Small cap series – Azure Healthcare

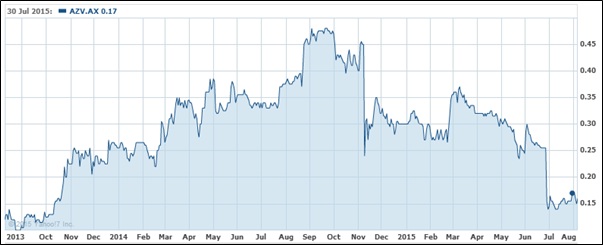

Azure Healthcare Limited (ASX: AZV) is a provider of healthcare communication and workflow management solutions. In a nutshell it manufactures and designs call systems for hospitals and other facilities and has enjoyed a good lick of success over the past few years. But is this changing?

On an Net Profit After Tax basis, the firm earned $894 thousand in the first half of 2015 and provided full year guidance in the range of $800 thousand to $1 million. That’s a fair decline for a firm who earned $3.9 million in Financial Year 2014! This also means that the firm in the second half will earn somewhere between a $106 thousand profit and a $94 thousand loss.

According to the firms full year guidance noted here,

“As a result of accelerated and additional $2.1 million expenditure on research, development and technical product support $0.9 million in duplicated factory and setup costs, which the Company has prudently opted to expense rather than capitalise, Azure Healthcare anticipates a Net Profit After Tax for the 12 months end 30 June 2015 in the range of $0.8-$1.0 million compared to its NPAT of $3.87 million for the previous corresponding period.”

In short, it appears that prior valuations of the firm took into account only projections on past earnings and little/no account of the expenditure requirements of the company in the future.

According to the announcement, the additional research and development expenditure is necessary as the firm transitions its operations in the United States. The upside is apparent however there is always execution risk inherent in such a move.

The information in this blog is general in nature and is not a recommendation or a solicitation to deal in any security. Please do your own research and consult a licensed financial advisor where appropriate.

Scott Shuttleworth is an analyst at Montgomery Investment Management. To invest with Montgomery domestically and globally, find out more.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Scott,

I was one of the posters that brought up AZV so appreciate the coverage! I think there are more risks with the stepping down of the founder and the duplication of costs and R&D which could increase significantly. Furthermore I’m uncertain as to whether there is use of smart phone technology, and they could be left behind if they are not investing in this space.

Thanks for the Article I have been enjoying the Small Cap series, it’s good to see some comment on the smaller end of the market

Thanks for the encouraging words Richard.

Thanks Scott. I’m giving the management the benefit of the doubt here. Their increased investment is occurring alongside favourable industry dynamics and thus, has significant upside if they get it right (and conversely downside if they don’t).

Hi rog would appreciate your opinion on czz .I have problems reading a balance sheet but this companys figures look good but I am a bit wary about there cash holdings.Dontknow if this is a concern.Would appreciate your thoughts.Thanks Mick.

OK Mick,

Will put it on the list and if its warrants a look, we’ll post a view.