Rising US housing starts – the multiplier effect to add 1.5% to US GDP growth?

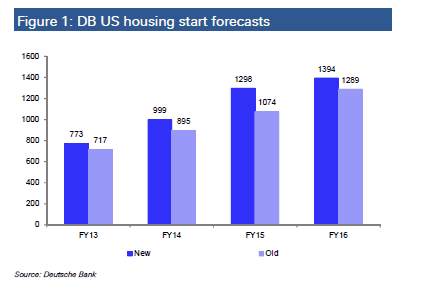

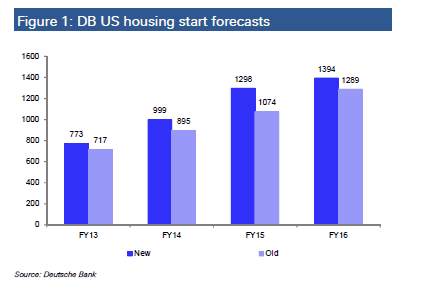

On 27 July 2012 I wrote “over the past fifty years, US housing starts have averaged 1.5m per annum. Currently starts are less than half the long-term average. Deutsche Bank is looking for US housing starts to jump to 1.0m by 2014 and to 1.4m by 2016 as follows”.

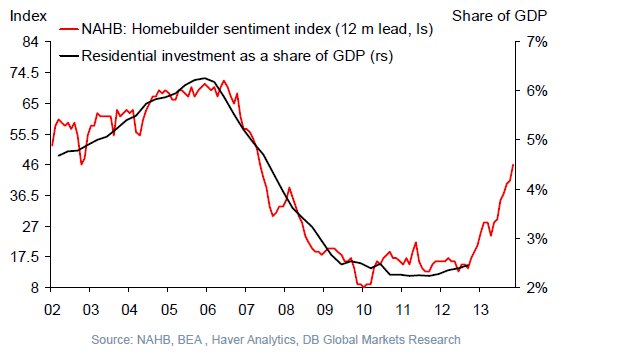

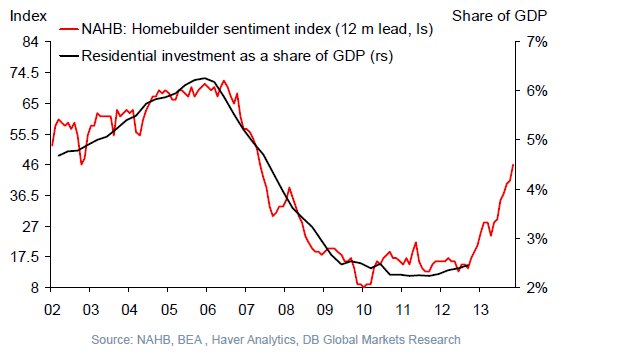

The US Homebuilder sentiment index from the National Association of Home Builders now suggests housing could add 1.5% to US GDP over the next twelve months.

The graph below has seen the sentiment index (red line) increase from a low point of 8 to 46, the highest level since May 2006. NAHB Chief Economist, David Crowe, wrote “While our confidence gauge has yet to breach the 50 mark – at which point an equal number of builders view sales conditions as good versus poor – we have certainly made substantial progress since this time last year when the index stood at 19”.

It will be interesting to see if the multiplier effect – some economists believe each dollar spent on residential construction generates $1.27 in additional economic activity – behaves as expected over the next year.

MORE BY DavidINVEST WITH MONTGOMERY

Chief Executive Officer of Montgomery Investment Management, David Buckland has over 40 years of industry experience.

David is a deeply knowledgeable and highly experienced financial services executive. Prior to joining Montgomery in 2012, David was CEO and Executive Director of Hunter Hall for 11 years, as well as a Director at JP Morgan in Sydney and London for eight years.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.