Small to medium enterprises throughout the pandemic and beyond

Small to medium enterprises (SMEs) have been underserviced in the lending market for some time, further exacerbated by the COVID-19 global pandemic. The onset of the COVID-19 Global Pandemic in March 2020 brought shock and great uncertainty for individuals and business owners. The global interruption presented governments and businesses with a new unchartered challenge that had to be addressed immediately and with no precedent to follow. As a result, many countries enforced lockdowns and harsh restrictions, imposing significant challenges to businesses large and small. Many SMEs unable to operate throughout lockdowns received government support after proving significant losses and disruption to the business’s normal operation; however, with the government support now gone, who is left to support them?

Small and medium-size businesses play a critical role in the Australian economy, employing more than five million individuals. According to the RBA, SMEs account for one-third of private output and are a key source of innovation and competition[1]. One key issue SMEs have always faced is access to finance. The lending opportunities provided to SMEs have been relatively flat over the past few years, with the big banks focused on servicing larger and well-established businesses.

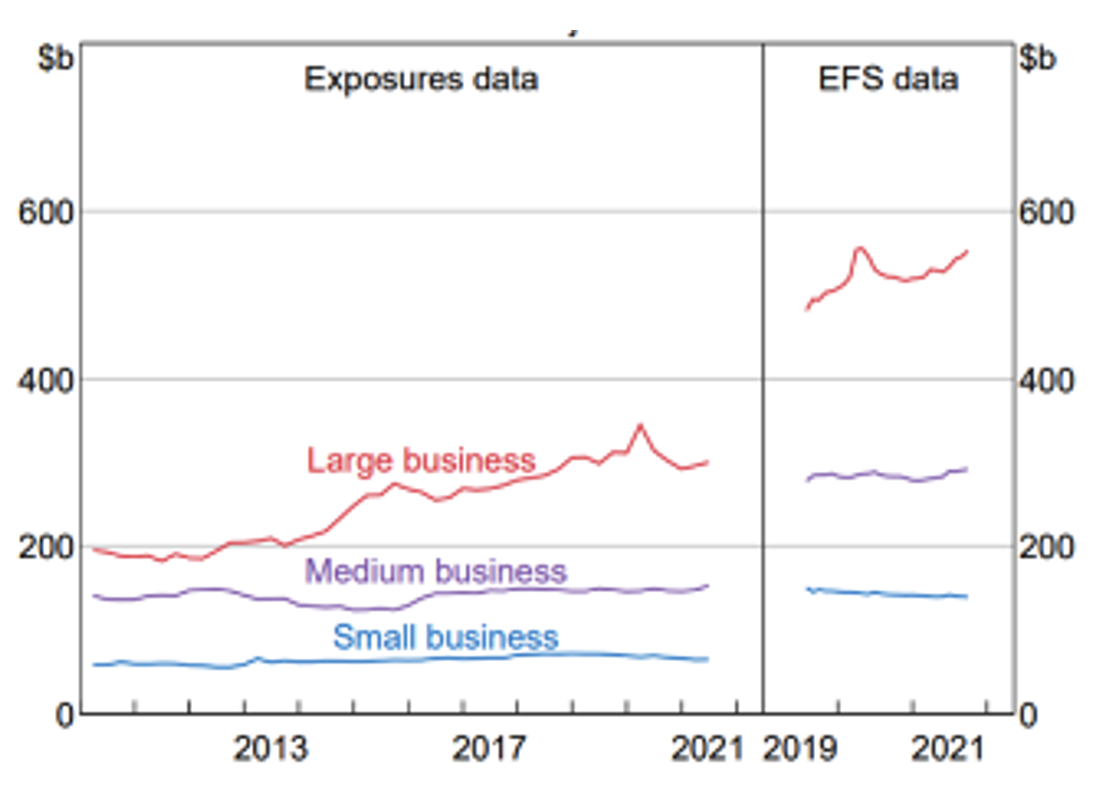

Lending to business break adjusted*

*Exposures data captures credit exposures on the balance sheets of banks allowed by APRA to use an internal ratings-based approach for credit risk management; EFS data is based on reporting of banks and finance companies that have $2 billion or more of business credit.

Sources: APRA; RBA

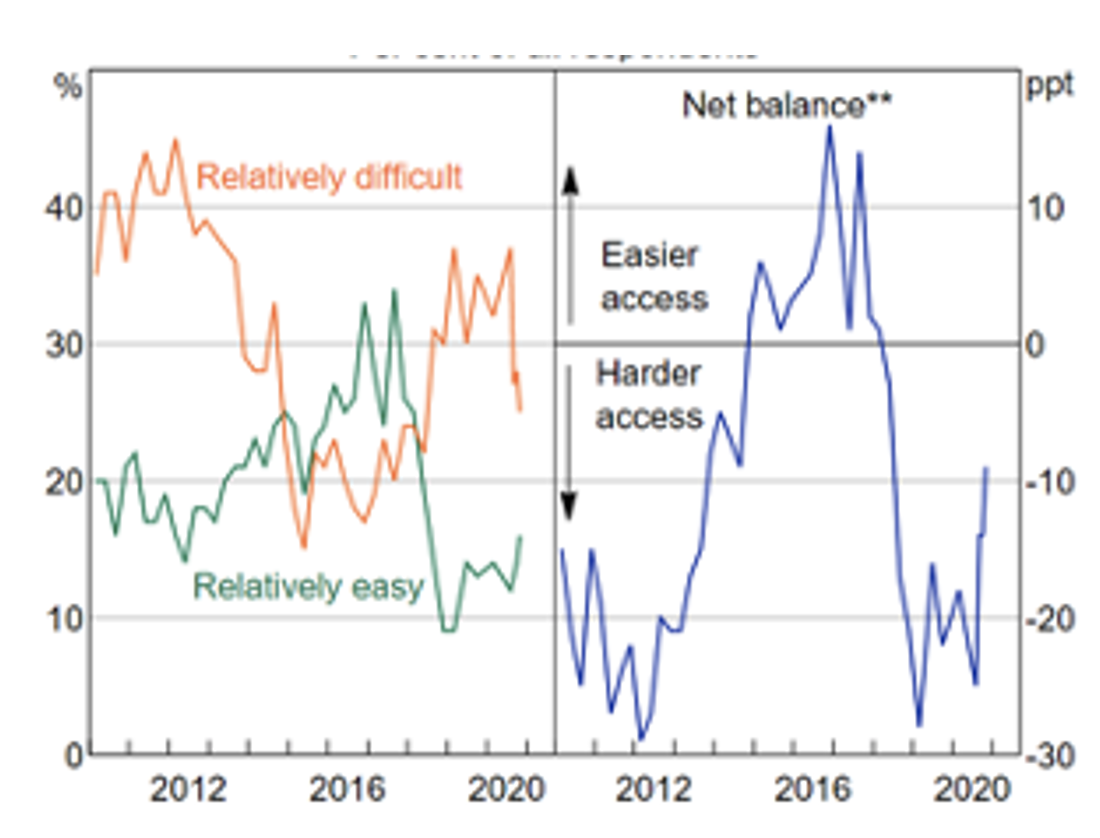

Small business perception of access to finance* (percent of all respondents)

* Survey has asked about perceptions of changes in access to finance relative to a previous period since July 2019; before that the survey asked for point-in-time assessments

**Net balance is the difference between the percentage of firms indicating access is relatively easy and the percentage of firms indicating access is relatively difficult

Sources: RBA; Sensis

SMEs received government support and stimulus throughout the peak of the pandemic as access to finance from lenders grew tighter. That said, the COVID-19 pandemic adversely affected many operating within the SME sector, forcing many businesses to shut up shop, let go of staff and discontinue trading for months on end with the harsh lockdowns and restrictions imposed. Further to this, SMEs have been largely affected by the pandemic given they are more likely to be in industries that have been harder hit by the lockdowns such as those operating within the hospitality, arts and recreation, travel, and tourism sectors.

The avenues of support and stimulus provided to SMEs throughout the pandemic varied across different providers. The government’s policy response with JobKeeper in Australia, and various other cash subsidies, provided some cash flow relief and enabled businesses to reduce their labour costs and retain staff throughout the pandemic. Some lenders offered SMEs relief by switching to interest-only payments and allowed COVID-19 payment extensions. The introduction of the SME Guarantee Scheme allowed lenders to participate and offer cheaper loans to SMEs. Some landlords also offered to reduce rental prices for a short term or allowed for rental payment extensions. Whilst these lifelines were provided, for some SMEs, these were not enough to withstand the prolonged period of lockdowns enforced over the two years. Most of these support solutions are no longer offered and ceased once lockdowns were lifted.

This brings us back to the lending gap in the SME market. The big banks have a more cautious and reserved approach when it comes to lending to smaller businesses and prefer to focus on large businesses that lend significant amounts. The big banks view lending requests from SMEs as inefficient, as the loan sizes are relatively small, however, the credit analysis required on the business is the same for a larger loan exposure. Therefore, there is a lower return on hours spent for the bank, unless technology is used to create efficiency in the assessment process. Outside of the banks, there are not many overseas lenders entering the market due to the size and scale of the SME lending space in Australia. It is a costly investment to enter a new market, and for this space, it may not be worthwhile for some lenders given the sheer scale. This leaves us with the fintech lenders that we support at Aura Group. Fintech lenders fill this gap for SMEs. These lenders rely on technology to provide the finance and fund business requirements such as cash flow management, inventory, invoice financing and CAPEX.

Fintech lenders aim to bridge the gap left by the banks and traditional lenders by tapping into an under-serviced SME market. The RBA noted that data suggests non-traditional sources of finance accounted for less than two per cent of overall SME lending in 2018[1]. The technological aspect behind these lenders plays an important role in completing credit and underwriting assessments for borrowers, as the lack of historical data for many SMEs makes the credit assessment process more cumbersome for lenders to undergo. Having said this, technology is beginning to pave the way, allowing lenders to have access to a greater range of datasets to assist in the development of their credit assessment and underwriting processes. With greater data comes greater knowledge and understanding. We are seeing Fintech lenders invest in data collection solutions, which provide richer data for them to complete their assessment. This is particularly useful for those smaller borrowers that have little information to provide and allows the lenders to respond to their client’s needs in a much shorter timeframe.

Further improvements to this space are being made, as lenders share their data which creates a richer database upon which credit assessment processes can be developed. Further investment into technology and data collection for SME lending will be crucial to the build of this market. With a larger database of information to tap into, lenders and borrowers alike will have a greater basis upon which to conduct their credit assessment and underwriting processes and source the best borrowing opportunities that suit its business’s needs. Perhaps in the future, a more unified approach to data collection and credit ratings will be developed specifically for the SME industry, creating a more streamlined and widely adopted lending space in Australia.

Join the Aura Core Income Fund Webinar

I will be joining Roger Montgomery to introduce the private credit opportunity and the Aura Core Income Fund on Tuesday 11 October 2022 at 6 pm. We invite you to register for the webinar here.

If you would like to learn more about the Aura Core Income Fund, please visit the fund’s web page to learn more:

If you have any immediate questions, please call the Sydney office 02 8046 5000 and speak to David Buckland or Toby Roberts.

[1] RBA Small Business Finance in the Pandemic

This post was contributed by a representative of Aura Group. The principal purpose of this post is to provide information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary, before making any decisions.

The Aura Core Income Fund (ARSN 658 462 652)(Fund) is issued by One Managed Investment Funds Limited (ACN 117 400 987 | AFSL 297042) (OMIFL) as responsible entity for the Fund. Aura Credit Holdings Pty Ltd (ACN 656 261 200) (ACH) is the investment manager of the Fund and operates as a Corporate Authorised Representative (CAR 1297296) of Aura Capital Pty Ltd (ACN 143 700 887 | AFSL 366230). Montgomery Investment Management Pty Ltd (ACN 139 161 701| AFSL 354564) (Montgomery) is the authorised distributor of the Fund. As authorised distributor, Montgomery is entitled to earn distribution fees paid by the investment manager and, subject to certain conditions being met, may be issued equity in the investment manager or entities associated with the investment manager.

You should obtain and carefully consider the Product Disclosure Statement (PDS) and Target Market Determination (TMD) for the Fund before making any decision about whether to acquire, or continue to hold, an interest in the Fund. Applications for units in the Fund can only be made through a valid paper or online application form accompanying the PDS. The PDS, TMD, continuous disclosure notices and relevant application form may be obtained from the Montgomery website: https://www.montinvest.com or from the responsible entity; www.oneinvestment.com.au/auracoreincomefund.

Any financial product advice given is of a general nature only. The information has been provided without taking into account the investment objectives, financial situation or needs of any particular investor. Therefore, before acting on the information contained in this report you should seek professional advice and consider whether the information is appropriate in light of your objectives, financial situation and needs.

ACH, Montgomery and OMIFL do not guarantee the performance of the Fund, the repayment of any capital or any rate of return. Investing in any financial product is subject to investment risk including possible loss. Past performance is not a reliable indicator of future performance. Information in this report may be based on information provided by third parties that may not have been verified.

Where information provided by Brett Craig, Portfolio Manager of the Fund, consists of General Advice, this is provided as an Authorised Representative (AR No. 001298683) of Montgomery.