REA continues to innovate and grow

With property prices still heading north – particularly in the major capitals – we recently took the opportunity to meet with the CEO and CFO of REA Group (ASX: REA), Tracey Fellows and Owen Wilson. Our discussion gave us a greater insight into REA’s 1H17 result and the prospects of Australia’s leading online real estate advertising company.

In brief, here are the key points on the firm’s result, and a look into the immediate future.

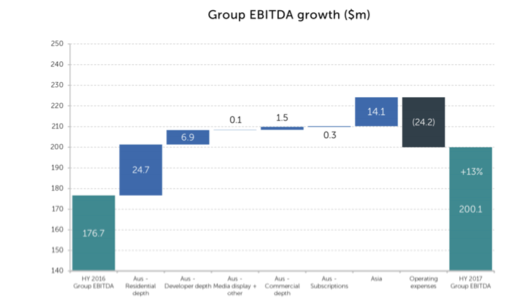

• Good result. Revenue and EBITDA slightly below expectations due to a weak IPP, slightly lower depth listing revenues and a weak European result.

• Australia residential depth (listing and subscriber revenues) grew 12% over 1H17; note that Asia in 1H16 was boosted due to the removal of myfun.com from the Australia segment into the Asia segment.

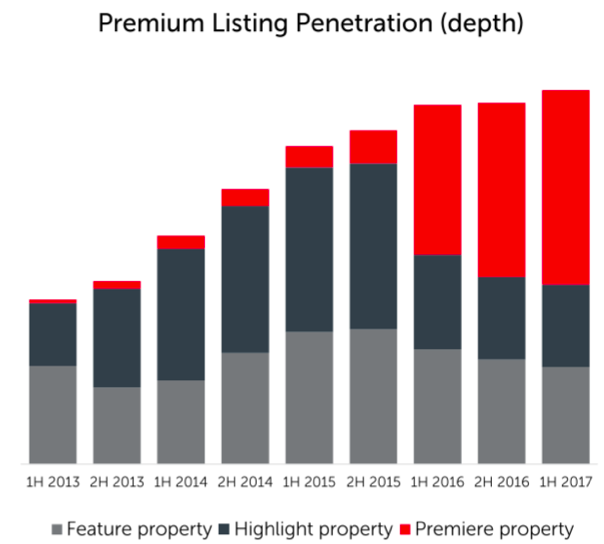

• Despite residential listings being down, paid listings on REA increased by 3% and premiere penetration also increased, as shown in the chart below.

• As guided, 1H17 EBITDA margins were below that of 1H16 due to the timing differences of marketing expenditures. The CFO guides that FY17 EBITDA margins will be above that of FY16.

Foreign business

• Move Inc appears to be improving, having moved from a -$4.6m loss in 1H16 to a -$1.8m loss in 1H17 (although note that the loss is only due to amortisation of intangibles; cash earnings are not disclosed). This is a positive but still a long way off in terms of this becoming a significant source of earnings. Note Zillow grew circa 30% over the half.

• REA’s European operations (Casa.it and Athome) were sold during the half. The profit from this sale is recognised in ‘discontinued operations’ ($163.4m). Post the transaction, REA has invested in a 14.7% stake in an Indian listing portal PropTiger(for $67.9m); notably, Newscorp has a 23% stake.

On the horizon

• Management will be releasing ‘Premiere Black’ within 5 months. Premiere Black is a listing product tiered above that of the standard Premiere. It will have a much higher price point and largely be targeted at high priced property in Sydney and Melbourne.

• Management has also released ‘audience maximiser’ which is a product that draws in more audience for a particular listing from other sources (such as news sites). There’s a 2-minute summary of the product.

• Audience maximiser effectively stacks onto a highlight/premiere ad and is best thought of as a price increase on a regular ad. Hard to say how effective this will be (we have no data and it’s unclear whether the additional volume will comprise worthwhile leads).

• Price increases on residential depth listings are again planned for July 2018.

Montgomery owns shares in REA Group.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

“Our discussion gave us a greater insight into REA’s 1H17 result and the prospects of Australia’s leading online real estate advertising company.”

I have never been able to understand what the benefit of meeting senior management is. This insight about the company’s performance – is it because the results released were not as clear as they could be?

Thanks for your thoughts Scott.

Hello Team

Thank you for the feedback on REA; I’m hoping to see your reviews of key stocks ALU, VTG and SRX

Hi David,

We have a portfolio of over 25 companies. What makes those three ‘key’?

perhaps not the appropriate term? I meant there has been a lot of interest in these from other subscribers (members of funds) and your team had covered them extensively in the past. And to be frank I hold them still. Appreciate some feedback.

Hi Scott,

Thanks for the update. Do the Montgomery Funds still hold REA shares?

Yes Julian.