Ramsay Health Care set to benefit as the world opens up

The COVID-19 pandemic has dented the profits of Ramsay Health Care (ASX: RHC), Australia’s multinational healthcare provider and hospital network. The good news is that earnings are growing again across key regions as lockdowns and restrictions start to ease. And an increased final dividend signals that the company expects a better year ahead.

Ramsay Health Care is one of the long-standing holdings in The Montgomery Fund. We are attracted by the strong market position and the inescapable demographic trends (ageing population and population growth) that should ensure that volumes over time are dependably growing. However, the COVID-19 crisis has created some issues for them due to, amongst other things:

- Various governments in the areas where Ramsay has hospital assets imposing restrictions on elective surgeries at times of high COVID-19 case loads and associated lockdowns. The purpose is both to free up nursing staff and to create additional hospital beds in case the public system is overwhelmed with COVID-19 cases. This has led to delayed or lost revenues as procedures have been postponed or abandoned completely in cases where the patient has died in the meantime.

- Increased operating costs due to increased price in Personal Protective Equipment (PPE) and other equipment. As readers probably read about when COVID-19 first started, there was a worldwide rush to procure PPE to protect medical staff from infection and this resulted in significantly higher prices being demanded by the manufacturers of items such as gloves, masks and gowns as well as the need to procure ventilators and associated consumables.

- Operational difficulties where staff have had to isolate periodically due to potential exposure to COVID-19 positive patients leading to higher staff costs due to the need for temporary replacement staff.

- Other cost increases due to additional procedures such as temperature screening and less efficient catering as canteen food service has had to be shifted to individually served food.

On Thursday 26 August 2021, Ramsay reported its FY21 results and as the year was significantly impacted by various COVID-19 related issues, it is hard to use the performance as a guide for long term trends. Despite this, there were some items in the results that are worth highlighting.

- Despite the extended lockdowns in VIC and various snap lockdowns in other states during the year, it was encouraging to see surgical volumes grew by 6.6 per cent compared to FY19 which was not impacted by COVID-19, while non-surgical volumes (rehab, mental health etc.) volumes were only down 0.5 per cent compared to the same year. This shows the volumes postponed during the initial lockdown in FY20 were deferred and we should expect surgery volumes to increase once we get vaccination levels up and we see easing restrictions in Australia. The trends in the UK and the other countries in Europe where Ramsay has operations are showing exactly this with elective surgery volumes returning strongly post easing of restrictions.

- The current lockdown in NSW will likely have a bigger impact than the lockdowns in VIC last year as Ramsay’s NSW business is about 2x the size of its VIC business and depending on how long the lockdowns last, we could very well see Australian profitability reduce this year if we are unlucky. This is a temporary event that should not have a significant permanent impact on the value of the business as most of this volume will have been deferred and will come back over time. We only have a “time-value of money” impact and, given current low interest rates, this should be minimal. There could be a self-correcting factor at play as patients with procedures that have been delayed might have deteriorated and will need a more complicated operation in the future which will result in higher revenues for the hospital.

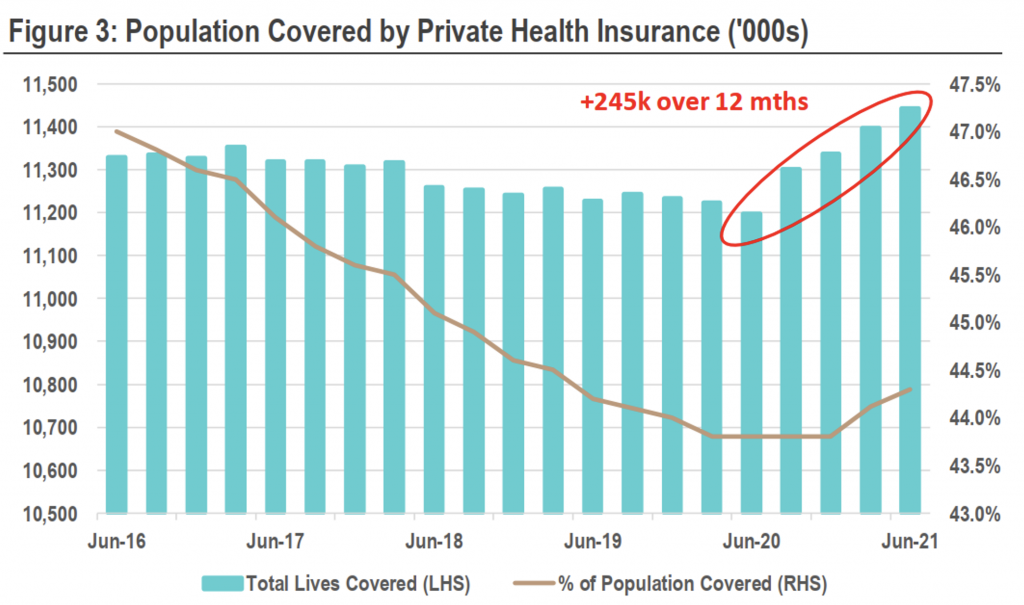

- The board and management signalled they are very confident in the financial position and outlook of the company by increasing the dividend payout ratio to 79 per cent from its normal level of 50 per cent. They also announced plans for significant increase in capacity expansion in both Australia and in its European operation. There seems to have been very little expansion in private health capacity in the last few years in many areas of the world and with owners having been financially impacted by COVID-19, it seems like Ramsay is doing a push to take future market share. This might be quite timely as we have seen a sharp reversal in the long-term trend of declining Private Health Insurance participation as COVID-19 has increased the willingness to ensure that you have a private alternative at times when the public system is busy with other things. In the chart below, we can see the sharp turning point starting in the June quarter last year and if this continues, it is definitely a positive sign for private hospital owners, especially the ones with some spare capacity!

Overall, we are reasonably happy with the developments for Ramsay under difficult circumstances and there are signs indicating that the company might come out quite well once the crisis ends with larger market share and the potential for a stop in the decline of private health insurance participation rates. There is also no changing the long-term demographic trends with a rapidly ageing population that will need more healthcare services as a whole in the future than in the past and this should provide good structural growth to the sector and to Ramsay.

Reporting Season Webinar

If you are interested in hearing our views on other company results, you can join me and the Montgomery Portfolio Managers on 20 September 2021 for the Montgomery Reporting Season Review, click to register.

The Montgomery Funds owns shares in Ramsay Healthcare. This article was prepared 01 September 2021 with the information we have today, and our view may change. It does not constitute formal advice or professional investment advice. If you wish to trade Ramsay Healthcare you should seek financial advice.

This post was contributed by a representative of Montgomery Investment Management Pty Limited (AFSL No. 354564). The principal purpose of this post is to provide factual information and not provide financial product advice. Additionally, the information provided is not intended to provide any recommendation or opinion about any financial product. Any commentary and statements of opinion however may contain general advice only that is prepared without taking into account your personal objectives, financial circumstances or needs. Because of this, before acting on any of the information provided, you should always consider its appropriateness in light of your personal objectives, financial circumstances and needs and should consider seeking independent advice from a financial advisor if necessary before making any decisions. This post specifically excludes personal advice.

INVEST WITH MONTGOMERY

Sorry I should have also asked what your fair value estimate is currently.

Hi Andreas: Agree with your prognosis on Ramsay. ROE is a fundamental test for me so why has Ramsay’s ROE deteriorated over the past few years? Especially 2020 and less so 2021. COVID?

KR Jeremy

Hi Jeremy, the decline in RoE is partly due to COVID as they saw a drop in surgery volumes as elective surgeries were restricted and they started working on a cost recovery basis with various governments meaning zero profits while under those arrangements but also due to the equity raise in April 2020 where they increased the number of shares on issue by about 10%.