Sirtex Medical Limited

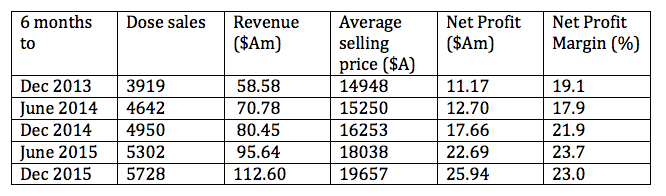

The half-year to December 2015 saw more records for Sirtex Medical (ASX: SRX).

- Dose sales grew 15.7% YOY and 8.0% sequentially.

- Revenue grew 40.0% YOY and 17.8% sequentially.

- Net profit grew 46.9% and 14.3% sequentially.

The US, which accounted for nearly 80 per cent of the Company’s revenue, lead the way and this was assisted by the average selling price of $22,190 per dose in comparison to Europe and the Middle East ($15,670 per dose and 17 per cent of total revenue) and Asia Pacific ($8,520 per dose and 4 per cent of total revenue). While Sirtex Medical looks expensive on near term fundamentals, the question is whether the Company can maintain its five-year average compound growth rate in dose sales of 20 per cent over the next five years?

While Sirtex Medical looks expensive on near term fundamentals, the question is whether the Company can maintain its five-year average compound growth rate in dose sales of 20 per cent over the next five years?

If it can, then dose sales could hit 30,000 by the year to June 2021, and assuming an average selling price of A$20,000 per dose, revenue of A$600 million could be attainable.

The company has recently built manufacturing facilities in Wilmington, US, Frankfurt, Germany and Singapore, which collectively could handle more than this. It is also expected clinical investment shouldn’t increase dramatically now the recruitment for the five major clinical studies (2,300 patients) are largely complete. It seems fair to assume Net Profit margins could trend up a little further over this period.

Assuming a 25 per cent Net Profit margin, then Fiscal 2021 Net Profit of $150m or earnings per share of $2.60 could be attainable. Would the market then place the stock on a fiscal 2021 PE of say 23X, giving it a share price potential of $60? While this is unknowable, Sirtex Medical shareholders could certainly dream!

One thing is for sure – there will be plenty of believers and non-believers voicing their opinions. And while Montgomery is no longer a shareholder, we will continue to follow the Company’s progress closely.

To learn more about our funds, please click here, or contact me, David Buckland, on 02 8046 5000 or at dbuckland@montinvest.com.

994826 2670There is noticeably a great deal of dollars to recognize about this. I suppose you produced certain good points in functions also. 172599

Many thanks for the update David.

Hi Roger,

Thanks for the post. One doesn’t necessarily need to have changed the view of Sirtex’s outlook in order to sell – it may simply be that it’s present value has significantly exceeded intrinsic value, and now may be a good opportunity to sell with a view to re-entry at a lower price. It is unclear from David’s blog what headwinds have emerged in Sirtex’s outlook which weren’t present 6 months ago which have led to your less optimistic forecast.

I’m surprised there is no comment on the large and increasing marketing spend? I would expect this to have a delayed impact on dose sales, potentially coming through in the next half. However if this marketing spend continues to outpace dose sales, it will lower the incremental rate of return, significantly reducing SRX value.

I am a little surprised at the negative reaction from the team. Sure the result heightens the tension. It could be leading to a polarizing moment at the full year results. They missed the mark, but only by a bit….

I understand your selling at $38-40+ and would hazard a guess that is when you sold a large portion. Under $35 it would indicate your team have reviewed their numbers and believe a new 5 year dose CGAR of 15-17%… Not to mention the margin of error you must apply, so maybe your thinking 15% CGAR? A bit light in my opinion.

Quite technical for me but still thankful for the info. Thanks for sharing.

Hi David

Thanks for this analysis. I am interested to learn the reasons Montomery no longer have a position with Sirtex, given what appears to be strong performance and the firm’s historical strong support for this stock?

Regards Richard

Hi Richard,

We believe that the outlook is not as bright as we had modelled in our valuation. Our valuation has changed as a result and the post above notes we think it looks expensive. Keep in mind we could be wrong too. You mentioned our historical strong support for the stock; You have to always keep in mind that we can change our mind at any time and our mind will have definitely changed if we have decided to sell.