Problems back home

It looks like the moment has finally arrived. The front page of yesterday’s Australian Financial Review was entitled “Resources Boom Falls to Earth”.

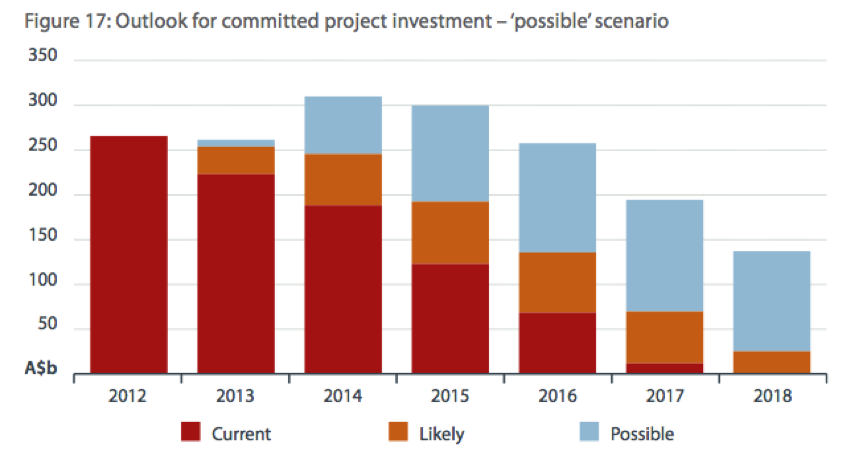

The graph below, from the Bureau of Resources and Energy Economics, indicates that the resource super-cycle is well and truly over, with the value of “current and likely” project investments forecast to decline by 75 per cent (from $270b to $70b over the five years to 2017).

The shelving of $150 billion worth of mining and energy projects over the past year, combined with above predictions, has put Australia’s resource service sector into a deep recession.

Over recent weeks, many companies servicing Australia’s resource sector have announced severe declines in their outlooks. The extent of this downturn seems to have caught the management of these companies by surprise. Taking a look at just ten of these companies reveals something of a problem for the rest of the country. Given that the stock market tends to cast its shadow before it, the average share price decline of 50% this calendar year – an average capital loss of 10 per cent per month, is an ominous sign indeed!

We now believe that this ‘average share price decline of 50 per cent’ could be a prelude to further severe earnings reductions for resource service companies in the year to June 2014 – and in the year to June 2015.

Additionally, small miners will feel the heat because they cannot obtain funding. Large projects are being shelved and a new brand of manager is running them, for shareholders rather than for growth. Finally, our assessment of commodity prices (iron ore in particular) is that they have peaked, and now risk falling significantly – thanks in part to China’s current oversupply of everything from ‘ships to solar’.

A logical progression would then be that this pessimism spreads to the currently indifferent Eastern Seaboard of Australia – at precisely the same time that many stocks look a bit stretched from a valuation viewpoint.

Indeed, if we figure that the contribution to GDP growth from mining capital expenditure was one to two per cent over the last few years, then its demise will put a real dent in the overall pace of economic expansion. Without another sector, such as residential construction, government spending, or household consumption taking up the reins, the risk of a recession is very real.