Rate Shock

With all the talk of productivity, cost competitiveness, the currency and interest rates, and because we are rolling over tens of millions in TD’s (that were paying five per cent) I thought it worth sharing what Term Deposit (TD) rates are on offer now (see ‘More’ below). We have written extensively about the loss of purchasing power now affecting hundreds of thousands of retiring boomers so the low rates are nothing short of shocking and understandably force many investors to buy high yielding stocks like Telstra.

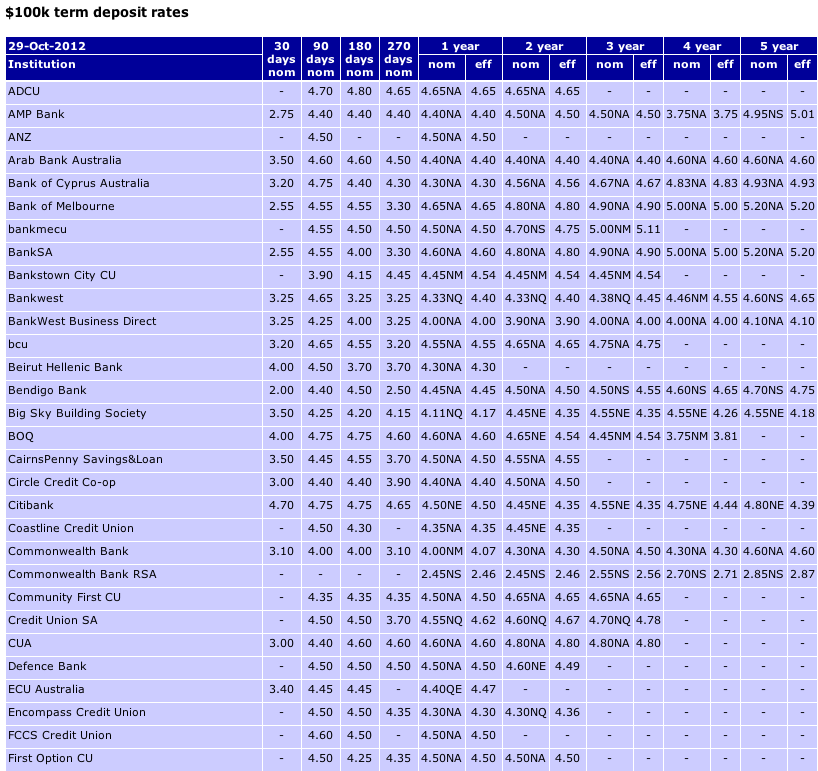

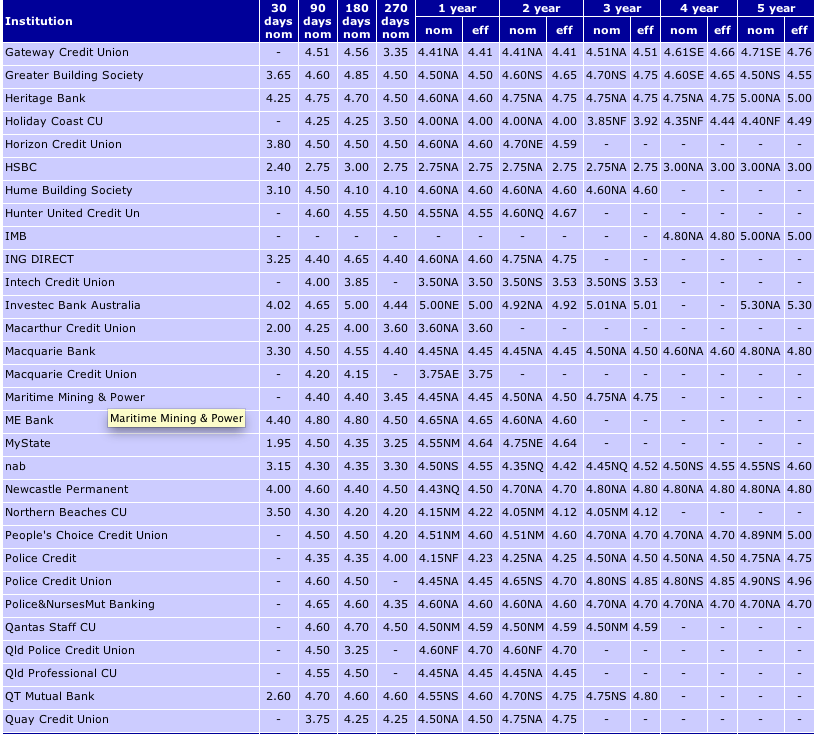

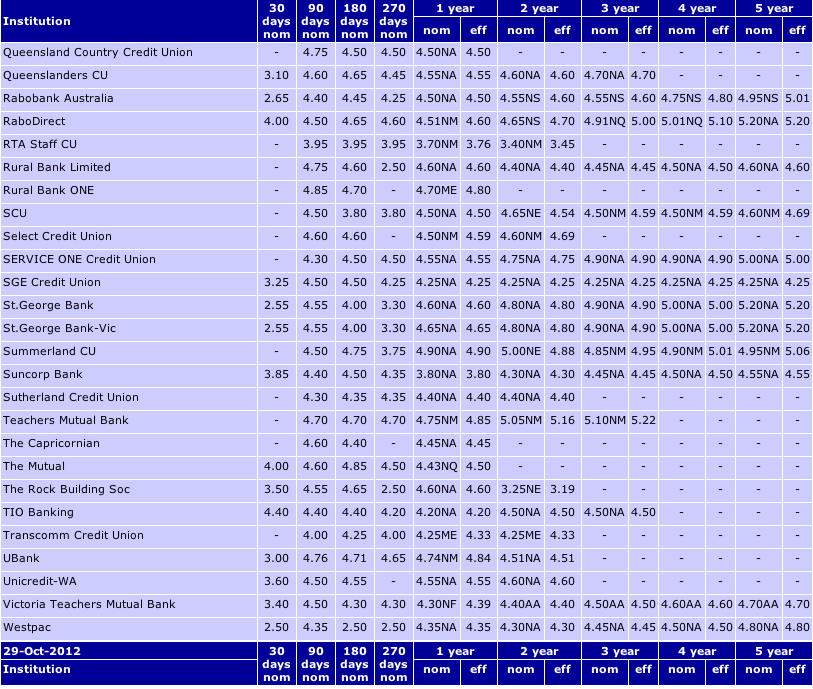

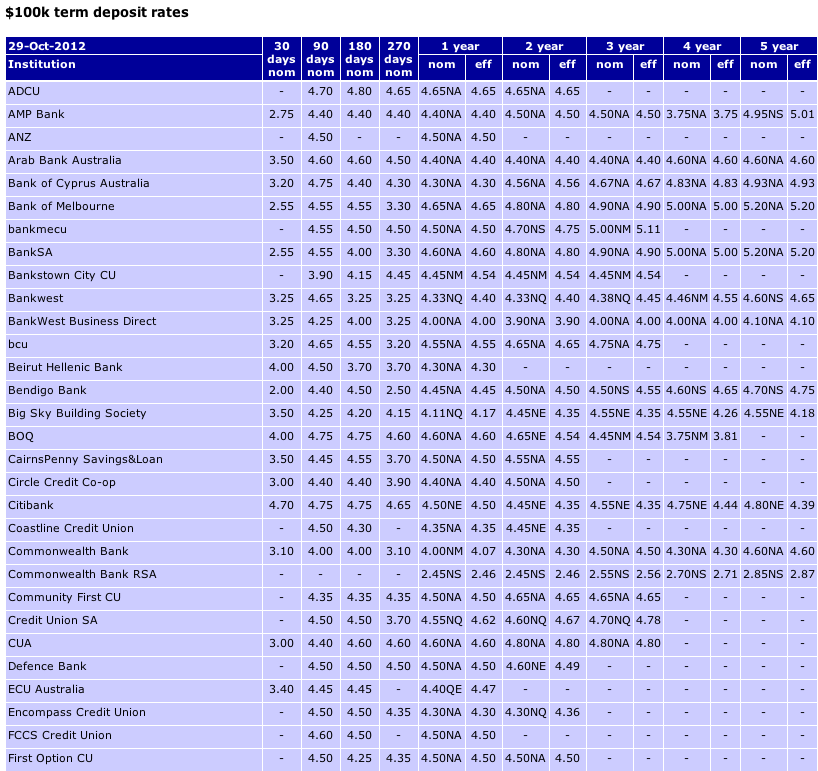

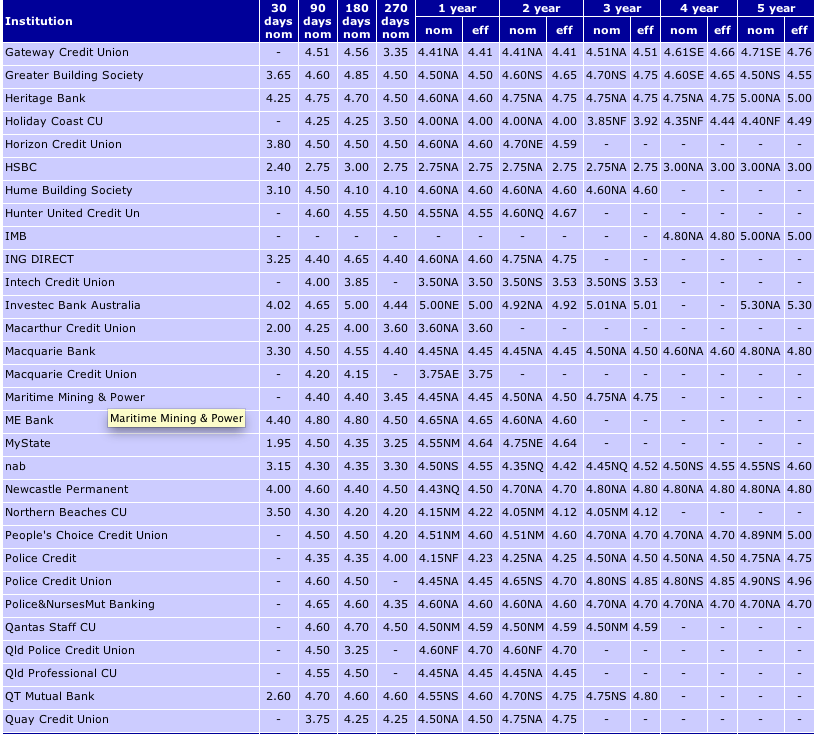

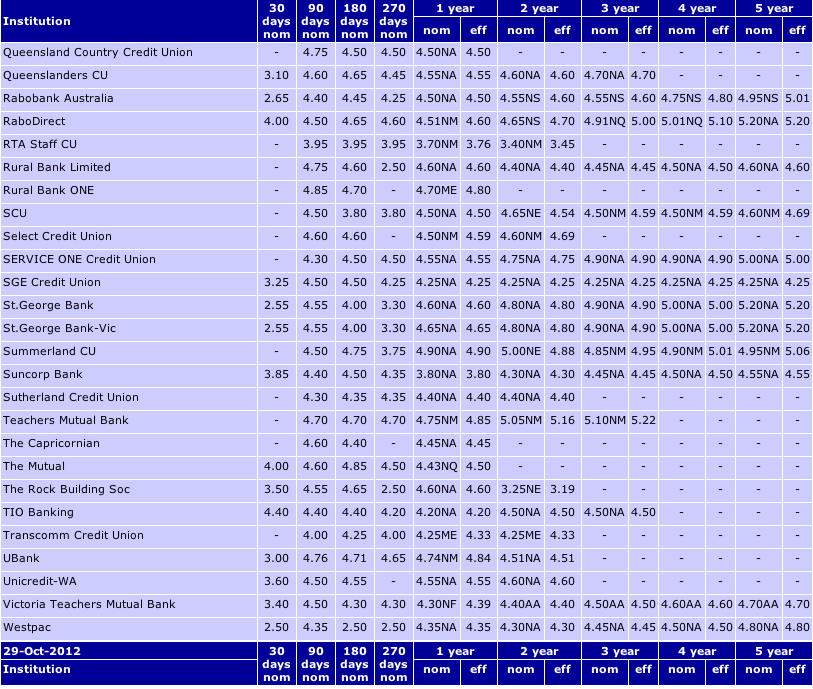

The tables below have been supplied by my friend Andrew Willink’s company Canstar Cannex. For further information contact the institution directly and for disclaimers regarding Cantsar’s service and published rates as well as definitions for the table’s labels, visit Canstar here.

MORE BY RogerINVEST WITH MONTGOMERY

Roger Montgomery is the Founder and Chairman of Montgomery Investment Management. Roger has over three decades of experience in funds management and related activities, including equities analysis, equity and derivatives strategy, trading and stockbroking. Prior to establishing Montgomery, Roger held positions at Ord Minnett Jardine Fleming, BT (Australia) Limited and Merrill Lynch.

He is also author of best-selling investment guide-book for the stock market, Value.able – how to value the best stocks and buy them for less than they are worth.

Roger appears regularly on television and radio, and in the press, including ABC radio and TV, The Australian and Ausbiz. View upcoming media appearances.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

Roger’s point was I think to highlight low and declining interest rates on cash which may attract some investors to high yield stocks that may be of poor quality. The table seems to me a good summary of TDs, though one can, as has been pointed out, obtain higher interest rates (+~1%) with bank online deposits. However, these are invariably introd offers, that will drop to 3+% after 4-6 months, and likely decline further in coming months as interest rates drop. For that reason I keep some of my cash in TD for 1 year at 4.7% and some in a flexible online account with major bank as a reserve for good share opportunities.

Although I’m not doubting the data obtained by Andrew Willink’s company Canstar Cannex, albeit they appear to be chalk board specials, I have personally seen rates on offered by the big four banks at much higher levels than as noted above.

One could speculate that the increased rates on offer are driven by an increase in bad debts both here and offshore, think BOQ / NAB.

Although with lower credit growth (retail and business) the need for deposits will slow, which in theory should pushing rates lower.

However as a consumer you can still seek out higher rates from the 2 tier lenders, but keep in mind ‘that the return of your money is more important the return on your money’ -. Think Banksia. Caveat emptor

Hi Roger,

Canstar/Cannex is a fantastic website, I use it regularly, not only for TDs but for other things, such as: home loans, personal loans, health insurance etc. It is a very very good database/website. In fact when I bought my house two years ago this was the first place I looked at.

Regarding TDs, I do see them as a good safe investment option; however, I,ve often seen TDs’ rates lower than savings accounts,in fact, some of these savings accounts have 5.50-75% interest. Therefore, I’d still prefer depositing my money on a savings account plus you can access it quickly. Perhaps if you have a large sum TDs could be a safe investment, as some of these savings accounts have a cap. not sure on this though.

thanks for the post, Fer.

Roger,

Following your method, intrinsic value is largely dependent on the Required Rate of Return (RRR) that one uses.

In your video today you talk of caution as the market rallies. Could it be that the latest rally reflects the fact that, as interest rates head to record lows (and are forecast to head even lower) – the Risk Free Rate, and thus the Required Rate of Return declines, inflating the intrinsic value of stocks?

Could it be that the value of holding companies is rising as the relative value of holding Term Deposits is declining – even though the absolute performance of these companies (in terms of earnings) isn’t really improving?

Joe

You are 100% correct Joe. But when rates fall to levels that are guaranteed to produce an erosion of purchasing power, we are loath to follow.

For those able, you’ll get another 30% more by going to Online Saver rates. Banks are wising up and tightening their conditions though but you can usually find a way in. Better rates than those above for sure, and at call.