Sitting pretty

If you are looking for evidence that a high quality business can do well over time, you need look no further than Nick Scali (ASX: NCK). Between FY06 and FY13, an investment in Nick Scali has yielded a compound return of 11.6 per cent per annum (without reinvestment of dividends). This return may not sound high, note that our investment horizon covered one of the most difficult economic period since the Great Depression.

Nick Scali is a retailer of high end furniture with currently 40 stores in its network across Australia. The firm operates from its primary brand; Nick Scali, but also from its lower cost option; Sofas2go. Nick Scali also holds a license to distribute Chateau d’Ax, a premium Italian furniture brand.

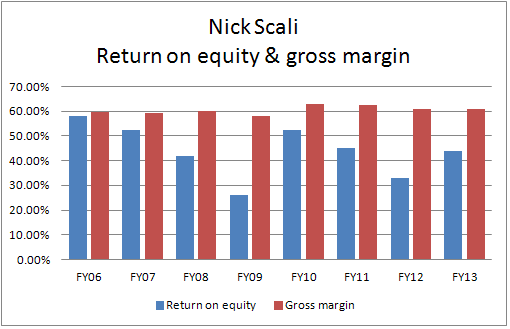

The firm has been successful in keeping up to date with market demand for various styles and fashion. This is a critical element for success as it the grants the firm some pricing power and the ability to earn high returns over time. Table 1 shows the performance of Nick Scali in terms of return on equity and gross margins from FY06 to FY13.

Table 1

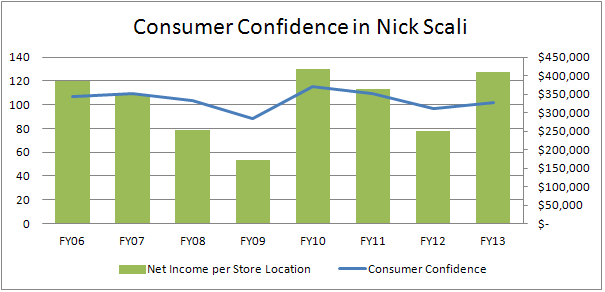

Whilst its market share is low (less than 1 per cent) the firm caters to a profitable niche of more affluent customers. Profitability over time is sensitive to consumer sentiment and this theory is supported by the firm’s financial results which I have compiled below in Table 2.

Table 2

Evident in this table is the historically positive relationship between net income per store and consumer confidence. Note that the annual confidence index is calculated by taking the average of monthly consumer confidence indexes as produced by Westpac and the Melbourne Institute.

Over the long term, given the firm’s growing brand name and store network I expect to see strong results from Nick Scali. In the short term I would note that consumer confidence has averaged 99 over the five months to May 2014. Nick Scali had a strong first half NPAT result of $7.9 million which was up 22 per cent on that of 1H13, however this was delivered when the 6 month consumer confidence average was 106. Given this, it would be wise for investors to be careful in their extrapolations of the full year result.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Sam

:

Hi Scott,

Thanks for the article,

Looking at the balance sheet for the FY13 I have noticed that borrowings have increased 3.3m to 6.8m, yet cash increased from 20.7m to 26.4m, is there a reason why the company would prefer to increase debt rather than fund with cash reserves?

Cheers

Sammy Giunta

:

Roger and Scott, today’s updated profit guidance from NCK was interesting.

+10% increase in total revenue.

+5% increase in revenue for same stores.

Yet underlying profit is forecast to be up 15%. Would this imply margin expansion for the company, or can there other reasons for this divergence?

Richard Benson

:

Re Nick Scali

This stock is extremely illiquid with small volumes traded and big buy and sell spreads. How do you get out if things go wrong. I have owned this stock for about nine months and while I like the fundamentals I would be tearing my hair out if I wanted to sell. I am a Skaffold member.

Richard

Roger Montgomery

:

Position size should reflect liquidity.

Sammy Giunta

:

Thanks for the article, Scott

I was wondering what your thoughts are on the recent housing boom we’ve experienced in the eastern states this last year, and whether this boom would contribute an added spike in Nick Scali’s earnings (beyond the above correlation between NCK’s earnings and consumer confidence).

This may sound overly simplistic, but I would have thought that with the surge in residential sales would also come an increase in the buying and replacing of furniture.

Roger Montgomery

:

Think you’re right.