Quarterly consumer price index update

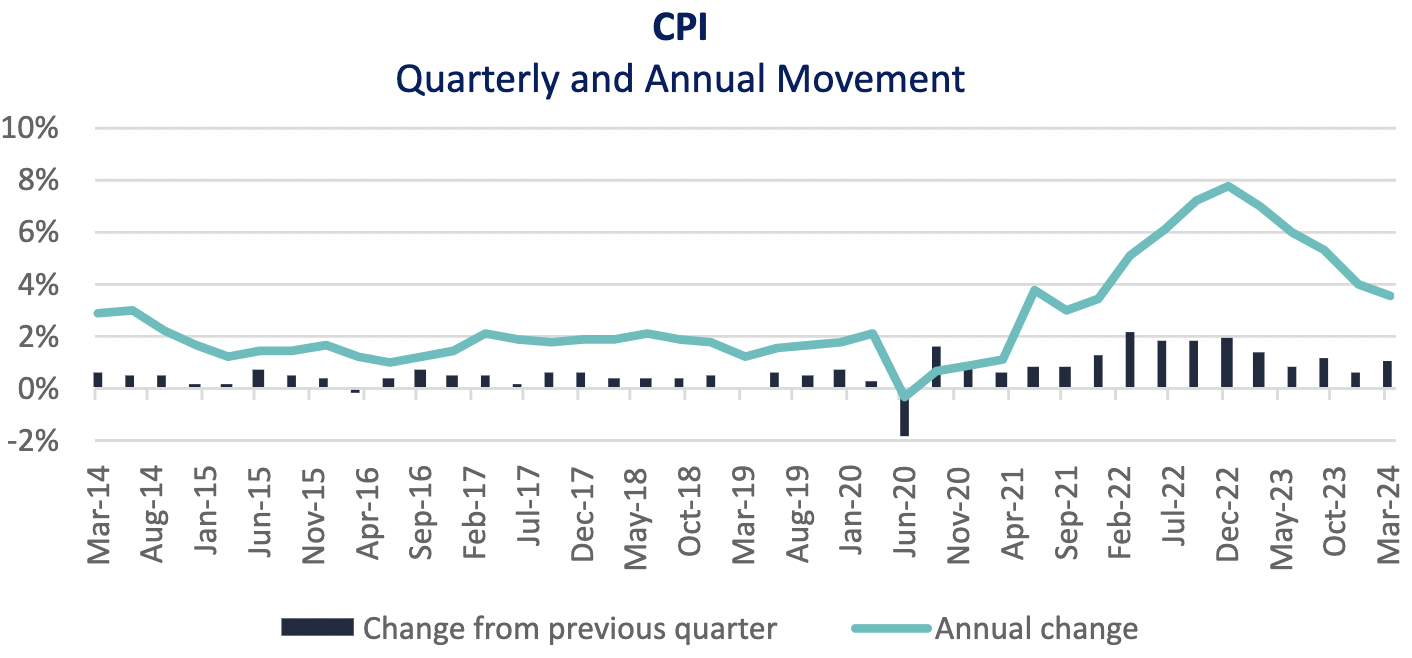

The long-awaited quarterly consumer price index (CPI) figure was reported last week. Over the March quarter, CPI rose by 1.0 per cent, which follows the previous 0.6 per cent December quarter increase. Over the 12 months to March 2024, CPI rose by 3.6 per cent. Whilst the annual rate of inflation is trending downwards, the quarterly figure increased by 0.4 per cent and poses ongoing challenges.

The leading drivers behind the quarterly increase:

- Education fees rose by 5.9 per cent. This uplift was the strongest quarterly rise reported since 2012.

- Housing rose by 0.7 per cent. The rental market is incredibly tight, with a 2.1 per cent increase due to an ongoing mismatch between supply and demand. Property prices also rose by 1.1 per cent. This was an improvement from the 1.5 per cent read in the December quarter. High material and labour costs continue to contribute to the housing pricing pressure.

- Food and non-alcoholic beverage increased by 0.9 per cent.

The most recent quarterly results have presented a slight blip in the data, however, on an annualised basis the inflation figure is heading in the right direction, approaching the Reserve Bank of Australia’s (RBA’s) 2-3 per cent target range. Despite this, markets are now concerned that these latest figures have potentially pushed out the RBA’s timeline, and there is not enough data to warrant an RBA rate cut in the coming months. The latest read is stoking fears that inflation is sticky and there is an ongoing battle in achieving a consistent path to their inflationary target range, within the expected timeframe.

Similarly, the U.S. faces ongoing inflationary challenges. The annual inflation rate rose by 3.5 per cent in March, a 0.4 per cent increase from the 3.2 per cent reported in February. The market anticipated 3.4 per cent. Both central banks require confidence that inflation is steadily slowing back within their respective target ranges. Widely speaking, it is evident that there is economic turbulence with ongoing geopolitical uncertainty having widespread global economic affects. Back home, other factors to consider are the strong labour market and upcoming tax cuts. The labour market remains relatively tight with the unemployment rate at 3.8 per cent in March. This coupled with the incoming stage three tax cuts, provides more turbulence and adjustment in the RBA’s economic outlook and monetary policy decisions.