Sobering

You might recall we have previously articulated Aldi’s game plan in Australia. Our recent posts here and here, provide some insights. In summary the company is significantly more efficient. They have 1200 Stock Keeping Unit’s per store, instead of 30,000 at Woolies or Coles, which means they can employ six people to run a store instead of 25.

In a high salary country like Australia that difference means lower prices can be charged and a profit still made. There is nothing that the incumbents can do that won’t reduce their margin (and ultimately their share prices).

As we have previously articulated, once a critical mass of stores and revenue is reached (that happened last December), the next phase of the strategy is to localise the supply chain. Less ‘Made in Thailand’ and more ‘Made in Australia’ Tick. Then start promoting the ‘Australian made’, ‘locally grown’ and high quality aspects of the product range. Tick. By way of example the media, including the ABC was all over the Choice ‘survey’ of grocery basket prices. It is advertising you cannot pay for and even we have fallen into line with this very blog post.

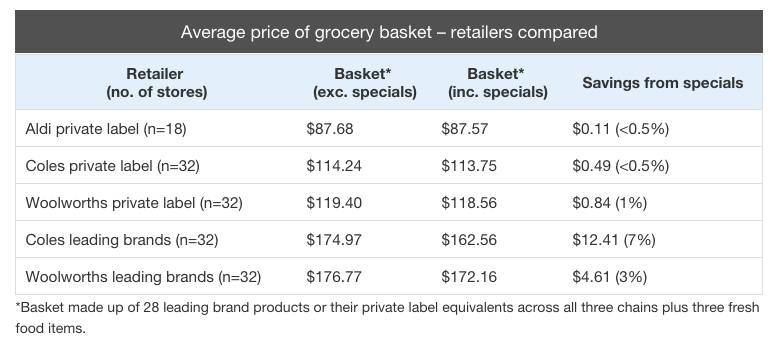

Choice’s survey reveals the price difference of a ‘basket of leading brand products’ between Woolworths, Coles and Aldi with some rather sobering outcomes for the majors.

We encourage all Woolworths and Coles shareholders to digest this new information.

In short, “It seems that Coles’ “down down” and Woolworths’ “cheap cheap” everyday low pricing strategies are no match for Aldi’s lower cost bases for labour, rent and other general and administrative costs, as Aldi retains its crown as cheapest supermarket.”

And whilst we have not commented on it recently, the ‘soft underbelly’ of the Australian Supermarket Industry is reeling and bleeding market share. This morning Metcash (MTS) wrote off a staggering $640m and for those who thought their dividend yield of 11 per cent was attractive, well that’s been suspended, probably forever.

Russell Muldoon is the Portfolio Manager of The Montgomery [Private] Fund. To invest with Montgomery, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Jon Quinn

:

What happens…If…WOW and WES imitate the ALDI model?

Russell Muldoon

:

Have you ever tried to steer something big and bulky and try and turn it around? Not an easy task.

And if they do, verbatim copy the Aldi model which reinvests all efficiencies back into the business to drive lower prices, then for WOW, that means completely cutting their dividend, halving their profitability (down to similar margins as Aldi) and a share price lower than $15 and possibly closer to $10 wouldn’t be out of the question.

Jon Quinn

:

Aha….privately owned…can move and think quick…no shareholder baggage.

mark-workum

:

How do we find the numbers that say Aldi is increasing its marketshare? And that its at the expense of WOW & WES?

I find you can do ALL your shopping at WOW & WES, but harder to do at Aldi.

In this time poor society, you think it grind growth to a halt at the big 2?

Roger Montgomery

:

“responding to customer feedback” Aldi is ‘trialling’ n anew store concept. BTW they aren’t responding, they were always going to do this – its the next step. And they aren’t ‘trialling’ anything – they know precisely how it plays out….

“Aldi is trialling a new style of retail store in Australia.

Over the past few months Aldi has opened four new shops which move away from the low-budget image. The new Aldi store concept is focused on expansion of fresh produce, improved product displays and new layouts which attempt to improve navigation.”

Patrick Poke

:

While I’ve had positive feelings towards Aldi, and negative feelings towards WOW and Coles as an investor for some time, as a consumer I’ve been loyal to Coles. I actually think the recent Choice survey may have changed my mind though, I suspect I’ll be buying more of my groceries from Aldi in future.

Russell Muldoon

:

You know what they say – if you cant beat them….

Curtis Taylor

:

It would be interesting to see some figures on the incumbents from France and the UK ie margins fell from x to y and ROE for those stocks fell from x to y. Curtis

Russell Muldoon

:

Easy to do Curtis. Perhaps a topic for a future post.

Paul Audcent

:

Like Scott I also have gotten out of Woolies recently. I have shopped in the UK, France and OZ and all that Roger has been saying yonks ago is coming true, Its quality of product that eventually will count, but the reference to the new global fund and the big USA manufacturers really was interesting. I think we will be in safe hands Russell, I’m sure all you lads are ready!

Scott T

:

Sobering indeed Russell,

I now think of Woolies the way Roger once described Qantas. “It is a wonderful airline, I love being a customer and think they do a great job, but it is a terrible business and we don’t want to own it” Thus I am still a customer of Woolies but no longer an owner.

On a broader point and thinking about the imminent global fund, surely this shift to much cheaper house brands, driven by Aldi but followed by Coles and Woolies will be having a big impact on the global food giants, such Heinz, Kraft, Nestle, P&G et al, who are all listed on the US market.

All the Best

Scott T

Russell Muldoon

:

I think its safe to assume that if WOW margins come down anywhere near Carrefour (Frances largest supermarket chain), any investment in WOW is likely to be a very disappointing one. Add to this distraction that of Masters and management have LOTS on their plate.

Lucas Hainsworth

:

Russell, the next phase could be similar to what exists in Switzerland.

Coop and Migros compete with Aldi and Lidl.

The natural thing that I see happening, is for the duopoly to look at stratifying their selections. You can see this with like at Southern Cross station where Woolworths has a cut down version of a large store. This hasn’t really started up yet.

So for example, Migros in Switzerland operate a three tier store size structure. M MM and MMM. Each store is identified out the front, M MM or MMM so you get an idea of what is in it, etc.

Obviously the larger you get the larger variety etc.

In the M size stores, you’ll have the Migros M-Budget style products, alongside a chopped down selection of tier 1, tier 2 and tier 3 brands.

MMM are your super box size with a variety of departments including fashion etc.

In the M shops, you also have more of a focus on convenience style foods. Coop for example hits up its Betty Bossi style produced sandwiches, that are at a price that’s 60% of what you would pay if you were to go to a restaurant for a takeaway meal.

Coles already has a small sized supermarket at every Shell branded outlet called Coles Express, which is owned by Vitol but operates under licence.

As it becomes more expensive to have big box destinations with 30k SKUs, WES/WOW need to look at where there are alternatives to offer a smaller selection of items, with a more competitive pricing point which are philosophically different from what you can get in one of the “flagship” stores.

AT the moment everyone here has this idea that a supermarket is some kind of monolithic battleship that is meant to fulfil every customers needs, but the reality is that I hate going shopping because with huge numbers of SKU’s, I hate having to sift through all the versions of curry sauce, or noodles to find IndoMie or whatever. If you can remove complexity, have 4 alternates, cut down on floorspace and look at innovative ways of introducing a shopping experience, its only then that they will be able to cut into what aldi is doing.

I don’t know if this is just me but when I walk into a Coles or Woolies store, I literally have no idea where to go to find certain things. There can be like three dairy sections etc.

I’d like to see an expansion of thinking about the Coles Express idea – look at where they can transition this away from a “convenience only store with convenience prices” into a “Convenience Plus” option, where you can get a sandwich, get your basics, shampoos etc, but if you want the selection of A B and C, then you roll into a Coles “Battleship” where you know there are a billion lines nicely organised.

Russell Muldoon

:

Thanks for that Lucas. Very insightful. What I found particularly interesting is that it doesn’t matter what they (WOW, Coles) do, everything appears to lead to lower foot traffic in their ‘battleships’ as you put it with a clear trend to smaller ‘frigates’ that are able to offer a pillar of what the consumer ultimately wants – convenience.