Sinking like a brick? Are house prices really going to crash?

One of the companies that is bound to suffer amid the western world’s slump in house prices, home starts and weak credit growth is Boral.

One of the companies that is bound to suffer amid the western world’s slump in house prices, home starts and weak credit growth is Boral.

Today, Boral (BLD) cut their full year profit guidance by $22m after weak house activity and heavy rain in NSW and QLD have impacted their operations. BLD had forecast profit to be $150m-$175m and now expect $128m-$153m. Boral’s Mark Selway noted that Australia’s residential building sector is “aweful” and the construction and building materials company blamed continued wet weather and slow housing starts for cutting its profit forecast by the $22 million noted. In an interview with Dow Jones today Selways said; “The residential housing market looks tough and, by the way, I think it’s going to get a whole lot tougher,” and 2013 was likely to be “the tough year”.

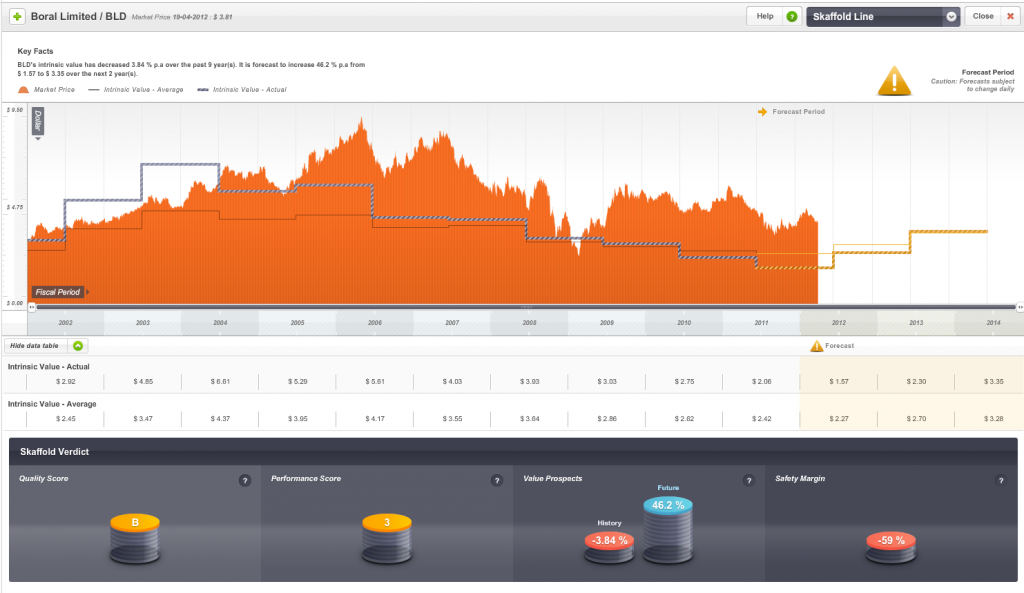

Below: Skaffold.com estimated Intrinsic Value for Boral.

The consensus analysts estimates that produce Skaffold’s current intrinsic value estimate will now decline further as will the estimate of value itself. Since 2003 Boral’s estimated intrinsic value has been in decline as can be seen in the Skaffold Line Evaluate Screen. You should also note the hockey stick – like increase from analysts earnings optimism.

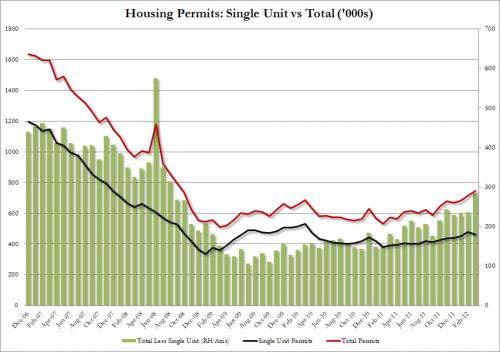

Over in the US the situation isn’t much better. After Warren Buffett noted his 2010/11 prediction of a bottom in housing “was dead wrong” one analyst said “March, housing starts, expected to print at 705K (which is crawling along the bottom as is, so it is all mostly noise anyway, but the algos care), came at a disappointing 654K, the lowest since October 2011, and a third consecutive decline since January. Want proof that the record warm Q1 pulled demand forward? This is it. As the chart below shows, the all important single-unit housing starts have not budged at all since June 2009. So was there any good news in today’s data? Well, housing permits, which means not even $1 dollar has been invested in actually ‘building’ a home soared to 747K, from 715K in February, and well above expectations of 710K – the highest since September 2008. That a permit is largley meaningless if unaccompanied by a start, not to mention an actual completion goes without saying.”

Total starts versus unit starts.

Apparently Harry S. Dent the author of various predictions of impending doom (and someone who’s rpredictions have been wrong as frequently as they have been right, is on Australia and said that we have a real estate bubble that is set to burst. He thinks there’ll be another worldwide economic downturn in 2012, and this will cause Australian real estate values to fall back to where they were 10 years ago.

“People in places like Sydney or Tokyo or Miami say, ‘Hey, real estate can never go down here, we’re a great place, everyone wants to move here, there’s not much land for development’, and what I say is that is exactly the kind of place that bubbles.” “Outside Hong Kong and Shanghai, Australia is the most expensive real estate market in the world compared to income.”

Thanks Harry! My own definition of a bubble is a debt fuelled asset purchasing binge where the income from the asset cannot pay for the interest on the debt that is funding it. Actually…that does sounds a whole lot like negative gearing????

Of course, some observers reckon the empty houses in Brisbane as sellers wait for prices to improve is a sign that the market is already crashing. Others suggest for a crash to happen home owners have to be willing to sell their property at that lower price. A lot of home owners are removing their property from the market if they can’t get the price they want. Whether the lower price gets a print or not however is not relevant. If my neighbour cannot sell his house for the price he wants, then the market price must be lower. We don’t need a transaction to occur to confirm it.

Gone are the days when the dream was to have one nice house with a Clark Pool, a BBQ and a new Holden in the carport. Now everyone wants to be a millionaire DIY developer and fixer-upper with his and hers BMW X5s. That simple progression leads to more volatility in the prices of assets those investors pursue. So what’s the impact on QBE and the banks now that Genworth have pulled their float? Would love to hear your thoughts, insights and observations. What are property prices doing in your area?

Posted by Roger Montgomery, Value.able author, SkaffoldChairman and Fund Manager, 20 April 2012.

The current problem with Australia is the policy of centralisation. If the bitumen roads around the country were used to repopulate the continent then the city problems would be put to bed. Over the last 30 years or more the bush has been depopulated and now there are many empty towns. The services are there, water, power, bitumen roads, wireless phone/internet etc. In the old days, the 1/4 acre block was used as people could plant a vegie garden run a chook shed etc, so then in a severe downturn, at least they could look after themselves. Now the disenfranchised are living rough in the cities. Take a trip to South America and see the long term results. Educated people living in squalor and turning to begging or crime just to stay alive.

Wake up Australia. Posted on a pillar in Sydney last year, there was an advertisement for a room to rent. $140 per week. Sound cheap? The add said “a two bedroom apartment, 4 boys in one room and four girls in the other”. Is that what our grandchildren will have to endure?

Hi All

If you think I am a bear on evevaled Australian housing and the consequences that may follow then have a listen to this.

http://www.youtube.com/watch?v=xrXcDxIEQ2c

It makes me look like an equity saleman from Goldman Sach.

Cheers

Ash, I wouldn’t like this person to be a friend, talk about a pessimist, thank goodness we have everyone being an expert so the number of views at some point in time balance out, most will be incorrect of course.

The global population is getting older and the number of baby boomers as a % of the population is increasing and most have dwellings closer to the CBD than young homebuyers.

We may therefore see an oversupply of houses on the market in the next 20 years as us boomers head for the exit lounge and these houses may be replaced with iner city affordable high rise apartments and flats.

The demographic and urban landscpe will change nothing is surer but I wouldn’t go juming off a cliff just yet.

There will still be plenty of trees around for the bears to climb while the Global debt is resolved.

Kind Regards

Kent

Completley off topic Roger, but thought i would post something about it.

Just had a look at Skaffold through the “try now” area where you enter 5 stocks and i have to say you and the rest of the team behind it have done really well. I have seen other applications and they appear to be trying to use 20 words when 1 will do. Skaffold looks so easy to navigate and understand. I can understand why people rave about it.

As i said, well done to yourself and your team.

Thank you Andrew.

I know builders making good money building in mining support areas, but outside that it is shocking. Margins are terrible, as so much excess capacity.

My opinion is that house prices are related to the rate of unemployment rather than personal income.

As soon as the unemployment rate goes up house prices will go down and vice-versa.

just what happened in USA, unemployment rate went up in some cities and towns, house prices went to the floor right away.

Property is now a ponzi scheme globally pure and simple and Australia is no different. The entry price in places like Sydney is now 10x income and simply beyond the reach of any SANE FHBer.

Only those that team up or get a leg up from their parents are able to even consider getting on the “Property ladder”. As the constant flow of mugs has dried up (credit growth is at the lowest level since records began), the ponzi scheme is collapsing.

The baby boomer generation who all paid much less than $200k for their house decades ago are going to have to come to terms with the reality that following generations are not going to fund their luxury world cruise retirement plans by saddling up a $800,000 mortgage for the same modest pile of timber framing.

Thanks Paul.

Some considerations from Robert Shiller’s Irrational Exuberance (2005 edition) –

“Obviously there is no hope of explaining home prices in the US solely in terms of building costs, population or interest rates. The pattern of change from year to year in home prices bears no consistent relationship with any of these factors”.

He goes on to say that interest rates have been falling since the 80’s. Incidentally so have wages in the US and so I cant see how you can link house prices to income growth – not in the US anyway. Your income may rise, but you still need a loan to get the house. The other way around may work though. The banks offer cheap money regardless of income (think NINJA loans and first home owners grants) and we rush in because the “boom” has started and we dont want to miss out.

His conclusion is that owner-occupied housing looks like a losing investment when compared with shares. Also that the generally supportive stance of Greenspan and other central bankers was a contributing factor to the stock market and housing boom.

This would appear to make sense as the share market boomed as well as the housing market since there was cheap money on offer and I suspect that cheap money went into any asset and the irrational exuberance went from there.

The following is from Adam Carr of Business Spectator and was written in late January this year.

“Your average Australian doesn’t have a lot of debt. ABS data (for 2010) suggests that the average value of mortgage loans outstanding is about $68,000.

Now, that’s across all households, and considering that two-thirds of Australian households don’t have a mortgage then for those who do the debt burden rises to about $200,000. Breaking that down another way, ‘middle wealth’ (middle 20 per cent) households have about $90,000 left on their mortgage, while high wealth (top 20 per cent) have $60,000.

I’m not really of the view that debt is a massive problem in Australia and I think this is consistent with RBA research which has shown that 75 per cent of all debt in Australia is held by the top two income quintiles. Maybe within those income quintiles there is some deleveraging. But given those income quintiles have quite a lot in the way of assets – even liquid assets and obviously income – I think the issue is often overstated.

By my workings, this gives debt outstanding, less liquid assets, of $51k and a debt to disposable income ratio of 130 per cent by that measure for the middle 20 per cent.

The top net worth quintile has a positive debt less liquid assets position – ie. no debt. This is the same as people in the fourth net worth quintile – no debt after excluding liquid assets which is the same for the national average and even the lowest net worth quintile – who have debts averaging $24k against liquid assets of $25k and income of $30k.

So to be clear, Australians, on average, have no debt once you take into account cash deposits, shares and super.

It’s only when you get to the second quintile (second lowest by net worth) that debt seems to become a ‘problem’, with a debt less liquid assets position of about 280 per cent – remember that’s 20 per cent of households at face value. However, ABS data shows that only 47 per cent of this lower quintile have a mortgage (although that’s the second highest proportion of households). So all of a sudden, you are only talking about 9 per cent of households that are eligible for this higher debt to income position – 25 per cent of mortgage holders.

My bet is that most of this 46 per cent of lower net worth individuals sit quite comfortably within the higher net income quintiles – ie. they may not have a lot in the way of assets, but they are higher income earners. At worst, we are talking about 4 per cent of households then with lower or average incomes and higher debt (about 10 or 11 per cent of mortgage holders) by my reckoning. That’s not to say they are in distress, it’s just that debt relative to income and liquid assets is higher. Given our very low default rates, this group are still having no trouble servicing their mortgages it seems.

So in sum then, Australia’s debt position is not onerous for the vast majority. Most Australians don’t even have any debt to talk of when you net out liquid assets. Even most mortgage holders appear to be in a great position – able to offset modest outstanding debt levels with highly liquid assets like cash and shares. This leaves only a small proportion with few liquid assets and a comparatively large amount of debt. That said, most of these people in turn appear to be younger (a good 10-13 years younger than other wealth groups according to the ABS). They also appear to be higher income earners and so at the reasonably early stages of their wealth accumulation phase. Debt servicing does not seem to be a problem”.

Given these actual debt levels and who holds it, and considering that the general mood now sees houses prices as heading downwards (due to groupthink and herding), I suspect that many housing “investors” will hold their investment property like shares. That is, prices will fluctuate but essentially go nowhere (as long as unemployment stays low), investors will simply switch their thoughts to being a “long term investor” (like when the price of their shares sink) and sit there and watch their investments return very little by way of capital or rental income.

Steve

Yeah nice Steve. Congrats and thank you for taking the time.

I like the caveot you have placed on it, “as long as unemployment stays low”. I agree. Once you get people who ‘Have’ to sell because of financial hardship i think all bets are off. Surely the risk must be to the downside with our unemployment rate. Its been so good for so long. So bring on 10% unemployment so I can actually afford a house…. :)

In Darwin there was a lull in house prices during 2010-11. This year Inpex has come to save the day and property spruikers have come from everywhere to tell us how we’ll become rich by investing in property during this ‘gas boom’. It’s all rather predictable and tiresome but I s’pose they hook the naive and hopeful. With (often, very) average 3 bedroom, 1 bathroom houses going for anywhere between $480k-$600k, it would want to be a very big boom for prices to go any higher. 2 bedroom units sell for around $350k from observation.

I’d certainly hate to be a young couple looking for somewhere to live here. Rents are expensive as well so there’s not much room to move.

Still, if we get an influx of millionaires wanting to work on the gas project, we should all be fine.

Until gas prices fall perhaps or projects are completed?

I’m a Father of 3 (wife stay at home Mum) and priced out off the market since we’ve chosen to raise our kids with a parent not after-school care, daycare, nannies, etc. How delightfully 1950s of us. Anyway, would like to see more regulation of RE industry. Is there an industry more corrupt outside of the mafia and other crime groups? For instance, claims of a 60% clearance rate on auctions out of Melbourne when there is a massive amount of unreported auctions might very well indicate the clearance rate is not actually 60%. How much longer do we have to put up with dodgy stats? These idiots like (name removed) who runs (name withheld) and yet is a media whore commenting on the state of the RE industry – beggars belief that the press would talk to him and expect any impartiality. Australia has become as corrupt as Greece. RE makes up how much of our national debt and it isn’t even regulated as an industry?

I don’t know about more regulation we are already a nanny state as it is – I think a more accurate statistic is the actual sales volumes per month which is collected by the Valuer General from statutory disposal notices over time versus the number of listings on say the major web portals is a good indicator and a much more reliable indication of whats happening in the market.

I cannot say whats happening in Melbourne but I can tell you that property prices in some provincial cities in Victoria have still increased over the past 2 years but the sales volumes are rapidly declining as are the number of listings on the market. This is a good indication that prices are at or near peak because something will have to give, either purchasers will stop buying because prices are considered by them to be too high, and the amount of unsold houses will start to rise leading to a panic by the vendors who have been holding back from selling waiting for higher prices. I think we are not too far away from a scenario of having 2 years supply of housing stock, prices may fall slightly BUT will stagnate for several years until rent levels and construction costs rise to levels whereby established housing become very attractive again. This happened in the last recession. Of course housing in certain suburbs will remain high and even increase because they are sought after and supply is limited but this wont always be the case. The same thing happened in the early 1990’s – we had a very tight housing and rental market – everyone of course was blaming the estate agents – and don’t forget that negative gearing was abolished only to be reintroduced (by Paul Keating) due to investors leaving the property market. As unemployment increased the amount of holiday homes and houses in general hit the market as people chased jobs in other states.

Auction clearance rates at best are very subjective. The Auction clearance rates will also vary greatly between suburbs so an overall clearance rate is not a good guide.

To fulfill a promise elsewhere in this thread, I announce that I have signed contracts of sale on my investment property in Hillside, Melbourne, subject to the prospective purchasers obtaining finance. The price I obtained is near what I was hoping to get and results in a not insignificant profit and frees me to concentrate my efforts on (very) gradually building a portfolio of part ownership of businesses.

Congrats Phil.

As Kath or Kim say

Noice Phil

Good luck

I do not think the value of houses/commercial properties has changed much at all – price certainly has though.

When investing ever becomes confusing I turn to Ben Graham.

Replacement cost method and net operating income method are what I use to value property. It is important to know what the “market value” is (aka price) but I would considers this to be relative value and not useful when looking for a margin of safety.

A fellow I know bought a duplex in the 70’s on a mid-teen cap rate!!

So at some point a rent roll is a rent roll and making a purchase will just makes sense at a certain price.

Using a replacement cost method to value a property sounds like something that an Accountant would advise a client to do but I can tell you this method is absolutely fraught with danger. In some cases the replacement cost may exceed the added value of the improvements plus the site value especially if the property is over capitalised. Replacement cost is only used for insurance replacement purposes which also includes an allowance for lose of rent, letting up, demolition, clean up, interest etc . You would be best to use the income approach as your primary method and a direct comparison approach or summation approach as your secondary approach. And certainly you value will be derived and compared based on sales and rental evidence. In certain circumstances commercial or industrial property may be sold to owner occupiers and hence your approach may be direct comparison with a check by income approach allowing for letting up etc.

It seems there are many headwinds faced by the “prospect of further capital appreciation” where housing is concerned. The “anticipated price” bubble has been entirely fuelled by cheap and easy credit availability, helped out by various Govenment schemes that have further raised dwelling prices.

Recency suggests to many that “low interest rates are here to stay”, however we all know that the Commercial Banks are not tied to the rates the RBA sets, and certainly ANZ have made it very clear that they will be setting their own rates. The Commercial Banks (and their Institutional Investors) have become quite used to making record year on year profits, and with the inevitable rise in overseas funding costs, they will be “expected” to maintain this level of investment return (which is why they are all regarded as “Blue Chip” investments after all!). If the “cost” of rolling over loans increases, this cost will be passses on to their “captive audience” of borrowers, in the form of interest rate rises (or at least less interest rate reductions than would be “preferred” by the RBA.).

The concept that “we’re now all dual-income households, so the “traditional” affordability ratio (3:1 or thereabouts for a single income) no longer applies” is also not quite true: With both adult members of the Family working, a lot of “value added” services are lost, and have to be addressed by external contractors – a typical (though not the only) example of which is child daycare, which is paid for in “after tax” dollars. All of a sudden the “dual income” isn’t quite so “dual” after all!

Finally, the popular belief that Residential RE is a great asset class overlooks some of it’s worst aspects: RE (residential and commercial) has appreciable holding costs (at least taxes, maintenance, insurance, assuming outright purchase), significant trading costs (legal, and transfer fees), and a major problem of very poor liquidity – there’s not much opportunity to sell off your RE property investments “one room at a time” – unlike almost all other asset classes.

The obsession with RE investment “Down Under” is a very good example of herd behaviour. There are pleanty of other, better, more liquid asset classes out there, but “everyone” with an opinion thinks they are “too risky” (shares, bonds) or “too long term” (Infrastructure, Agribusiness).

I suspect that we “are living in interesting times”, and the future for many who’ve invested heavily (often exclusively) in RE might not be quite as rosy as the Sales Brochures would have them believe . . .

All excellent and valid observations.

Will they go up, will they go down?.. I’m no prophet but the one big mistake made in assessing the residential property industry is ignoring emotion.

A lot of the assessments made in this forum is akin to asking your accountant to buy the engagement ring for your bride. Don’t use logic to make an emotional investment. It generally doesn’t end well.

Non investment residential housing is the most emotional purchase a family makes in their lifetime. To think people are making a rational decision is irrational.

70% of the residential housing market is emotional.

There may well be areas of high prices but while the grass remains greener on the other side of the hill and the joneses continue to have a nicer house then I don’t think we will ever see a rational housing market.

Yes the market forces play a part (Australia is in under supply, while the US was clearly in oversupply prior to crashing) trying to read the market forces through the emotional fog is near on impossible.

What’s the rule? Maybe run with bulls while they’re running and tread

water in the uncertainty?

I think the golden rule of property still lives; you make your money when you buy not when you sell. It’s good buying times, if you’ve got cash, good on you, now is a wonderful opportunity to capture amazing deals.

Just saying :)

I thought that everyone in the USA was saying that there was a giant undersupply prior to the crash in the US property market. And if you have a look at many markets around australia at the moment you can see that we are also in OVER SUPPLY. Take Melbourne, Tasmania, Gold Coast, Sunshine Coast, Cairns, many parts of QLD and SA. But those in the real-estate industry continue to say that we are still in undersupplied. (are you in the real estate or finance industry Stuart???)

And you make it sound like buying a house is only emotional and that those emotions are greater then anything else…. as if the ability to get debt, your job security, your income, stimulus from the government, market sentiment (both local and international), and ones perception of whether house prices are going up or down in the future doesn’t have anything to do with it.

As someone who is only been married for less then 2 years I can say that it would be nice to own a house (and we probable have around a 30-40% deposit and good incomes) however that emotional desire for a place of our own is completely out-weighted by the fact that house prices are falling in Australia (like they have around the world), we can get a good return on our money in the bank, having the money we have in cash provides excellent security (like we could not work for 3 years and maintain our current standard of living).

You see, while it might be emotional to own your own home, there is also the emotion of buying a place (with debt) and then it falling in value below our equity level. There is also the emotional aspect of losing our security of having our money in the bank. Of loosing our ability to save large amount of our income. You see emotions work both ways and the emotions of purchasing a house does not out weight our emotions of a falling property market and less security.

There is also the emotion of starting a family and not having the need for both of us to be working full time. The emotion of raising our kids with out the pressure of a mortgage to pay.

Also when I talk this over with my wife she feels the same way.

House Prices are falling and that will be very, very emotional for many people (esp. if they purchase in the last few years.)

couldn’t agree more with you ruben, i’m almost in an identical situation to you, perhaps not quite as much of a deposit in cash, as we have some in shares also.

I hope it all works out for you and your family.

Cheers

Hi Reuben

The best advice I can offer is to take all of that emotion, put it in the cupboard and then sell the cupboard. Please don’t take any offence by my comment. You look as though you are in the same position I was in when we were starting out. We were married for 2 years, fairly well cashed up and feeling secure when the opportunity came up to buy a block of land and build our 1st house. We paid cash for the land and had to borrow to build the house at 10% with a ceiling of 13% which it quickly rose to. We decided to make the sacrifice and I worked away from home on very good money and we paid it off in just over 2 years. In that time our 1st child was born ,but we didn’t change anything, just included her in our activities and life went on. After 5 years in that house any opportunity came up to purchase a cheap house so we sold the first and with the proceeds paid cash and reno’d the 2nd. After 2 years in that house another opportunity came up to purchase a cattle property (My life’s dream) that was very cheap so we sold the house and spent the next 12.5 yrs there until personal circumstances(not financial) had us moving again. Then another opportunity presented itself with a cheap house so we bought that and have been living in it for 6 yrs. At no stage of this journey could I tell you at which part of the cycle the housing market was in because it didn’t matter. As long as you can buy the next one for less than what you sold the previous and haven’t over capitalised. You just have learn to recognise an opportunity and sieze it , then manouvre yourself for the next as it presents itself, all things you’ll learn as you go along. I hope this helps put a more positive slant on things for you.

Cheers

Pete

So how will you feel when in 5 years time your “property portfolio” is worth 50% of what it is valued at now?

Hi Zetetic

In answer to your question, I couldn’t care less. sorry for being so blunt. I don’t have a property portfolio as such, what I was describing was our family home and have no intention in selling at this point in time. Unless someone came along and offered a price to good to refuse, then we would have to think about it. I think it is pure speculation to think that a “property portfolio” would be worth 50% less in 5 years, because nobody knows for sure what outcome we’ll have by then. The only time it matters is when you’re trying to sell and if you’ve over capitalised or paid too much on the initial investment, a lot like buying shares.

Hope this helps

Cheers

Pete

Leith wrote to me saying: As well as NIMBYism, several other trends related to household income, household formation, and ease of credit, worked together to excessively and unsustainably force up house prices to unfair levels.

These factors are combined with unchecked commodification of shelter for the population, caused by misguided governments who omit to regulate house prices, while unfairly allowing over-leveraged bidders to force up housing costs so they (the government) can benefit from vast streams of land tax, stamp duty, and council rates revenue.

Australia’s dangerously unregulated property environment includes many unfair elements. Sadly the truth in Australia is that every spare dollar of household income is spent on overpriced housing and capitalized into ever increasing house prices as young families battle for decent shelter while speculators unfairly hoard the available housing stock!

People have had just about enough of this ridiculous property bubble and its damaging effects to our economy and society.

Roger, depends how you define ‘crash’ They already have had major pullback

My 2c cents are for value I consider; well what’s would be the cost to build right now where I live. So:

400 sq/m blocks up the road (with a nice view of more suburbia) are selling for 300k, you could chuck a 3-4 bedroom house for 200k (if you believe a builder! ;). Unless land starts being given away or carpenters work for $1/hr not much is changing on the value side of the equation.

Short term price has other options!

When walking my dog round my local suburb I’m struck by the number of “For Sale” signs that now have “Sold” plastered across them. I live in Perth, so make of that what you will. There are lies, damn lies and statistics, and then there is the evidence of your own two eyes.

Hi Roger

A great post. Housing prices are driven (at least in part) by the purchasing power of the buyer. In the past 30 years there have been 3 shifts that have increased this purchasing power (and therefore driven up prices): (1) on average a reduction in interest rates since the early 1990s; (2) the use of 2 incomes rather than one to pay off a mortgage. In many families both parents work and both incomes are used to pay off the mortgage. This is very different from perhaps the 1950s or even the 1970s; (3) banks (until 2008 and the GFC) were willing to lend a lot more than 30 years ago (up to 95%). There must come a point when interest rates are at relatively low level and family borrowing is at its limit that housing prices will either start to decline or, at the very least, level out.

I’m not sure that any of these factors are linked to an increase in the intrinsic value of the house. It is just that there are more buyers with more money.

I can never work out (or have anyone explain to me) why house prices don’t go up at the rate of inflation. I understand how the value of a company can go up by more than inflation as that is driven by the growth prospects of a company, but how is a house any different to a bottle of coke? Why does the coke go up by inflation (or thereabouts) but the house does not? Until I fully understand the difference between the house and the bottle of coke I will stay out of the housing market.

Again, great post.

Kind regards

Adam W

Brilliant stuff Adam!!!

…Because the price of a coke is controlled by the Coca Cola Company & Pepsi (to a lesser extent)

Hi Adam,

Housing prices over time go up with average weekly wage rise.To paraphrase Kyle Bass …It makes sense …..earn a bit more money buy a bit more house.

What changed the equation was in the mid to late 1990’s our banks decided that you did not need 20% down but they would lend 90% or 95% or 100% 0r 110% of the price of a property. Have some more money so buy a bit more house. A rocket on prices.

Darren showed how property prices have rise over the last 10 years and said that over a 10 year period prices always go up in Australia. The last 10 years are a debt bombed with asset price expansion. If you look through the history of Australia and other parts of the world we have had extended periods ( up to 20 years) where housing prices in real terms did badly.

It is an asset class like all others that is subject to peaks and troughs.

Glen Stevens probably should have cut interest rates at the last meeting but all said he has done a good job and is way smarter that me. His comments a few years ago was something like this. ” the way to wealth generation in the future wont be like the past. Wealth will not be created buy being leveraged into residential real estate.” or something like that antway.

Now back to the 95% gearing et al. leveraging that was happening in 2000 – 2009. Have a close think about what will happen with leverage back at 80%.

And ask your bank if I need 5% down or 20% down at the moment.

If higher leverage pushed prices up then lower leverage can push prices down.

Just my view and cheers.

Hi Ash,

I think you will find that the strongest correlation is not between house prices and wages, but mortgage payments and wages because most people finance the majority of their purchase through borrowing. Since most purchasers of houses make their purchasing decisions based on the affordability of the mortgage payments, not on the upfront cost of the house, the large drop in mortgage interest rates between the early 1990’s and now explains a large part of the increase in house prices over this time. Not all of it, of course, but a large part. Increases in what banks were willing to lend was also a contributing factor, but I doubt that alone would have been sufficient to cause such a large increase in house prices if mortgage payments had not fallen so much and made borrowing so much more affordable for the average person. Apart from those who took out their mortgages in late 2008 or 2009 when interest rates were at their lowest, most people today will be paying a lower interest rate than when they first took out their mortgage, which means that one of the factors that caused the big increase in house prices hasn’t changed. While I still think that houses are expensive, because interest rates are so much lower than they were I don’t think that houses are as expensive as many other people consider them to be, so I will be surprised if they fall as much as some people are expecting them to.

David S.

Perhaps this will help..http://www.bis.org/publ/bppdf/bispap52t.pdf

Thanks Roger. That was very interesting, especially their distinction between overvaluation (which is due to temporary structural factors such as rate of land release) and a bubble (which is due to speculation). I was a bit surprised at their conclusion that Australian housing was not significantly overvalued in 2006, but I suppose that suggests that changes in financing arrangements, such as the changes in interest rates through the 1990s and 2000s and increasing access to securitisation, had a bigger influence on the increase in house prices than I was assuming. I would be interested to know how much of the decline in house prices in the last year or two can be explained by reduced access to RMBSs for the smaller lenders.

David S.

A question for them and one I’d be interested in hearing an answer to.

Adam,

Another factor to consider is the rise in real incomes. According to the ABS between 2000 and 2009 that rise was a compounding 2.4% per year. Helps explain why house price rises don’t match inflation.

The ABS also note that real income declined in 2010 by 1.9%. Not sure what the 2011 number was, but if that decline becomes a trend house prices will only go in one direction.

Over 50-100 years house prices follow wages and salaries so I reckon you are spot on Craig.

Hi Craig and Ash and Roger

Thanks for your comments.

Ash, you are correct – Having spoken to my bank recently, the banks now want 20% deposit, or for you to take out mortgage insurance, or for a family member to sign a ‘family pledge’ – i.e. getting a family member to put their house on the line. (I think the work ‘guarantor’ has negative connotations these days.)

Craig, I agree with you – wage rises (or decreases) will be one of the most significant factors when it comes to purchasing power and is therefore reflected in house prices.

Perhaps this illustrates that investing in quality companies at a discount to intrinsic value is a preferable investment.

Cheers, Adam

Adam,

My wife and I, after going through the house hunting process for the first time several years ago, have always advised our friends – when they embarked on the same journey – to never accept the general theories propagated by the media or other friends, however well-meaning they are.

You have to look at as many places as possible, and build a knowledge base, otherwise you may miss out on exactly the right house, at a reasonable price (maybe better).

There are so many reasons people make decisions to sell. Sometimes the planets align, but if you aren’t aware you can’t take advantage.

An hour or so ago I heard Jeremy Hook on YMYC say something along the lines of “at the moment you need to be selective”. I presume most value investors tuning in would have been thinking “its always time to be selective”.

Same when buying a house. But despite the times, if I had my deposit, I wouldn’t be sitting back banking on a crash, I’d be out looking.

The better informed usually win.

It is a classic asset bubble as more buyers with more debt drives up the ‘velocity’ of house exchange. When I was a kid we rarely moved but now people move much frequently and not related to their job. It is more to do with a pattern or debt acquisition, house purchase, renovation, sell and then start again. In effect a tread mill that relies on new entrants stepping on the bottom step of the ladder so you can move up. Other things flow from this as in terms of investors expecting the asset to gain in ‘value’.

The question is what happens when the ‘engine’ stops and buyers leave the market and prices level out and start to fall. No buyers means no sale, or move to the next level in the ladder.

And so back to moving less frequently? Thanks Iain.

Thanks for the post Roger,

Boral’s result is not at all surprising, neither the focus of the announcement on temporary setbacks due to adverse weather rather than the state of the housing market.

I’d like to say a few words on banks, and one of the core technical issues I think we need to worry about. That is, risk weighting of bank assets.

Since 2007 Australian banks have been able to make use of the Basel II the capital requirements. The calculation for the risk-weighting of mortgage assets is entirely at the discretion of the banks (ie internal risk models) and is not disclosed (commercial in confidence), and for an outside analyst, I see no way in which to replicate these calculations.

However, we do know that banks are required to hold no more than 2% capital against residential mortgages. These numbers are critical for the continued high return on equity our banks enjoy. Moreover, the amount of capital a bank has to put aside for each mortgage essentially determines the rate at which new loans can be made. So given how important this number is, it’s important to consider what determines risk weighting.

The Basel II framework requires models used for the calculation for risk weighted assets to include several general factors: Probability of default, Loss given default, exposure at default and expected losses – with these numbers based on fact and historical statistical values. The most important factor in this calculation is the probability of default. From the bank’s disclosures we do know that this is based on loan-to-valuation ratio bands and the historical performance of the various bands, over the last 5 years. That is, the risk weighting of assets is determined by what has already happened, not what is likely to occur in the future!

This is where there is a significant weakness in the whole methodology, and one which severely skews our financial system. As house prices rise, as long as banks keep lending, the probability of default remains low – non-performing mortgagees can always sell into a rising market. Moreover, high LVR loans accumulate equity and become less ‘risky’ as valuations rise. This leads to a positive feedback loop – banks can lend more as risk-weightings reduce, this leads to higher asset prices (it is undoubtedly the expansion of lending that leads to house price rises), larger bank profits, and a general reinforcement.

The problem is, this positive feedback loop will work in reverse too – as house prices fall and non-performing loans creep up, risk-weighting increases, restricting banks’ ability to lend into housing. Restricted lending leads to lower prices, higher arrears rates, and the cycle continues.

Now, it appears that APRA has begun to realise the Basel II structure can be gamed, and in the latest iteration of reforms (http://www.apra.gov.au/adi/PrudentialFramework/Pages/Basel-III-Capital-Reforms-March-2012.aspx) requires more detailed assessments of future risks of loss under varying economic conditions, rather than based on historical statistics. Moreover, management and boards will now be held accountable for this process, meaning “we couldn’t have seen it coming” will not hold.

The question is, will these new regulations end up choking off the credit-fueled housing market, and could they cause what regulators fear before banks have the chance to raise their capital and extend the duration of their liabilities? Or is it too late anyway? Regardless, it is clear that the flow of credit into housing cannot continue indefinitely and the easy days for the banks are over.

Interestingly, I recently read a Deutsche Bank research note (http://www.scribd.com/Jeremy_Murphy_CHa2Ps/d/87596469-0900b8c084e74ea6?secret_password=pag6g78ve8bdhqegn2g) indicating foreign investors are now more ‘underweight’ Aus banks than in any time in the last 15 years. Interestingly, it’s our super funds and households who are overweight banks. The banks make up 23% of the market now, but represent 25% of super funds’ local equities exposure, compared to 13% of foreign investors funds, and 60% of households’ portfolios! Do ‘they’ know something we don’t?

Also, I’ve not had time in the above to discuss the implicit government guarantee currently propping up the bank’s credit ratings (the economic imperative for the Govt. getting back to surplus) and the moral hazard it creates, the reliance on overseas funding (something like 90% of GDP is owed overseas by the banks), the implications of funding housing to the exclusion of productive investment, nor the social costs of highly unaffordable housing, etc. But that is all secondary to investment considerations, I guess…

Well done Rob. Nicely tied together. You’ll have no shortage of supporters with the view.

I have an interesting tidbit to add to your observation.

Just last week I went to finance a machinery lease that is maturing.

The bank for the first time in 20 years has asked me for REAL ESTATE security for our new loan.

Now is so happens that I sold my house in December, as asset prices in Western Sydney are approximately 10 times average weekly earnings now, (when I bought my house I bought at 2 times annual wage).

Now i believe that prices generally move with wages… and lots of arguements either way.

But just last week my decision has come home (pardon the pun) .

Why have the banks changed their practice, are they feeling the pinch?

I am happy having sold my bank shares and being personally debt free.

The company will be paying down loans too now.

regards,

Eddie.

Thanks Eddie,

No wonder there’s no credit growth within the banks. Perhaps someone here at the blog knows of a service they can pitch that can assist? All the best Eddie!

Hi Roger,

People have been saying that Australian property is in a bubble for more than 10 years.

Given the cheery consensus that appears to believe Australian property is in a bubble, and everyone is fearful of a market crash, should we follow the advice of Warren Buffett and “be greedy when everyone else is fearful”?

Would that mean we should be buying property now?

I for one don’t believe in the hype that Australian property is in a bubble, and certainly don’t take much notice of people from the US giving their view on Australian property.No matter who they are, I don’t think they really understand what drives our property markets. (For that matter, I don’t think anyone does).

The property market is much like the share market. At any one time, there are shares that are cheap and others that are expensive. It’s the same with the property market, not every house is over priced, but some may well be very expensive, and the average might well be “expensive”.

As for the view that our property market might crash by 25%-30% or more, I think that’s about as likely as it rising by 25% and I could easily imagine that we’ll be having this same conversation in 10 or 15 years.

Hi Mike,

Your post is a salient reminder that when fear is greatest so too is opportunity. And you are right that discussing the subject of property with reference to median prices and indices is akin to saying XYZ is cheap because the All Ords looks so.

Saying things Like buy at the maximum point of fear or be fearful when others are greedy and greedy when others are fearful are pretty useless to inform you when to buy or sell. They are fun lines to trott out but are meaningless. how do u define the maximum point of fear? You know in early 2008 when the stock market fell from 6800 to 5000 people were pretty fearful and it sure felt like the ‘maximum point of pessimism’ but we all know what happened afterwards. I’ve learnt from Roger just because a market falls x% it’s not a screaming buy or good value. The market may just be expensive rather than ridiculously expensive after a fall.

Instead of using buffetts or Jim Rogers and co’s one liners to dictate your transactions, focus on fundamentals…which are screaming expensive.

Your last point raised my eyebrows. Before property came off the boil in 2010, the short period between 2008 and 2010 saw a 25% price increase. In fact my unit increased 60% in these two years with just a coat of paint (I realised this gain and am now renting – although i’m not a flipper – it was just coincidence).

If property can go up so quickly – why would you think it could not go the other way when all the other fundamentals are reversing (lending massively down, lending requirements up, unemployment up in non-mining sectors, sentiment down).

Crash or slow deflate it does not make sense to buy property for a while. I’ll continue to enjoy renting at less than the mortgage interest would be on the same property and invest my surplus elsewhere (shares) and keep my sizeable cash holdings ready for a deposit when prices return to sane levels and to weather a storm of potential massive unemployment during the coming dark times while everyone over-leveraged lose their shirts.

Had a look at an app i have which shows the recent trends and it says my area has dropped 14% however my former suburb has stayed flat and my wifes former suburb increased 5% over the last 12 months. I believe this app used RP Data.

It also tells me that for my current area there are far more properties for sale than loans that have been approved to buy for this area and that there is a “slightly” higher amount of available properties versus demand and that there should be “modest” competition between buyers for properties.

I know the above doesn’t contain anything definitive but it all points to prices going lower even more.

As a further example which i alluded to below, the unit that is for sale above myself was one we were initially offered when purchasing off the plan. The price was around $470k (April last year, building completed in Novemeber and prices were similar), it is still on the market and the price is now $449K. So that is not quite the 14% but as it is still unsold who knows where it will end up.

According to REX (accessed through onthehouse) my suburbs median price reached a peek in March and then dropped and see-sawed for a bit but has been in decline since September.

Hi Andrew,

I reckon knowing that “for my current area there are far more properties for sale than loans that have been approved to buy for this area” is very useful in terms of timing purchase and sale decisions. Given property prices seem to have been disengaged from value for a decade or more, it could indeed be very helpful for those on the cusp of a financial transaction.

I see that the current housing market has a wide “buy/sell” margin in comparing the perspective of vendor and buyer. The result is that houses go stale on market.

As property lacks liquidity, it reminds me of some of the stocks that trade very thinly (ie REH/EMB). However REH and EMB are A2 for me. Property is C5 (lots of young families with 90%+ LVR)

Good observation Thomas

Hi andrew, what is the app you used if you dont mind me asking?

is it for iphone or android?

Hi gez,

I don’t mind at all. It is commbanks property guide. It is free on the apple app store, not sure about android

Hi All

Housing prices are certainly way overpriced. Most with a rational unbiased intelligent mind would agree. We are currently having a mild correction but to have a crash of say 40 or 50% we need a catalyst.

The below is an extract from Wikipedia

An investment boom in Australia in this decade saw increased economic expansion despite the fact that the investments were providing less of a return. This can be attributed to foreign funds’ becoming more available to Australia. This influx of capital led to Australians’ experiencing the highest per capita incomes in the world.

However, by the end of the decade, overseas investors became more concerned with the difference between expected returns and actual returns on Australian investment and withdrew further funding. Consequently Australia saw the start of a severe depression. Australian economic historian Noel Butlin would later argue that the history of Australian settlement has been one of growth financed by foreign capital, punctuated by depression caused by balance of payments crises after a collapse in property prices and exacerbated by the imprudent use of capital.

The scary thing is this was written about the 1890’s depression

This is also remarkably similar to today’s situation except for the fact that foreign capital financed our housing bubble. Borrowing money from foreigners to push up our housing prices was certainly an imprudent use of capital.

The graph below is curtsy of a speech by Ric Battellino Deputy Governor RBA in 2010

(Sorry Blog won;t let me post the chart but it;s madness, Trust me)

Total madness, and a typical parabolic curve that we see in all

bubbles.

I hope the foreigners don’t want their capital back in a hurry but the European banks have been big lenders to us and they are already showing signs that they want it back. Well why wouldn’t they, most of them would be insolvent if the marked to reality instead of mark to model or mark to markets or whatever they have decided to do.

We have two potential catalysts from a housing price crash.

1) The Europeans want their money back and our big 4 banks where most of the debt lies can’t replace the funding from Asia. They will then have to call in loans and start selling overpriced real estate. This won’t be pretty but it’s very unlikely now that the ECB are now printing money with LTRO

2) Commodity price falls and resource projects being delayed or abandoned. Let’s face facts Retail Manufacturing Finance and Tourism are in recession. We are only posting positive GDP results because of the commodity cycle. A major commodity price fall will see wide spread unemployment of at least 10%. If I were one of these 10% I would not have to sell my house but I would be in the minority. If you look at history commodity prices are very cyclical and have a boom bust cycle. On that basis it’s certain to happen we just don’t know when. All that said I am mindful of Jim Rogers who says in his flamboyant way “ Buy commodities if the world gets better commodities are the place to be as there are shortages developing. If the world does not get better then they will print more money and commodities are likely to do well.” I am also mindful of Jeremy Grantham who thinks we will have a paradigm shift in commodity prices but we may have a dip in prices due a China hiccup.

Most crashes happen when most people don’t expect it. In this case everyone who is anyone knows residential real-estate in Australia is very overpriced and are expecting a big decline. So my contrarian nature says that it won’t happen.

Like when a noted journalist who has a website that Roger writes on said sell all your equities my premi bear personality was awoken and transformed into a major bull. When the journalists are saying sell you should be buying. My Favorite Jim Roger quote “if everyone is on one side of the boat you better get to the other side”

But all is in balance now I am back to permi bear.

.

Jim and other smart investors think you should be in real assets as the money printing around the world is huge and real assets are a protection. So if our real estate was not so overvalued it would be the place to be.

In Summary, Housing prices are overvalued and assets always revert to the mean. Let’s hope this happens slowly and not quickly. Or am I totally wrong about this, is it better to flush the bad out quickly like Russia in 1998 or do things slowly like Japan USA and Euro are trying to do.

Cheers

Another great contribution to the discussion Ash. Thank you.

Roger,

Lots of property Bears on here, not one Bull………. lots of stories of people selling because they think property will get worse…….. If it was the stock market I would be thinking it is a good time to buy.

I’m in violent agreement except that this may not be a large enough sample….

I would like to add that one of my good mates sells real estate in Brisbane, I remember that during 2005,06,07 my mate was hardly having to put much effort in to sell houses, people were falling over themselves to buy, there was almost panic buying, but come 2008, 09,10 he could not sell a house to save himself, he pretty much went broke (he works totally on commission). These days things are starting to pick up for him and he thinks the property market in Brisbane is getting better.

What do I think…….. well I don’t think we will crash from here (we would have in 09, 10 if we were ever going too) I just think property will be flat for a few years to come and when you add inflation we will go backwards in real terms. Although I think what people have been paying for property in rural and mining towns has been pretty extreme so there might be some big pull backs out in the sticks……

Good perspective Darren. Your comment that you “don’t think we will crash from here (we would have in 09, 10 if we were ever going too)” may stir a response…

Darren,

This blog tends to be frequented by individuals particularly more cognizant of the discrepancy between the price you pay for an asset, and it’s actual value – whether that be value in use, or in the returns the asset generates.

It doesn’t surprise me that people here are attuned to the fact that housing in nearly every major city in Australia does not represent good value at this point in time.

But we also know that things that are severely over-valued can remain so for very long periods of time (QAN, TLS, ABC, perhaps ORG?)

We don’t pretend to predict when prices catch up with value on here, so why should we expect the same from people saying there’s a price-value discrepancy in real estate? All we know is that in the long run markets tend to follow value (whether that be up or down).

Stay away from overvalued assets if you can, and in the long run you should do fairly well.

Solid perspective Rob. Thanks for sharing.

As a 30-something year old it is interesting to reflect on how much pressure has been brought to bear on my generation over the last decade or so to enter the property market. Well-meaning parents who have seen massive increases in their property prices (not values) over the years have repeatedly drilled into us the importance of ‘getting on the property ladder’ and especially ‘before it is too late’. Like many who visit this blog, I recognise those phrases. They represent a stage in the asset price cycle where there is no longer just speculation – asset prices will always go up! Also known as a bubble.

I watched the majority of my peers become seduced by this thinking – purchasing property using mortgages which they can just manage to service with two full time middle class incomes. The majority of them are in negative equity. I feel for them but at the end of the day they make their own decisions. I am happy to accumulate capital in productive enterprises that generate wealth. If property prices ever resemble a decent return on equity in the future I would consider purchase for the purpose of living in it. Other than that I would not touch it. I’m happy paying rent – it is not dead money, mortgage interest is dead money. Rent is what you pay for the commodity called a house and there are heaps of them. Cheaper than interest too.

The real question is what happens next? Bubbles usually end badly, but what government would suicide itself by standing idle while property values plummet and a recession ensues (which would be very good for the Australian economy longer-term)? There is bound to be interference that complicates this picture.

The smart money, however, is already moving. Boomers wishing to protect their retirement savings are cashing out now while they can still obtain inflated prices. At the very very best property asset prices will track at or below GDP growth (they have to, how can the next generation pay more when both adults are already working full time just to survive? Please don’t suggest sending the kids to work!). More likely property prices will revert towards their true value, the capital required to generate a decent return on equity. As more and more people realise this, the selling will accelerate as everyone attempts to get out and lots of anguish and broken lives will ensue. It won’t be pretty and I imagine that my generation will remember the moral of this experience until the next ‘sure fire way to make money’ comes along (assuming they manage to clear bankruptcy by then).

And then those same parents will be forced to sell their properties to fund their own retirement and healthcare…

I’m agnostic about whether prices stabilise, rise or fall further but I am hoping the sum of views here over the next few days will help to cause a position on direction to coalesce.

Having been a real estate agent on the Gold coast for 25 years do you think the average Joe gets the real story? – whoever pays the piper calls the tune so the press and reports supported by the industry will be biased.

How about a nice townhouse right by bond university – which can produce 400/wk from students, last bought for 385,000 just sold at a Ray White auction with the usual suspicious bidders at 208,000!!!

And the unsold units etc. many linked to the failed mortgage funds [MFS, Equitytrust, City Pacific, etc. etc.. – liquidators selling at any price just to cover their fees.

“Usual suspicious bidders”? Do tell. I’m sure I speak for everyone here at the Insights Blog when I say; we’re all ears.

You have not heard of dummy bidders?

I don’t think there will be a nationwide property “crash” in Australia. Affordability is actually better than it was a couple of years ago and if things start going bad, the reserve bank still has a fair bit of room to move with interest rates.

The basics of supply and demand will always apply to property and that is why it is difficult to make a sweeping assumptiong across all states of Australia.

There are currently areas where demand is outstripping supply (eg. the gladstone region of queensland) and areas where there is a big supply (eg. gold coast apartments).

We still have very low unemployment which means there are plenty of people out there with the ability to take on a mortgage to buy a property.

For property to crash all over Australia I would think you would need a big restriction in lending from the banks or a large increase in unemployment across all states.

These are both possibilities, but looking at the current state of affairs, I wouldn’t be too worried.

Have a look at the 10 year returns for property in each capital city on this page: http://www.abs.gov.au/websitedbs/d3310114.nsf/home/6416.0+-+House+Price+Indexes:+Eight+Capital+Cities

The below table shows the change in home prices between 2002 and 2011 (a 9 year period) for the capital cities of Australia.

2002 2011 % Change

Adelaide $166,000 $402,000 242%

Brisbane $185,000 $450,000 243%

Canbrerra $245,000 $538,000 219%

Darwin $190,000 $510,000 268%

Hobart $123,000 $339,000 275%

Melbourne $241,000 $484,000 200%

Perth $190,000 $500,000 263%

Sydney $365,000 $575,000 157%

History shows that Aussie real estate has almost always gone well in any 10 year period in the past. Stick with it for the long term and invest where the jobs are and you should do ok.

Hi Darren, Good data from the ABS. I went directly to the source page because I haven’t had the opportunity to investigate the blog link you sent through. Interesting that the anecdotal evidence being discussed here doesn’t reflect the official stats. Individual properties and suburbs can produce results that diverge considerably from the averages.

Posted by Duncan on April 21, 2012 at 1:46 pm

Hi Folks

We’ve been living on the sunshine coast QLD for 6 years and over the last couple of years there has been a slow decline in the price houses are sell for. Having been renting, we bought our modest house, 6 months ago, for the same price the previous owners had paid 6 years ago. I still think we paid too much. We need two incomes to cover our debt and basic living costs on a $300K mortgage. There are a lot of people in the same situation and very nervous about there employment prospects. At four times joint income we can manage. If people and especially government stop spending a lot of people will be in a lot of trouble and house prices will have to fall.

Keep Spending modestly

Dunc

just some comment on this post.

Duncan according to some people business man should not pay more than 5 times one gross income.

Thanks Ned.

I think it depends on where you might have your property. I bought a 1 bedroom unit at Coolum Beach, Queensland right opposite the beach in ideal position but have seen the resale value drop 20% since it was purchased 4 years ago.

On the other hand mid market residential property in Perth is holding strong with a 150% increase in 11 years in my area. Perhaps a bubble, I don’t know, but given it is pretty difficult to get a rental property in Perth at the moment, perhaps it will hold strong for a little while longer.

Thanks for letting us all know Simon. Its remarkable how different the picture looks on the ground when compared to the official stats.

Simon, I live in Perth and confirm the market for rentals is tough, properties are scarce and people are paying top dollar. Not a lot for sale and what is for sale can take quite a while to sell! It is hard to know which way this will go, my feeling is that (despite the market being massively overpriced in my opinion) a drop in interest rates may see a number of people trade up. Despite the rumblings in China there is a massive amount of construction activity going on in the Pilbara and unless something really drastic happens most of this stuff will get built.

Thanks Stevek! Good points.

House prices are definitely falling in Adelaide. Houses are not selling quickly and usually sell only after substantial price reduction. First home buyers are waiting patiently on the sideline.

Thank you sir. A voice from beyond.

I also live in Adelaide, and concur – there’s no price appreciation in most suburbs here. There are some exceptions. There always are. On the other hand, I spent a couple of weeks in WA on a family holiday at the beginning of this month, and things are a bit different over there. South of Perth, down in Dunsborough, they have seen some falls. However, between Perth and Mandurah, on the freeway, things seem to be holding up. Up the top, in the mining towns, there is still plenty of money to be made in property I am told. When the boom goes bust… as they always do one day… There are a lot of properties up north that may well halve in value, because the value is only there because of huge demand, and that demand won’t last forever. In the meantime, it seems there is still money to be made in property in the west.

Hi Roger,

Land prices where I live in rural nsw are about the same prices as they were 15-20 years ago, with no signs of improvement in the foreseeable future. People are making low returns on all types of industries except those mining related, most people have a lot of debt, even if they wanted to buy a bargain property banks won’t lend to them. It’s the perfect storm. the weighing machine applies to every business and asset class.

So true Bruno. Thanks for taking the time to contribute to the discussion. I look forward to hearing from you again.

According to inflation figures for the last 10 years an item that cost $1 in 2002 sold for $1.33 in 2011

This occurred during a period of very benign inflation

It also means that any asset that didn’t get from $1 to $1.33 after tax in those 10 years lost purchasing power.

Median house prices in capital cities all beat the inflation creep for the last 10years to June 2011 (pre-tax: Sydney $1.63, Melbourne $2.07, Brisbane $2.39, Adelaide $2.37, Perth $2.55, Hobart $2.67, Darwin $2.63, Canberra $2.20 – no allowance for -ve gearing, rent return, repairs and maintenance, rates etc)

However, between June 2011 the median prices were at the same levels as the second half of 2009. So they lost 3% pa (6% total) in real terms over that period.

By comparison, in the 10years to Dec 2011 the All Ords Accumulation made it to $2.00 (no allowance for franking credits and brokerage).

In the absence of a burst bubble, an economic melt down or something else inflation will do a good job of reducing the housing bubble’s size.

What we aren’t hearing in the mainstream media yet is that house prices have already fallen approx 10% in value

I find the new house price index an interesting idea. It seems like the wrong time to introduce an index when a market is elevated if you are interested in keeping prices up.

Sources: ABS.gov.au, http://www.rateinflation.com/, Australian Foundation Annual Report

Thanks Matthew,

Great to hear from you. According to some of the anecdotal feedback here at the insights blog, prices may have well fallen further than 10%!

Roger,

What would your method of value investing inticate if it were applied to residential property?

widespread overpricing in housing! Think about the return on equity of a residential property Chris…

Let me share with you a story the Y generation will find incredible. I hope it will illustrate the amazing disparity of price to return in today’s Australian real estate market.

The year is 1964. The Beatles are the focus of world-wide adoration. The free world is still in shock over the assassination of President J F Kennedy. In Elizabeth Drive Liverpool, west of Sydney, a block of 12 new 2 bedroom apartments, all with lock-up garages, balconies, and individual laundries, and owned by a famous circus-owning family, has been listed for sale at… guess how much… $240,000. Not each. The whole block of 12. The nett income from leases after all usual expenses was $24,000 p.a. which is 10%. I was the eager young real estate agent for the sale, and arranged a mortgage for the property through a city solicitor for 5 years, interest only, at 8% pa..

The eventual purchaser, who had enough cash to buy outright, saw the wisdom in gearing the property to 50% of the price and commenced his ownership at a nett yield of 12% per annum on his equity, leaving him enough cash to buy a second similar property. (This property today would sell for about $3,600,000 and as an “investment” would be flat out yielding 3% nett, so any gearing and you’re in negative territory.)

As the years passed, prices rose dramatically, rents rose marginally by contrast, and some clever marketing guru around the 1970’s decided to spruik “negative gearing” as the way to go, and do you know why? Because that’s all there was left!! That’s why!. Soon the yield from property was so low, that the cost of borrowing against it was so farabove the achievable rents, that positive gearing was a thing of the past. And ever since, investors on high incomes have been persuaded to buy properties with borrowed funds for the privilege of collecting rents at way below the costs of borrowing in order to get a tax deduction and MAYBE the prospect of a capital gain one day. (Capital growth was pretty well assured for many years, but for now…..?)

SO what is normal? If the 1960’s picture was the norm, then Harry Dent is right, and we’re in for the grandfather of a real estate bubble-burst.

My answer is this. While employment is Aok , interest rates are about where they are now, and land and infrastructure are as dear as now, all seems tickety boo. That is, in great locations.( Elsewhere it’s already on the nose. ) If inflation causes an uptick in interest rates and a downturn in employment, all hell will be unleashed, as an avalanche of unwanted properties races down the slope toward a fast retreating hoard of buyers.

It’s so long since the ’60’s, I don’t know what is normal any more. But if those days and their expectations should return, imagine what YOUR property could be worth. Horrifying, isn’t it? You have a $500,000 2 bedroom apartment rented at $480 per week. After expenses you bank about 70% of the gross, i.e. $17472, so a future buyer expecting an 8% return will offer you $218,400. Oh, sorry, minus stamp duty and legal fees. Make that a round $210,000. A nightmare scenario? Not if 1964 comes around again, it isn’t. (8% was the return on an individual apartment in Liverpool in 1964) Better hope history is an unreliable guide.

Fantastic David. What a terrific story. And you can bet that if and when prices do revert to those sorts of yields, the commentators will point out how its a return to normal. Your allegory, reminds me to later share with you a story later of what the world’s fastest chicken sexer did in the 1940’s with four 10 acres blocks that are now the suburb of Dundas.

Roger,

If you use return on equity has there ever been a time in the last 40 years when it was the right time to buy residential property.

Oh I think the early 80’s may have been ok.

Roger,

So if you where a property investor rather than a stock market investor, the value method would not be appropriate. Perhaps another method would be timing (eg: when interest rates have peaked and start their downward cycle). Indeed using such a method would have done pretty good in the stock market too.

…or you could wait for value. Over very long periods I would expect prices to revert. But shares are so much easier.

Hi Folks

We’ve been living on the sunshine coast QLD for 6 years and over the last couple of years there has been a slow decline in the price houses are sell for. Having been renting, we bought our modest house, 6 months ago, for the same price the previous owners had paid 6 years ago. I still think we paid too much. We need two incomes to cover our debt and basic living costs on a $300K mortgage. There are a lot of people in the same situation and very nervous about there employment prospects. At four times joint income we can manage. If people and especially government stop spending a lot of people will be in a lot of trouble and house prices will have to fall.

Keep Spending modestly

Dunc

Thanks Duncan. Thats remarkable. Zero return after six years! Thanks for the insights too. Look forward to hearing from you again.

I’ve lived in the outer suburbs of Melbourne and now from this year currently live in the middle suburbs and my observations are: the outer suburbs have so much housing stock coming on its phenomenal. Huge amounts of land is being converted into mcmansions, large paddocks and undeveloped areas are popping up estates. In the middle and inner suburbs, there is a huge supply of apartments coming on. At the same time, I see plenty of apartments with ‘for lease’ and ‘for sale’ signs up the front, and more and more seem to be coming on the market and staying there longer as the months go by. I have never seen such huge amounts of construction or properties for sale/lease in the 15 years I have lived in Melbourne.

I think this has the makings of a large price drop in Melbourne, its the lowest yielding capital city (3-4%) and there is a huge amount of supply coming on. It doesn’t look too promising, I really do wonder how developers are going to flog off their brand new 1 bedroom apartments for starting at $399k….

Thanks for those insights. Interest if only because the official line is that there is a supply shortage!

Hi Roger,

According to my own analysis of the property indices, If you owned Melbourne’s median price since April 2010 (peak), you would have lost $700/wk until now not including interest expenses or inflation.

In the inner east of Melbourne I have not seen an auction (townhouses) get sold under the hammer (0 out of 9 since February). In my opinion any apartment inside Melbourne CBD or Docklands are fetching a 20-25% discount.

I would avoid owning equity positions on banks as they will be experiencing more arrears/foreclosures

The Bank of Queensland capital loss/raise announcement recently is like the canary in the mine.

Thats certainly something we are trying to better understand. The banks offset a lot of their risk through mortgage insurance but that doesn’t apply to all mortgages. Nevertheless sentiment can be a big driver of market values.

Mortgage insurance is an interesting thing to me, it just doesn’t make sense. Maybe someone else can explain where I am wrong, but this is the way I see it:

Those that need lenders mortgage insurance (LMI) are those borrowers who have the least amount of equity due to a small deposit as well as the least capacity to save (through low income or high expenses). This group is also the first to be hit in an economic down turn.

So if you are a mortgage insurance provider like Genworth you concentrate your risk to the front line of defaults. Same problem that sub-prime only mortgage backed security holders found themselves in the US.

Here is a quote from a lender’s mortgage insurance website:

“For lenders, LMI gives the institution the confidence to approve more home loans and enhances their ability to lend to a broader range of customers. For borrowers, LMI means they can purchase a home or an investment property sooner, allowing people with less than 20% deposit to get into the property market earlier.”

I recall this tune was played in the US and it didn’t end on a high note.

Also, insurance is only as good as the insurer:

If a borrower wants a $500,000 house but only has $40,000 in savings then they will need $10,000 in LMI. This insurance is capitalised in to the loan. I don’t see how this helps the bank because if house prices have dropped 10% then the house will be sold for $450,000 and there isn’t enough money in the pot to repay the bank.

Of course, these LMI companies work out their numbers based on historical default figures with a margin of safety built in. But these kinds of events are inherently unpredictable and they aren’t a problem until they are. When eventually it does collapse, it is really really big and wipes out A LOT of equity because of the leverage involved.

My opinion: don’t purchase LMI, don’t invest in LMI providers, and don’t invest in those companies that rely on LMI providers until after the event

So that rules out QBE for Matthew and Genworth if it ever lists.

Hi Matt

Have you thought about what happens to the banks if house prices drop 25-30%. They don’t have insurance on ones who put 20% down. It could get interesting

Cheers

In regards to banks lending and their loan books, i would be interested to know if any have experienced a tightening on lending to people. I know when my wife and i went to organise a loan for our home we were offered borrowing capacity up to a million (we took just over $350K).