Wrap platforms?

I believe that is in the pipeline Garry

I looked at 4 stocks you recommended early this year and all but one has been a dog so is that something to crow about I wonder.

HSO,APN,VTG,Isentia and CSL.

Thanks Jeff,

So let me get this straight. Of the 25-odd stocks owned in the domestic funds and a similar number in the Global Fund, aggregate performances for which are all available online – you looked at four, and for three, their share prices didn’t go up in the time frame you looked at? Wow that is a real shock! All jokes aside, we would be delighted if there were only three. It is absolutely inevitable that some of our holding will not work out. That is why we have a portfolio of over 20 and why we may only invest 3% in any opportunity. If you are going to judge a fund or its manager on the short term performance of four stocks…

Boom, Boom guys….well done. Keep up the good work and continue with the high level debate and sharing of information….even if it is painful at times.