Should you always be greedy when others are fearful?

Here’s something curious: the American Association of Individual Investors (AAII) – an organisation with over 160,000 members – has a sentiment survey that offers insight into the opinions of individual investors by asking them their thoughts on where the market is heading in the next six months. They have been conducting the weekly survey of members since 1987.

The belief is that tracking sentiment gives investors a forward-looking perspective of the market instead of relying on historical data, which tends to result in hindsight bias.

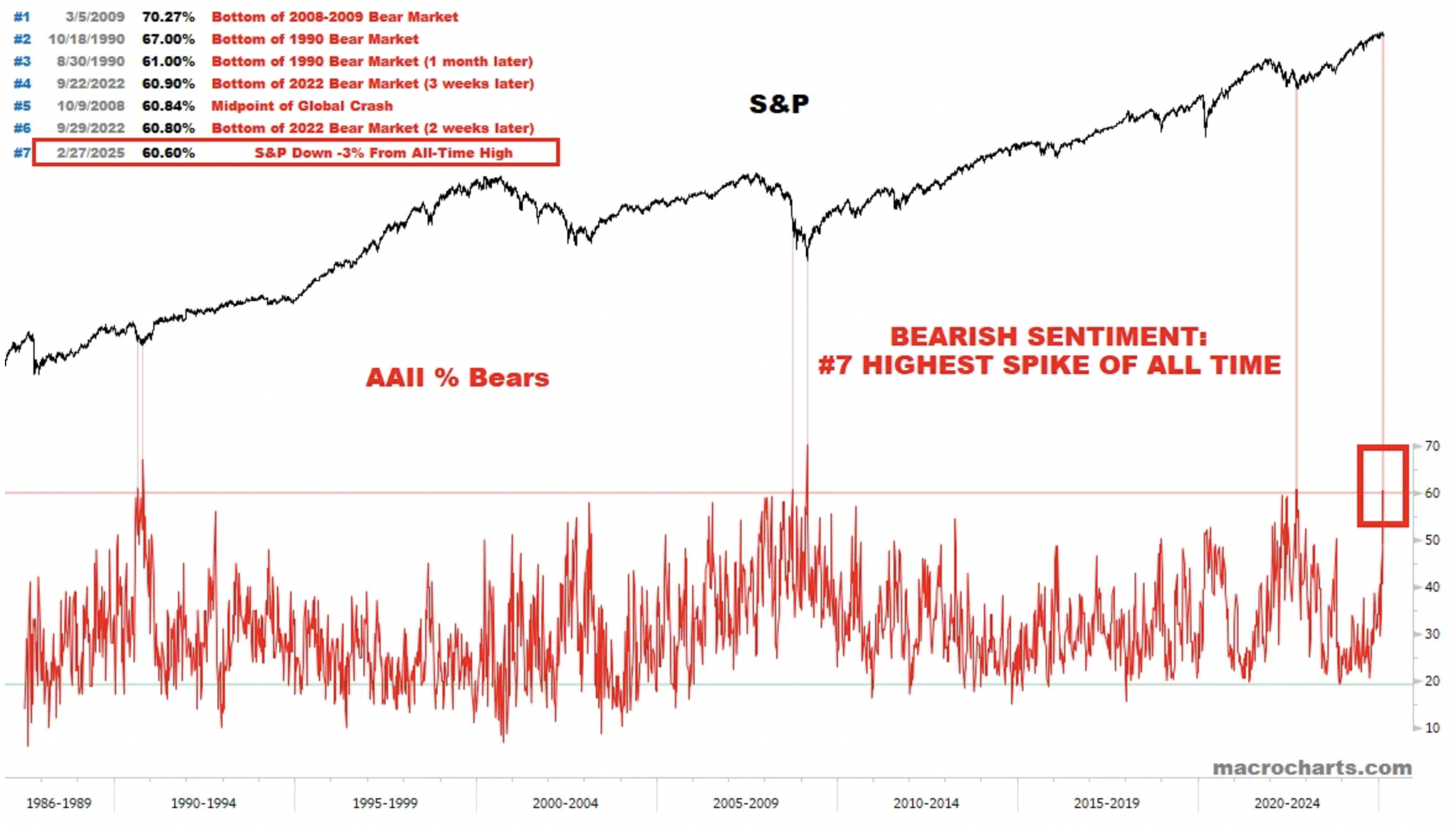

At times, the indicator has been a very useful and highly profitable contrarian indicator. The six highest levels of bearish sentiment have all coincided closely with significant market lows. One can imagine how this might transpire; as the market (in this case, the S&P 500) declines sentiment declines with it until it achieves a nadir and extreme bearish sentiment is recorded, fueled by investors who have all, by now, given up on equities.

The indicator represents the pulse of Ben Graham’s Mr Market allegory.

The AAII Bearish Sentiment result reflects the level of expectations that stock prices will decline over the next six months, and the organisation notes that higher than current readings are tied to periods such as the 1990 recession, Iraq’s invasion of Kuwait, and during the depths of the global financial crisis (GFC).

The highest level of bearish sentiment since the survey has been conducted was 70.27 per cent on March 5, 2009, a date coinciding with the low of the GFC. The next two highest bearish readings were 67 per cent and 61 per cent in 1990, conducing with the bear market of ‘the recession we had to have’ and the remaining four also produced extraordinary buy signals (Figure 1).

Figure 1. Be greedy when others are fearful

Source: Macrocharts.com

Source: Macrocharts.com

As you can see from Figure 1., the highest spikes in bearish sentiment tend to occur at the end, or near the end, of historic bear markets.

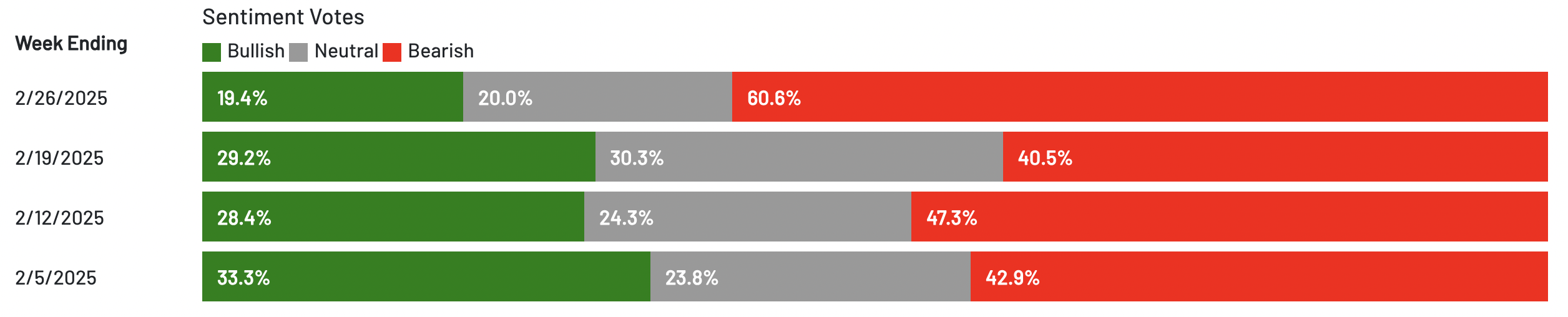

Figure 2., reveals the level of bearish sentiment this week.

Figure 2. Latest AAII Bearish Sentiment survey results

What Direction Do AAII Members Feel The Stock Market Will Be In The Next 6 Months?

With a reading of 60.60 per cent this week’s AAII survey result puts bearish sentiment at the seventh highest level since the survey’s inception. Having soared to 60.6 per cent, the reading is up from 40.5 per cent the previous week. The 20.1 per cent, is, according to the AAII, the largest weekly increase since August 2019. And the reading brings bearish sentiment to its highest level since September 2022.

With a reading of 60.60 per cent this week’s AAII survey result puts bearish sentiment at the seventh highest level since the survey’s inception. Having soared to 60.6 per cent, the reading is up from 40.5 per cent the previous week. The 20.1 per cent, is, according to the AAII, the largest weekly increase since August 2019. And the reading brings bearish sentiment to its highest level since September 2022.

By the end of September 2022, the S&P 500 had fallen 24 per cent and then rallied 63.5 per cent, to where it is today.

This time, the S&P 500 is a mere three per cent from its highs – hardly a bear market. So, the bearish sentiment isn’t being influenced by market prices. Perhaps for the first time in a long time, investors aren’t letting market prices inform their expectations.

Rather than using market prices as a guide, investors must be grappling with economic conditions and geopolitical concerns.

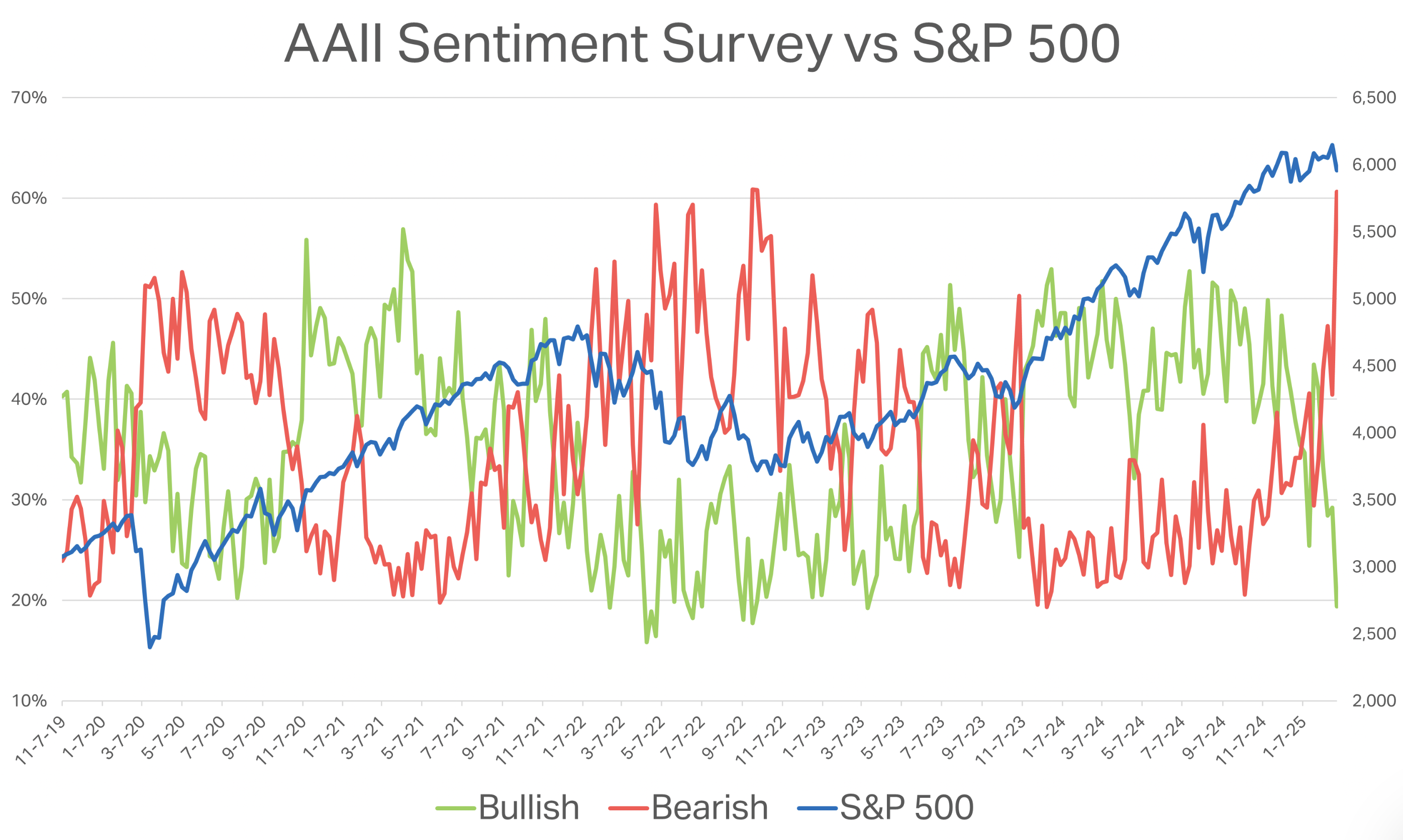

Figure 3. AAII bullish and bearish sentiment versus S&P 500

Figure 3., probably provides a more useful insight than a single extreme reading. Sometimes, a spike in bearish sentiment marks the beginning of a period of bearish sentiment that includes, or coincides with, poor performance from the S&P 500. In other words, were bearish sentiment to continue, it may reflect or influence the actions of investors exiting the market or selling down (risk-off).

Figure 3., probably provides a more useful insight than a single extreme reading. Sometimes, a spike in bearish sentiment marks the beginning of a period of bearish sentiment that includes, or coincides with, poor performance from the S&P 500. In other words, were bearish sentiment to continue, it may reflect or influence the actions of investors exiting the market or selling down (risk-off).

Of course, time will tell. As we have written about here previously, our expectations (based on the combination of a disinflationary backdrop along with positive economic growth) are that 2025 should be an ok year for stocks but not as good as 2024 and 2023. Once scenario for a better year in equities would be if central banks return to injecting large amounts of liquidity into the financial systems and markets as the Federal Reserve and U.S. Treasury did in 2023 and 2024.

Meanwhile, a much worse year would transpire from an escalation of geopolitical tensions that culminated in armed posturing or conflict.

A reasonable conclusion would be to expect more volatility. Perhaps AAII members have got that right.