Signs of a merry Christmas at JB Hi Fi?

JB Hi Fi (ASX:JBH) is a retailer we have followed closely over the years. What attracted us to the business was a focused and well-executed business model that delivered strong returns on equity, coupled with a store roll-out program that allowed those returns to be realized on an expanding pool of assets. Over time, this led to increasing market share and growing EPS. In fact, between 2004 and 2010 EPS grew at a rate of over 30% p.a. compound.

More recently, JBH has encountered cyclical and structural challenges. Australian consumers have become more inclined to save than spend, a strong A$ has moved some of their spending offshore, and the growth on online retail has presented a significant change to the competitive landscape. For most of 2012, our interpretation of these factors has led us to err on the side of caution and we haven’t owned JBH. With the share price falling materially during 2012, we have been glad of this.

At the same time, JBH’s share price has more recently reached a level where it may be possible to see real value and, if a light could be seen at the end of the cyclical tunnel, a case for investment may well present itself.

Before I come to our thoughts in whether we can see a light, let me deal with one issue that doesn’t concern us: JBH’s balance sheet. Some commentators have noted that at 60% ND:E, JBH’s debt is worrisome. However, JBH’s Equity (the denominator in this equation) has been artificially reduced by large share buybacks, and so some care needs to be taken in using this sort of gearing measure. Looking at the balance sheet more broadly, JBH’s debt level appears quite manageable in relation to its earnings, cashflows and enterprise value.

Back to the more tricky issues. It is hard to see online retail as anything but a real and permanent headwind for retailers like JBH. Customers now have more options and much more information, and a generation of consumers is being brought up to be comfortable with this form of shopping. While it may not represent a large share of total retail spend for the foreseeable future, it will constrain the prices traditional retailers can charge, and will reduce their growth rates.

On the plus side, JB Hi Fi has been quicker than most in responding to this challenge. It moved early to establish its own online presence, and it has been working hard on its suppliers to better allow it to compete on price. As a result, we expect JBH to fare significantly better than some others for the foreseeable future.

As to the cyclical issues, depressed consumer spending and a high A$ should in time return to more normal levels. It is not easy to define “normal”, but our sense is that these parameters belong at a higher and a lower level respectively. While both are relevant, it is perhaps consumer sentiment that has the greatest potential to improve the mood of retailers in the near term.

There are many ways one can try to gain insight into the mindset of consumers. For our purposes, one approach that can be helpful is to look at the frequency with which certain search terms are entered into internet search engines. We like this approach because the information provided can be very timely and focused.

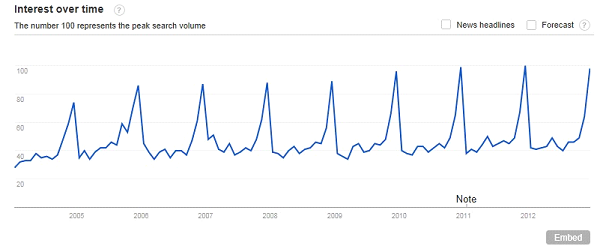

The chart below provides an illustration. What it shows is the relative frequency with which the word “perfume” has been Googled in Australia over the years. You can see a very clear seasonal pattern with a spike in interest around Christmas, coming off a steady base. If Christmas stockings at your house normally contain some perfume, this year is looking like it will be no different.

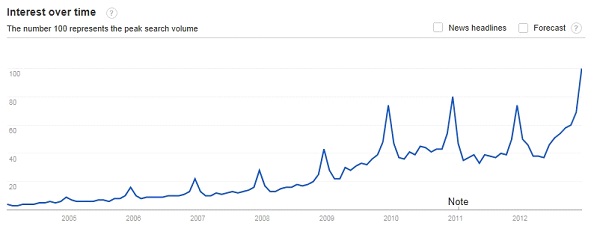

The next chart shows the frequency with which the term “JB Hi Fi” has been searched in Australia. Here you can also see the seasonal pattern, with a spike in December, but you can also see a clear uptrend, which corresponds broadly with the growth of the business.

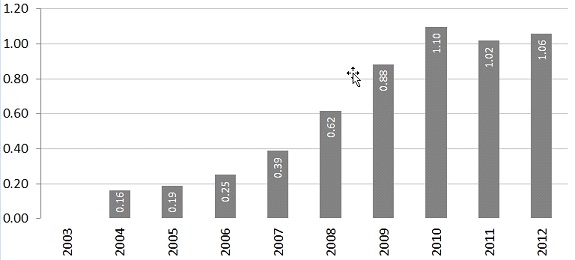

Something that we find interesting about this chart is that the upward momentum stalled between Christmas 2009 and Christmas 2011. If you look at the following chart of JBH’s earnings-per-share, a similar pattern emerges, with growth stalling between 2010 and 2012 (Note the 1 year offset – eg. Christmas 2009 is reported in the FY2010 result).

JBH EPS

The other thing that’s interesting about the “frequency of search” chart of course is the apparent surge in interest more recently. The 2nd half of calendar 2012 appears to show a significantly higher level of online enquiry than we have seen previously, with the December peak some 25% higher than the 3 prior years.

Given the historical correlation between JBH’s performance and the level of search interest, it is tempting to view this as a sign of consumers again warming to JBH’s product offering. However, this analysis is far from conclusive. While promising, a surge in search interest is not the same as a ringing till, and the longer term structural challenges remain in place. Nevertheless, we will be watching closely in the weeks and months ahead to determine how we should position our funds in relation to JBH.

I had a look at the Google trends for JB vs Harvey Norman. I found it interesting that Harvey is on top volume wise, but JB appears to be catching up. How much you can take from this I am not to sure. I am just a sucker for graphs…

http://www.google.com/trends/explore#q=jb%20hi%20fi%2C%20harvey%20norman&geo=AU&cmpt=q

This will be a great indicator for how JBH will progress. There have been a number of high impact electronic releases this year in the ipad mini, samsung galaxy, new iphone, new nintendo Wii platform etc, it’s music streaming service has been open for a while now and from what i understand a few more stores as well.

My issue still is very much in regards to cd’s and DVD’s. This takes up a fair whack of floor space in JB Hi Fi Stores and i just don’t see much of a future for them and nor am i completley sure what they will replace them with. I still think that perhaps JBH stores will look like the store on level 6 at pitt street mall but that hardly inspores a lot of confidence as it can be hardly termed as busy.

In saying that, with some very decent movie releases this year, it can be argued that the DVD section might get a fair bit of business late next year when they are released and JB’s lower price than other b&m retailers should make it an attractive choice for Bond, Hobbit fans etc (although lets be honest, this is hardly going to be enough to sustain the whole business).

At least they got on the online bandwagon early, i like the way they have linked the online and b&m stores where you can order online and pick it up instore. They seem to at least be aware of what the headwinds facing the industry is and prepared to act on it. They also i think have a very good philosophy as to what type of service they need to offer so i still think they are one of the better retailers in Australia. If only a couple of other high profile retailers had the same forsight, they might not have spent 3-4 million buying high profile “faces” but instead invested it in a decent online platform.

I expct JBH to be a company that can survive today and in the future, i think it still has a lot going for it and that it can meet the challenges coming there way. I am sure also they are wishing that pesky aussie dollar starts to get lower as well so that the incentive to buy from the states decreases.

Still on my watchlist, but not anywhere near the top of it.