REA Group delivers solid 1H25 results but highly regarded CEO to resign

REA Group (ASX:REA) has delivered a commendable 1H25 result, with revenue and earnings before interest, taxes, depreciation and amortisation (EBITDA) beating consensus estimates, alongside early January listings showing promising growth. However, news of CEO Owen Wilson’s upcoming retirement and revised cost guidance provide uncertainty the market will need to digest.

Owen Wilson, highly regarded by industry peers and investors – notwithstanding the fumbled acquisition attempt of the UK’s Rightmove (LON:RMV) – has announced his intention to retire in 2H2025. The company noted that identifying and appointing a new CEO has already commenced, signaling a structured and strategic transition.

It’s my view that companies enjoying the benefits of the network effect became successful not through the genius of a leader, but meaningfully through being anointed by consumers. It explains why replicating the network effect in new geographical markets is often less successful when companies try. It all comes down to consumers deciding to use the platform and anointing it as their favourite. Nevertheless, a steady and skilled hand at the helm makes a difference and REA Group’s transition will be something investors won’t like – even if they don’t admit it.

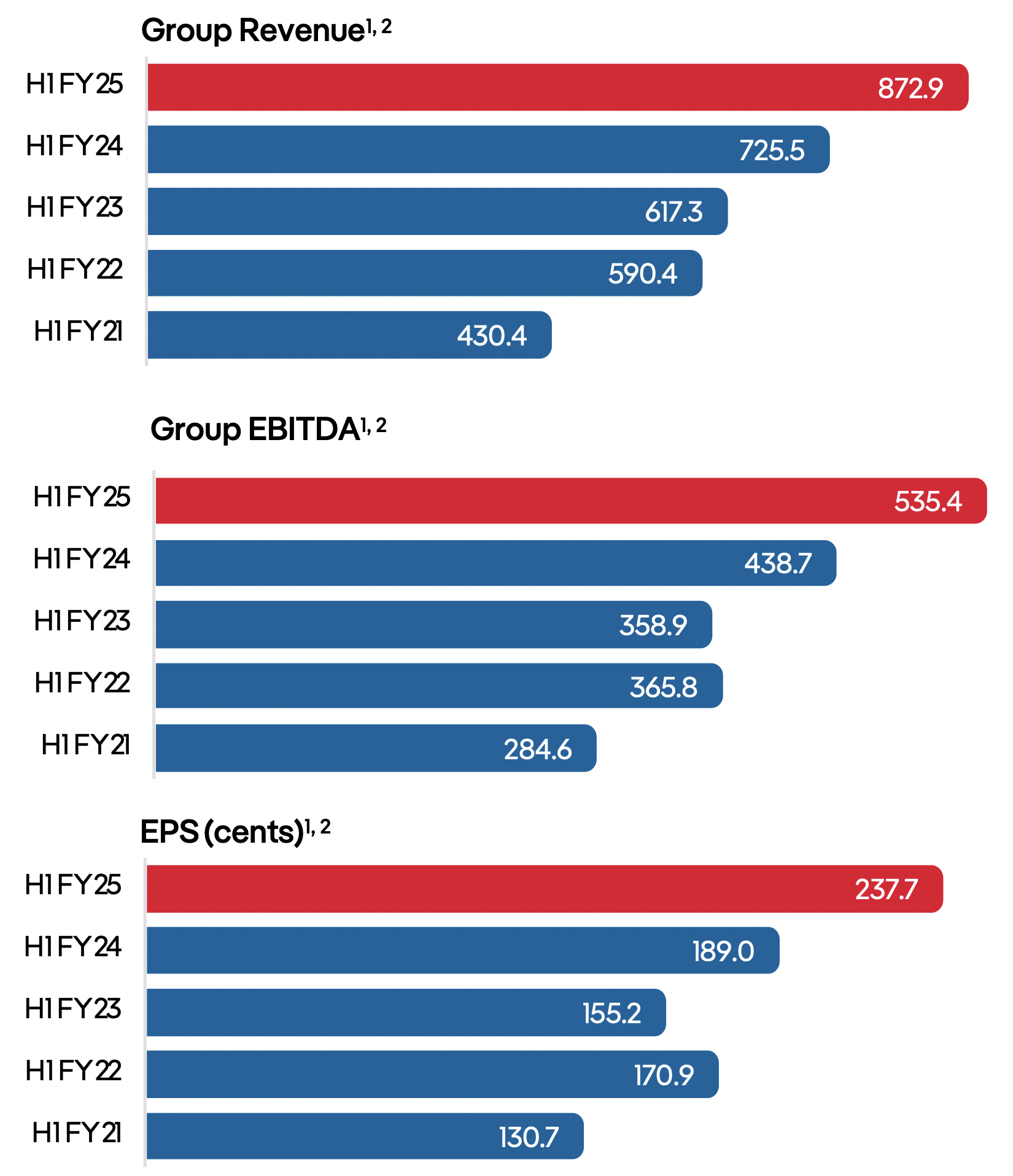

1H25 Financial highlights

Revenue came in at $873 million, surpassing consensus forecasts of $854 million.

EBITDA, including contributions from associates, reached $521 million, above consensus estimates of $515 million.

Reported net profit after tax (NPAT) of $314 million also exceeded the consensus estimate of $307 million.

Finally, statutory net profit of $414 million was 246 per cent higher than the previous corresponding period, with the difference between reported and statutory profits primarily related to the treatment of impairments in the investment in PropertyGuru and Realtair.

Perhaps most importantly, the 21 per cent increase in revenue from residential listings, which represents about 70 per cent of the business, was driven by only a five per cent increase in listings and a 10 per cent increase in price. More on that power competitive advantage in a moment.

Figure 1. Financial highlights

Source: REA Group HY25 results announcement

Performance by segment

Listings volume grew solidly with 2Q25 volumes rising four per cent and overall 1H25 listings up five per cent year-on-year. Notably, Sydney listings were up seven per cent and Melbourne listings were up five per cent.

Buyer demand saw four per cent year-on-year growth in enquiries and inspection interactions onsite increased 36 per cent year-on-year.

Residential division revenue increased by 21 per cent year-on-year, driven by growth in buy yield of 14 per cent. This was supported by a 10 per cent average price increase in Premiere+ products, which was only partly offset by a one per cent negative geographical mix impact.

Commercial/ developer revenue grew by 10 per cent year-on-year to $110 million. Media, data, and other revenue expanded by nine per cent to $43 million, and financial services revenue rose by 13 per cent to $41 million.

India, a focus of expansion for REA Group, reported revenue of $64 million and an EBITDA loss of $13.9 million. Enhancements to the Housing.com app supported 37 per cent year-on-year growth in first-half traffic, and seven new tier-two cities were added, bringing the total to 20.

January listings update

Early data for January showed Australian national listing volumes increasing three per cent year-on-year, with Sydney up five per cent and Melbourne down two per cent.

The reported three per cent national growth outpaced industry expectations, indicating resilience in the property market.

FY25 guidance and outlook

REA Group has maintained its expectation of double-digit buy yield growth for FY25. However, the pace of growth could be impacted if the negative drag from the company’s geographical mix persists.

The company continues to target positive operating jaws in FY25, highlighting a focus on maintaining profitability despite rising costs.

Group core operating cost growth guidance has been revised from high single digits to low double digits. This adjustment reflects revenue-related costs, including employee incentives, and cost of goods sold (COGS) related to audience maximiser revenues in Australia and rent pay on credit in India.

EBITDA losses in India are expected to be marginally lower in FY25 compared to FY24, reflecting gradual improvement.

Losses from associates however are projected to be marginally higher in FY25, a revision from previous expectations of modest improvements.

What it means for investors

REA Group’s performance in 1H25 reinforces that which we have noted for more than a decade – this company owns one of the strongest competitive advantages of all – the ability to raise prices without a detrimental impact on unit sales volume. The first-half revenue and EBITDA beats underscore the company’s strong fundamentals, particularly in the residential and commercial segments. The early January listings data, surpassing industry trends, is a further testament to its dominant industry positioning and continuing growth in market share.

However, the retirement of Owen Wilson introduces an element of uncertainty, as his leadership has been a key pillar of REA Group’s success. One might suppose the decision was related to the botched takeover attempt of Rightmove in the UK, but if I were REA Group’s Chairman I probably wouldn’t accept Wilson’s resignation. Markets hate information vacuums, so investors will be eager to be kept abreast of the CEO selection process and any strategic shifts that may follow.

Additionally, the upward revision in cost guidance reflects heightened revenue-driven expenses. While this is not inherently negative (the company has a track record of making this announcement), maintaining positive operating jaws will require careful cost management and a continuing demonstration of the ability to leverage its competitive advantages for revenue growth.

Final thoughts

REA Group remains the leader in the digital property space, and its solid 1H25 results reinforce its long-term growth potential. While investors will remain vigilant about near-term risks, including leadership transitions and cost pressures, this is a company with undeniable quality characteristics. With double-digit buy yield growth still on track and improving listings data, the company’s major drivers are pointing in the right direction.