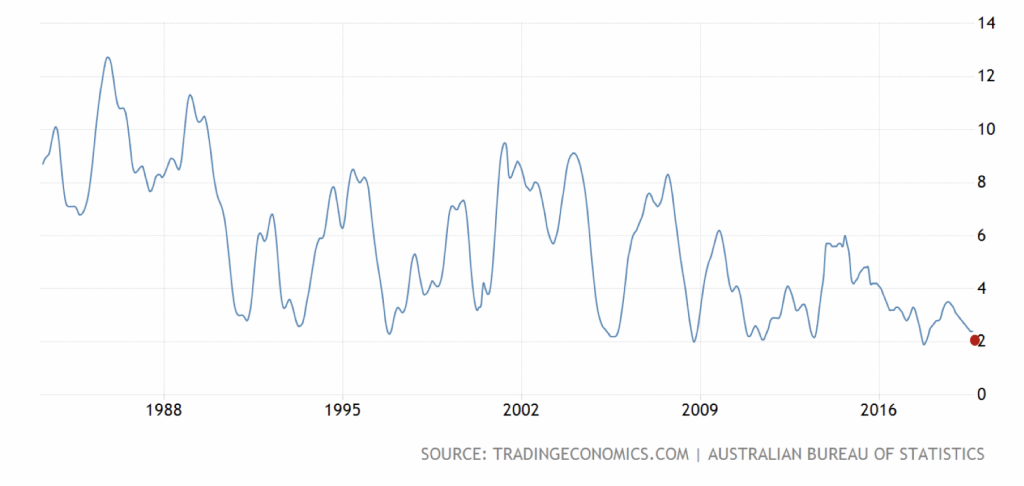

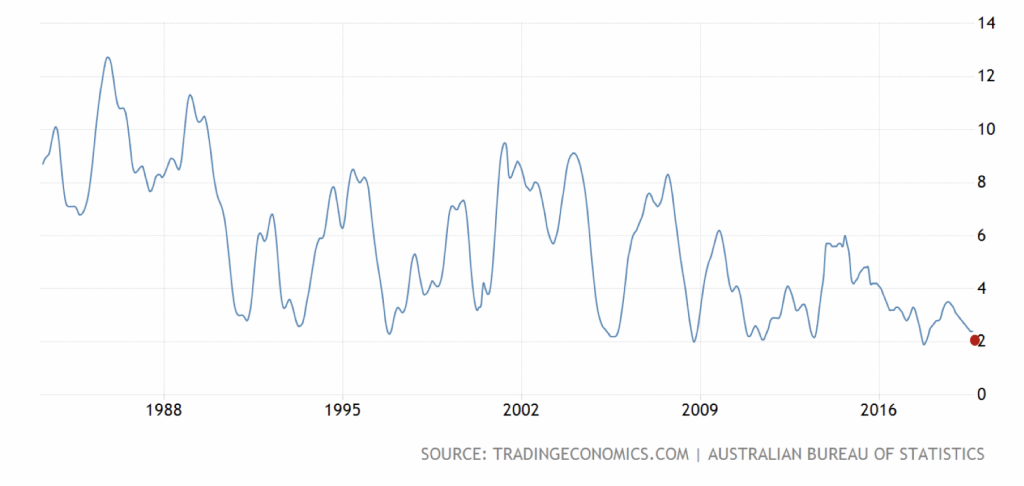

Retail Sales, the saddest since the recession

The Australian Bureau of Statistics (ABS) has reported the first annual decline in retail sales volumes since the recession of 1990-91. This comes just a day after Australia’s national accounts revealed household consumption is the weakest it has been since the Global Financial Crisis.

The value of retail sales in October was flat (zero growth) seasonally adjusted compared to forecasts by economists of 0.3 per cent growth. Annual growth is now at 2.1 per cent.

In the two largest markets, Victoria and NSW, retail sales went backwards by 0.4 per cent and 0.2 per cent respectively.

Australian Retail Sales, Year-on-Year

Investors will be hoping to see a cheerier Christmas. We have previously highlighted one of the five small cap themes investors are increasingly looking to play is the potential recovery in domestic household consumption. You can read Dominic’s article here: Will Christmas shopping rescue Australia’s retailers?

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking.

Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

John

:

Walking around David Jones and Myers on a Monday day evening two and a half weeks before Christmas, few shoppers and nobody buying up big? Also few Christmas decorations up? Yep ‘saddest’ is a good description.