Put not your trust in money, but put your money in trust. -Oliver Wendell Holmes

If you have been following the Montgomery story for some years, you will know that here at Montgomery we are focused value investors. If you have been also following the Skaffold journey you will know it is the online investing platform through which anyone can adopt and implement a value investing approach.

It is encouraging then, for all value investors, to observe that the approach we have adopted, and which we try our best to share is working.

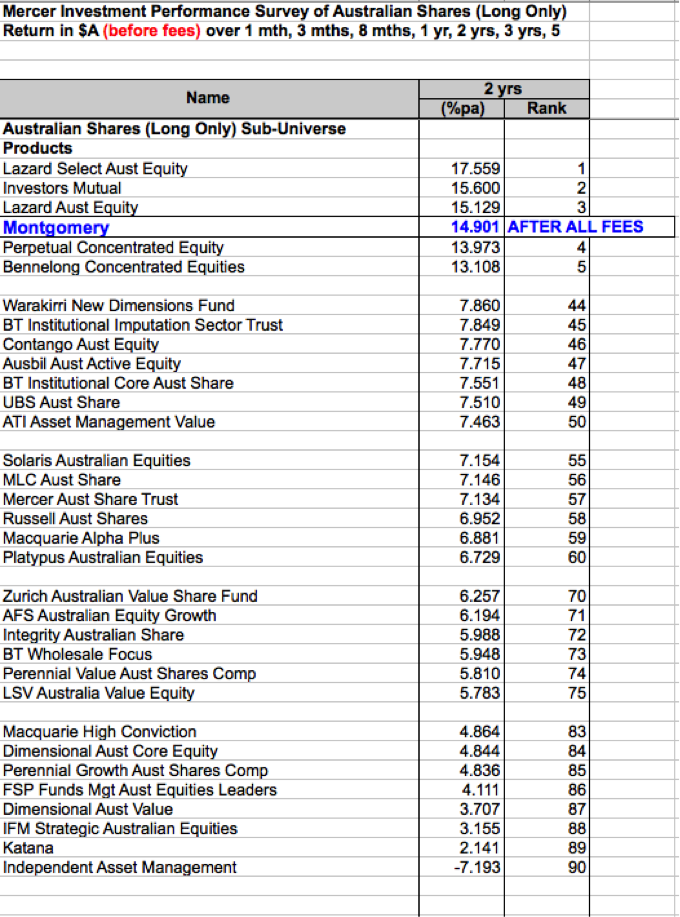

The Mercer Survey of 90 Australian ‘long only’ equity managers to February 28, 2013 was released recently and you can learn more about Mercer and purchase their full surveys here.

Interestingly, the survey almost coincides with The Montgomery [Private] Fund’s two year anniversary on 23 December 2012.

The most recent Mercer survey reported on 90 funds and 61 managers. Had Montgomery been included in the survey, based on the two-year returns alone we would have ranked above 59 of the 61 managers surveyed and above all but three funds.

Importantly, you should be aware that the survey reports returns before fees but investors receive returns after fees have been taken out by the manager. The return for The Montgomery [Private] Fund, that we have interposed in the abbreviated table below, is AFTER all fees. if we too reported before fee returns we would rank number #1 or a very close number #2.

It is not our belief that we will always rank so well and inevitably any investor in our funds must expect, and be willing, to endure periods of significant underperformance. For our team however the relative performance is heartening and suggests our process is something to work tirelessly to preserve, protect and repeat.

Please note Montgomery Investment Management is not included in the Mercer Surveys (but we would like to be in the future). To purchase or subscribe to Mercer’s information and in-depth research about Australian Fund Managers go to http://www.mercer.com.au

Figure 1. Abbreviated survey. The full survey available only from Mercers includes 1, 3 and 8 months results as well as 1, 2, 3, 5 and 10 year results and all 90 managers.