Sirtex Medical Limited

After Sirtex Medical Limited’s (ASX:SRX) share price rallied to $13.24 yesterday, the company’s market capitalization reached $640m. Not yet a big business, nor one that is widely held or covered by the investment community, we believe it has very bright prospects.

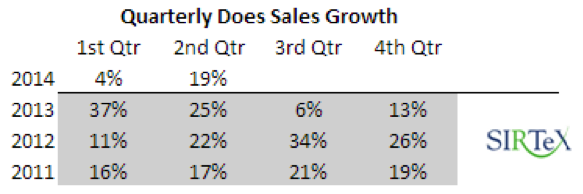

For 38 consecutive quarters, dose sales of ‘SIR-Spheres’, a medical device used in the treatment of liver cancers (Hepatocellular Carcinoma) to deliver a highly focused radioactive treatment, have been growing strongly. The table below shows those figures for the last 14 quarters.

Whilst focusing on quarter-on-quarter growth is something we don’t encourage given the extremely short time frame involved, SRX’s December 2013 quarterly update seems to have impressed the market.

This was in stark contrast to the September 2013 quarterly update, when SRX reported just 4 per cent growth and many market participants immediately began to extrapolate this as being the ‘new normal’ level of growth for the business.

There was concern that the prospects for SIR-Sphere dose sales had faded, and that the business’s outlook was not as attractive as had previously been believed. Following the announcement yesterday of 19 per cent growth for the quarter on previous corresponding quarter, we think that any concern has now been proven to be incorrect.

Given Sirtex is cycling from 25 per cent growth in the December 2012 quarter and SIR-Spheres transitioned for a large portion of the December 2013 half-year to a new reimbursement scheme in the UK, this number is even more impressive. It reinforces our confidence that the company’s Phase III trial (now fully recruited) is likely to deliver positive news flow from early 2015, particularly given the continued growth of SIR-Spheres usage by oncologists.

All things considered, it was a very positive announcement.

With the depreciation of the Australian Dollar against major sales currencies such as the USD, GBP and EUR likely to further add to forecast revenue in fiscal 2014, we believe Sirtex is not a business to be betting against right now.

The Montgomery Fund and The Montgomery Private Fund own shares in Sirtex.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Hi Roger

Sirtex is on my watchlist.. However I am concerned about a few things..

Do you think that the current share price has already priced in some of the expectations that the clinical trials would be successful? Has Sirtex already committed much capital to expand its manufacturing capacity in anticipation of the trials being successful..? What are the implications to its balance sheet and cash flow position if the trials fall short? If that happens, its share price would be absolutly smashed and therefore I would be interested to hear how you would derive its intrinsic value, as I believe in taking a position in Sirtex only if there is an adequate margin of safety.

I agree it is a great quarter sales report but am concerned that the company only has one product and its major competitor has a bigger presence in europe and the us.

The risk of revenue growth not being sustained seems too high?

Hi Roger,

Sirtex are also looking at applying their selective internal radiotherapy for bowel cancer, as well as liver cancer, but it’s still early days.

Watching this one, fav on list

As Sirtex is the largest holding in my portfolio I was very pleased to get a welcome boost to my total investment capital yesterday as the market reacted positively to the new quarterly growth figures. I’ll be a buyer on any future dips! Thanks for your coverage. By the way, another health care company, RMD is also another of the stocks I own. How’s that product testing going that one of your staff was undertaking?

HI Russell, good post. I really enjoy hearing the thoughts of you all on specific companies. Always find a few nuggets of information which help.

I am always interested in how people deal with outlier results. For example, using the very small sample above i calculate that before the 2014 1st quarter result i would have said there is about a 3-3.5% chance of them achieving only 4% revenue growth. Now that it has happened that probability has gone up to around 5-5.5% of it happening again. Obviously based on this there is little chance of it being a “new normal”.

As i said, i know i am using a small sample which can skew things but i am very interested to hear how this would have been interpreted and what tools they use to test whether it is the new normal or just a random event which will happen but very infrequently at the moment.

Do you use probability distributions, confidence intervals etc in guiding decisions on how to interpret events?

Hi Andrew,

Given the future is unknowable, it may be appropriate to use probability distributions and confidence intervals to work through a risk-adjusted assessment of a particular situation. A good recent example is the work Tim Kelley did on McMillan Shakespeare, as seen here: http://rogermontgomery.com/fbt-fairly-badly-trampled/.

Is the current share price justified, as things stand? My valuation for Sirtex using the Value.Able method is well below the current share price.

If the trials go well and the drug becomes the go-to drug for liver cancers, then the company’s value and share price will both shoot up (excuse the pun). There is obviously a risk that the trials are unsuccessful though.

I’m interested in hearing your estimate of Sirtex’s intrinsic value, and how much of a premium to intrinsic value you would need to sell them before the clinical trials are completed (still some time off).

Would you pay a premium to intrinsic value if you were absolutely confident in the success of SIR-Spheres? Or do you make no exceptions whatsoever?

Hi Andrew,

For fiscal year 2014, we see 8,700 doses (+19%) at US$13,700/dose and an exchange rate of US$0.90/A$1.00, delivering revenue of $130 million. The Sirflox trial, due in early 2015, and the Sarah trial, due in early 2016, will hopefully transform Sirtex to a frontline therapy. If successful, dosage volume could quadruple to 30,000 pa, representing a 5% share of the eligible number of patients, and in all likelihood the share price would be significantly higher.