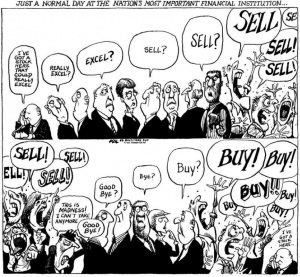

Rumours… or Fact?

We often see the market jumping at shadows. Take the recent weakness in the share price of McMillan Shakespeare (ASX: MMS). Given the absolute and ‘in writing’ promise by both Abbott and Hockey that changes to fringe benefits tax for salary packaging were off the table, we have been miffed by the swirling rumours that there would be changes in the budget detrimental to MMS.

We prefer facts to rumours. So we made a few calls.

Montgomery analyst Ben MacNevin chatted with Leigh Penberthy, President of the Australian Salary Packaging Industry Association. Leigh met with government around a fortnight ago, and the message was very clear – “Any changes to the FBT are off the table in the coming budget”.

The policy could be addressed in the government’s next white paper on the tax system, that it will commission before the next election.

We remind investors (as opposed to short-term speculators) of the following statement:

[March 19, 2014] “Fifty-five announced-but-unlegislated tax measures will no longer proceed – including the previous government’s $1.8 billion FBT hit on the car industry, and the cap on self-education expenses that would have hit tradies, nurses and teachers.”

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Roger,

MMS shares seem to have been dragged through the mud. Every negative bit of publicity about the local car industry has resulted in a dramatic sell-off.

Clearly, the stigma around the Labor-proposed FBT changes is still in the market. It is difficult not to be pessimistic about McMillan given the events over the last 12 months.

I understand MMS is in your portfolio – at the current prices sub $10 prices, have you accumulated more shares in the company?

Is it priced at a sufficient discount to intrinsic value?

Are you prepared to purchase more McMillan shares given the longer-term risk of changes to tax legislation?

Andrew

The margin of safety is not as attractive as it was at the purchase price of $7:25. Our weighting is appropriate but lower prices would currently be an interesting scenario.

Hi Kevin,

As a quite experienced investor, I would suggest to you what Warren Buffett would suggest. If you don’t know the company well, don’t invest. Do not invest in something where you can’t trace through where the earnings are coming from, what are the risks and you have spent time on the company reports and know something about the industry. After researching the company and the business dynamics, you should be able to come up with what Roger frequently calls “intrinsic value”.

I also suggest to you what Warren Buffett suggests, since you said you don’t want to spend a lot of time on investing, Buffett would suggest investing in an index fund.

You should have not invested in MMS because you don’t know enough about the company. It doesn’t matter what happens on budget night, where will the company be in 10 years? You must be able to answer this with all your investments otherwise it is gambling. Is the current price below your “intrinsic value” for the company enough to give you a margin of safety?

Hi Roger and Everyone – am I allowed to comment? (despite being VERY NEW and NATIVE to investing)

Last December’s ASX Video, you mention MMS dropping last year due to proposed changes in FBT. That we needed correct temperament to take advantage of that situation (I wasn’t following anything last year and it was that ASX Video that made me interested in investing and made me realise how foolish I was for not taking an interest twenty years ago.) I couldn’t believe the exact same stock has being dropping again. I brought only what small amount I could afford. I wasn’t going to wait until Budget Night when everyone realises that there will be no changes to FBT. Not sure if I jumped the gun too soon or if I had procrastinated. It might go down further tomorrow but I guess I have to ignore MMS for a while. I am not going regret my decision and say to myself “I should have waited until the eve of Budget night”. I studied MMS as much as a new investor could and I am satisfied that I did my best to understand that company.

As you can see, I am very inexperienced in investing. MMS is only the third stock I have brought. My first was a bio-tech that no one believes in, my second is an IPO happening this Tuesday (I actually rang CFO because I didn’t understand one aspect of the Prospectus). I used up about 29% of my savings on those 3 shares. The other 71% – I am not educated enough to know what to buy. Everything seems expensive. I don’t know what to buy – I am not buying just because someone says something great. I know everyone has more experience than me and they can tell me immediately. I am making my way through your excellent book. I guess I have to study slow and invest slowly at my slow learning pace.

I must now save very hard. I hope I can have 1/3 with my own shares: even shares that everyone here may disagree with, 1/3 with Mont Fund and some emergency money. In the meantime, I have to make do with what I have.

Can someone please tell me where I heard this? (I will probably get this wrong.)

If someone is prepared to spend only minimum time in researching (or investigating?) their investment opportunities, then they should be satisfied with minimum returns like cash, fixed interest. Someone like me is probably better off with minimum returns rather than betting red-black.

I like about this article. It makes me aware of this fact: there is so much “noise” out there and it is very hard for someone new to investing like me to distinguish what is real news and what is “noise”.

Thank You.

Hi Kevin,

I hope one of the other regular visitors to the blog here, someone with a little more experience, can offer you some suggestions or the benefit of their experience…

Hi Kevin

Most of us have been where you are now Kevin. Only difference is that you are wise(unlike some of us) and ask for help. Your choice of first 3 stocks you ever had (IPO,BIO stock and MMS) speak volumes.

Even if they double in value by next week it is not the right way to go.

If I was you and had 1m to invest I would put it in Mongomery Private and If I only had 25K I would put it in Montgomery fund.

You would then learn from Mont pro’s how and what to do.

For less than 1%/year you would have Roger,David,Tim, Andrew, Ben and Russell working

for you. Sounds good?

I think you guys are pretty safe here but i am sure all your clients will be pleased to see that you investigated the matter anyway rather than stick with your pre-existing or prior analysis.

The current government seems pretty loath to stray away too far from anything they have promised, especially the areas they were most vocal about even if overall public or stakeholder sentiment has changed and disagrees with that view.

From a personal perspective, ignoring the politics, i am always happy for rumour to exist as it can form the catalyst for reality being seperated from market perception and create opportunities (to buy or sell).

I think it is important for investors to embrace volatility rather than be fearful of it or as i say to use short term inefficiency/volatility to take advantage of the reasonably efficient long term.

If you speculate on rumours then good for you, but expect to be wrong from time to time (or perhaps continuously). I will stick to sound analysis and my increasing use of statistical and probabilistic decision making where i come up with a hypothesis and try to prove it correct or not. My latest one is that DJS and MYR need to be very concerned about a particular popular cosmetic chain.

I guess in summary my overall point is, that once again your team have shown why the fund has been doing well by always being ready to change your mind when the facts change but also to make sure that it is based on fact rather than fiction.

Roger should we interpret fluctuation in TPM price (+/-15%) the same way. Mind you not a bad buying time.

Don’t take your cue from share prices. There’s a fight coming up for TPG that may have a national interest argument running against it.

After the big show the Libs made about FBT prior to the election there is no chance of a detrimental change to FBT prior to the election – they would be flayed alive for it.

Even after the election, I doubt that $1.8B is enough for the government to risk the political pain. There are plenty of juicy areas of the budget to trim back without upsetting their voters and those bits will go first.