Shipping firms profit from the supply chain crisis

The global supply chain crisis caused by COVID-19 has significantly increased the cost and time it takes to ship goods. This has been bad news for some businesses – particularly those that find it difficult to pass on rising costs. But the crisis hasn’t been bad for everyone. For the world’s major container shipping companies and freight forwarders, it’s meant rising profits and soaring share prices.

Shipping is an industry that is not possible to get exposure to directly in Australia but it is an industry I have looked at very closely in previous jobs, both as an investor and as a banker providing capital and financial advice, so it is an industry I still watch.

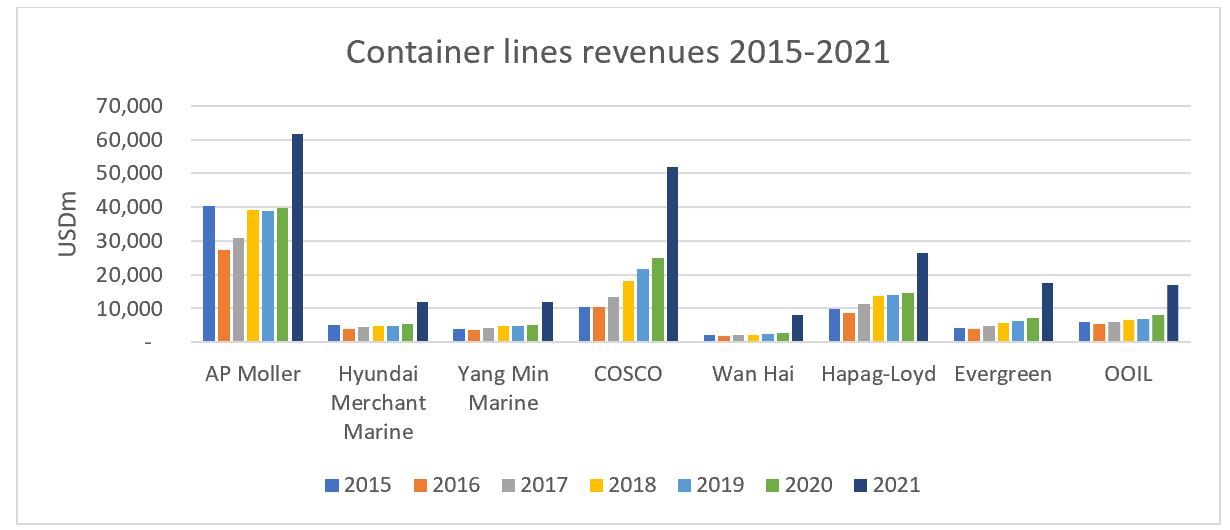

If we start by looking at the container line shipping companies, we can see they all saw big increases in their revenues in 2021 with (on average) more than double the revenues of 2020. By the way, 2020 in most cases was also a very good year:

Source: Bloomberg

The total revenue for the major listed players combined in 2021 was USD288 billion which was up USD145 billion compared to 2019 which we can regard as a more “normal” year not impacted by the pandemic. That USD145 billion is a direct increase in the cost of imported goods around the world and is roughly equivalent to the GDP of Hungary or Ukraine in 2021 who are placed on number 54 and 55 on the list of world countries ranked by GDP. No wonder we are hearing companies complaining about the cost of shipping and we are seeing goods inflation kicking off.

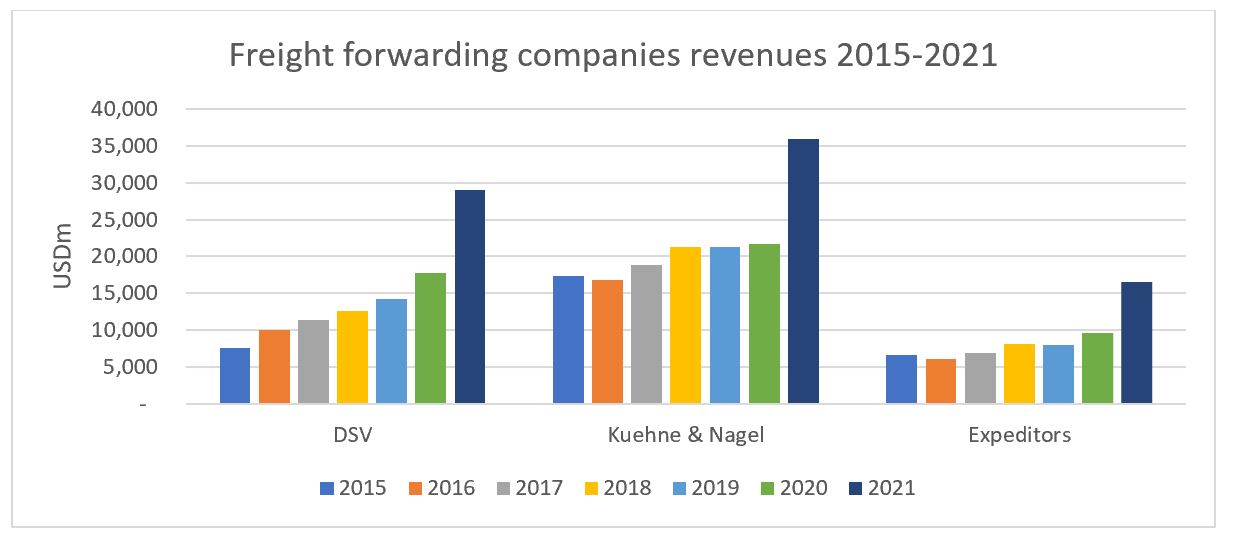

It is worth noticing this is only part of the increase in total shipping costs, as the rest of the supply chain has also increased their revenues. If we look at some of the major listed freight forwarders (the middleman between container lines and importers/exporters), we can see a steep increase in revenues with a combined increase of USD38 billion and if we add this to the USD145 million we arrive at the GDP of Greece on place 52:

Source: Bloomberg

On top of this, we have the additional costs for port fees and land-based transport. These are harder to quantify as these sectors are less consolidated, but we have seen significant increases here and I would not be surprised if the total additional revenues in the total transport supply chain increased by significantly more than the numbers we have shown above.

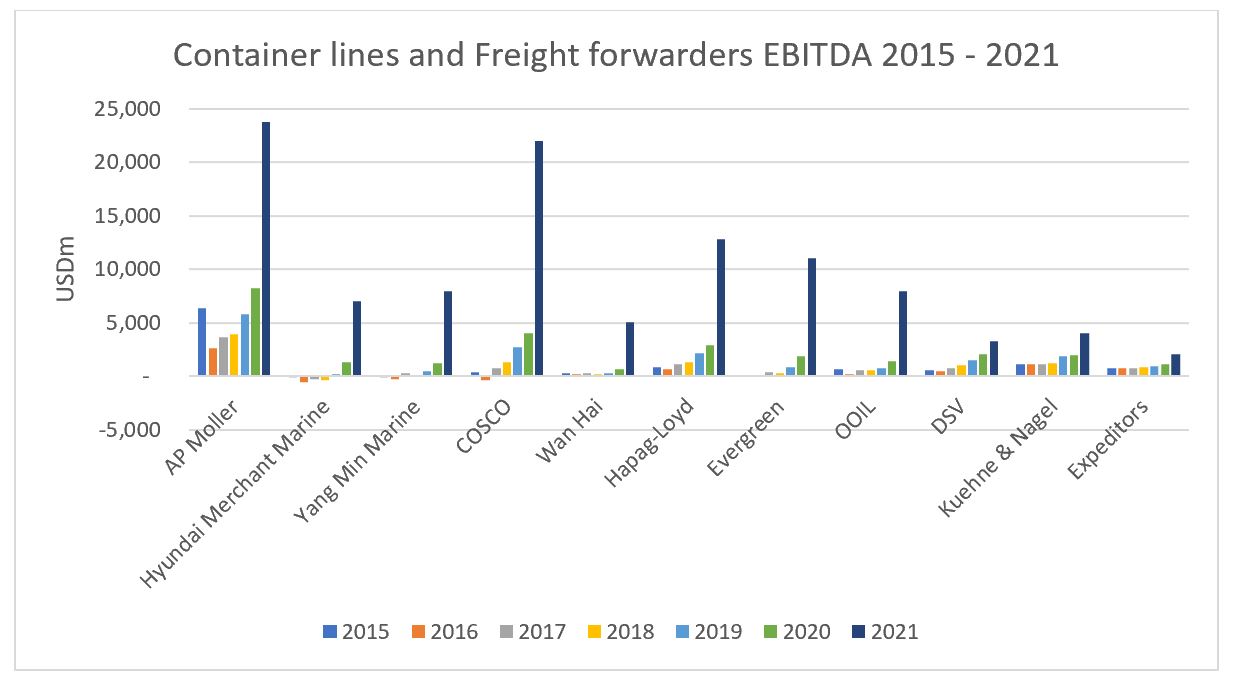

This increase in revenues has of course resulted in a profit bonanza for the participants in the industry as we can see from the chart below which shows the EBITDA for both the container lines and the freight forwarders:

Source: Bloomberg

The combined EBITDA in 2021 was USD106 billion which we can compare to a combined USD17 billion in 2019.

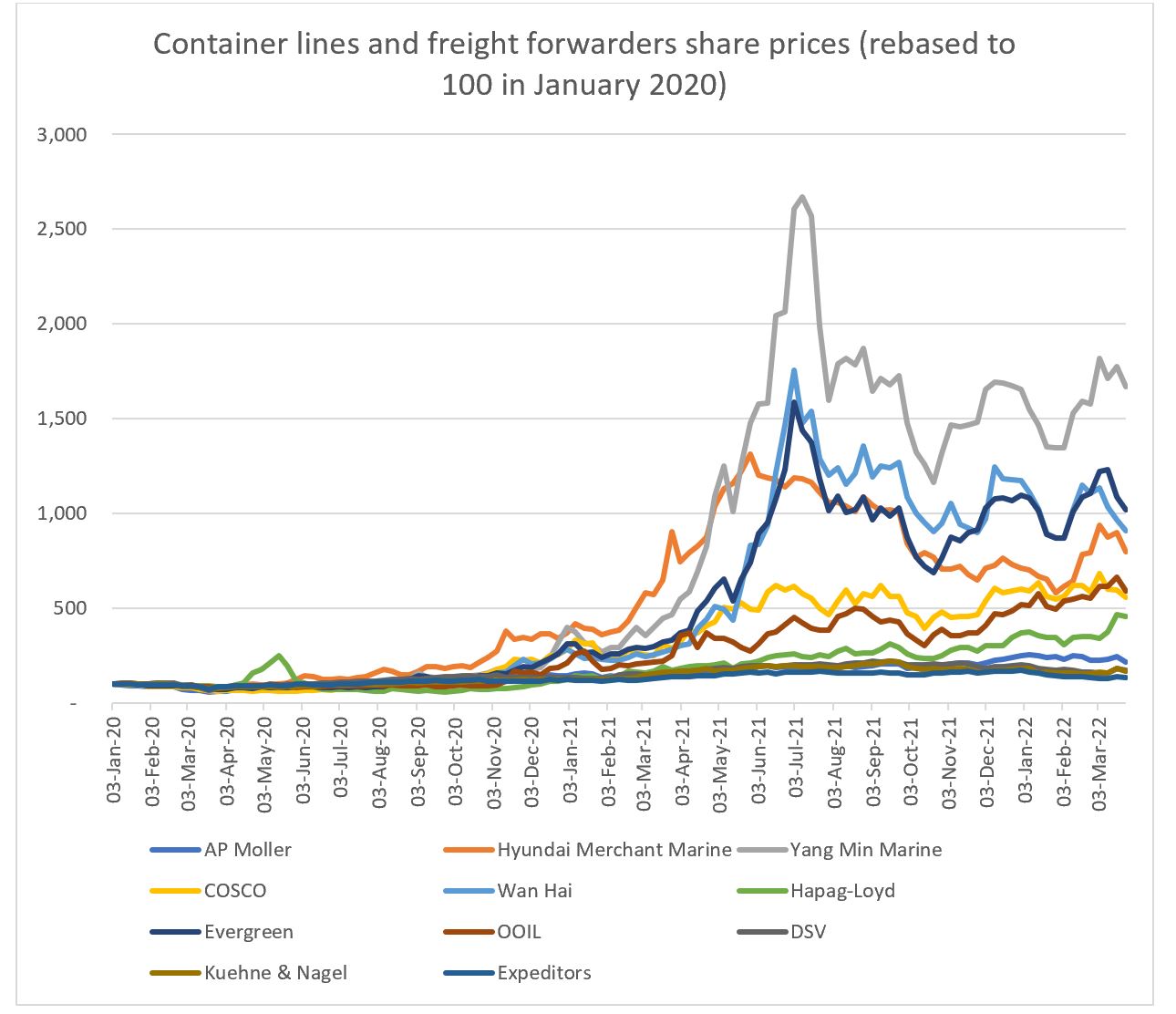

Steep increases in profits most often lead to increases in share prices and this has been the case here; the average share price of the companies that I have included is up 6x since the beginning of 2020:

Source: Bloomberg

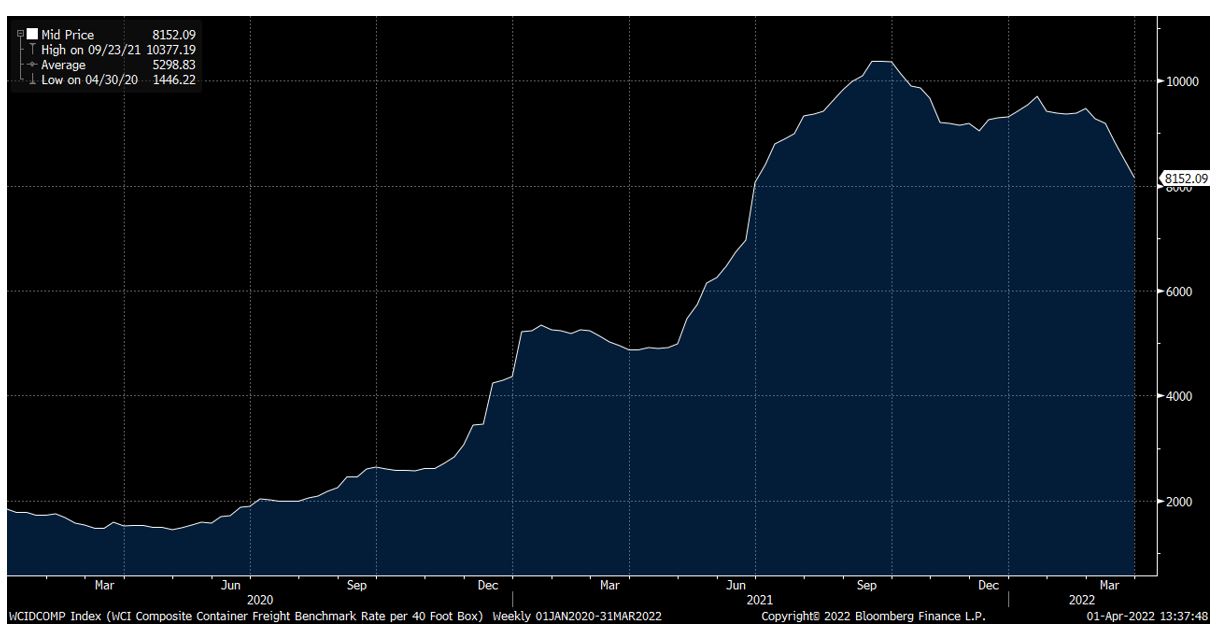

Container freight rates have now started to come off as we can see in the chart below from Bloomberg but they are still at very elevated levels and it will be interesting to see if the share prices will start to decline or if investors will continue to be attracted by the current cash generation of these businesses.

Source: Bloomberg

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY